- United States

- /

- Energy Services

- /

- NYSE:SLB

Is SLB’s Valuation Attractive After Recent Global Energy Transition Partnerships?

Reviewed by Bailey Pemberton

- Curious whether SLB is a hidden gem or an overpriced risk? You are not alone, as many investors are looking for clarity on its real value right now.

- The stock has shown some short-term resilience, climbing 1.9% over the past week and 1.5% for the month. It is still down 4.7% year-to-date and 13.6% over the past year.

- Recent headlines have spotlighted SLB’s ongoing efforts in global energy transition and its strategic partnerships in emerging markets. These moves are drawing attention to both its growth potential and evolving risk profile in a fast-shifting energy landscape.

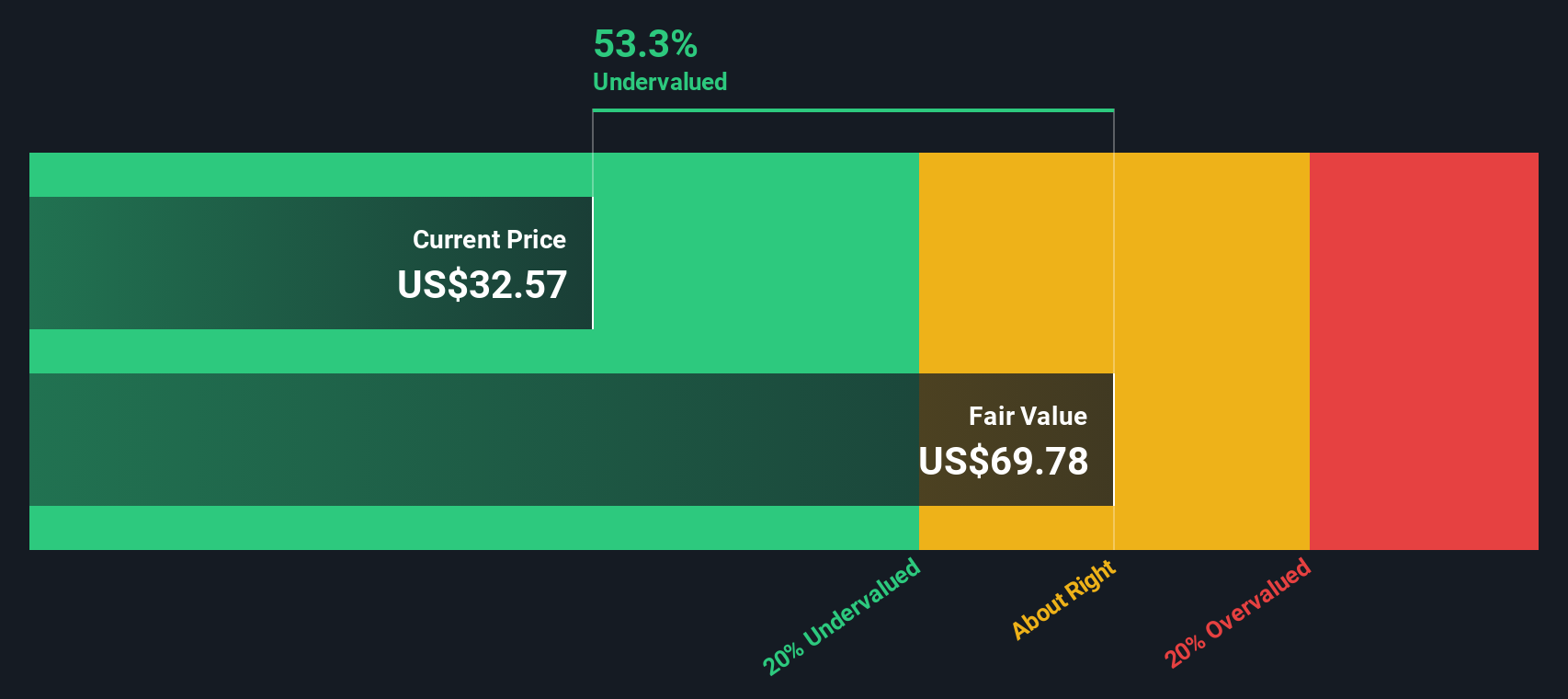

- SLB currently scores an impressive 6 out of 6 on our valuation checks, signaling it looks undervalued across the board. Let’s review how we arrive at this number with different valuation approaches. There will also be a smarter way to think about value at the end of the article.

Find out why SLB's -13.6% return over the last year is lagging behind its peers.

Approach 1: SLB Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. For SLB, this process involves estimating the cash the business is expected to generate and calculating what those future dollars are worth now.

Currently, SLB generates approximately $3.27 billion in Free Cash Flow (FCF). Analysts anticipate that by 2029, annual cash flows could grow to about $5.99 billion. While analyst estimates typically cover up to five years, additional projections out to ten years are extrapolated by Simply Wall St. If these forecasts hold, SLB's FCF is expected to show healthy growth, reinforcing its appeal as a cash-generative business in the evolving energy services sector.

Using the 2 Stage Free Cash Flow to Equity approach, SLB’s intrinsic value is estimated at $91.95 per share. Compared to today’s price, this reflects a 60.2% discount, which suggests the market may be undervaluing the company's long-term earnings power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SLB is undervalued by 60.2%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: SLB Price vs Earnings (P/E)

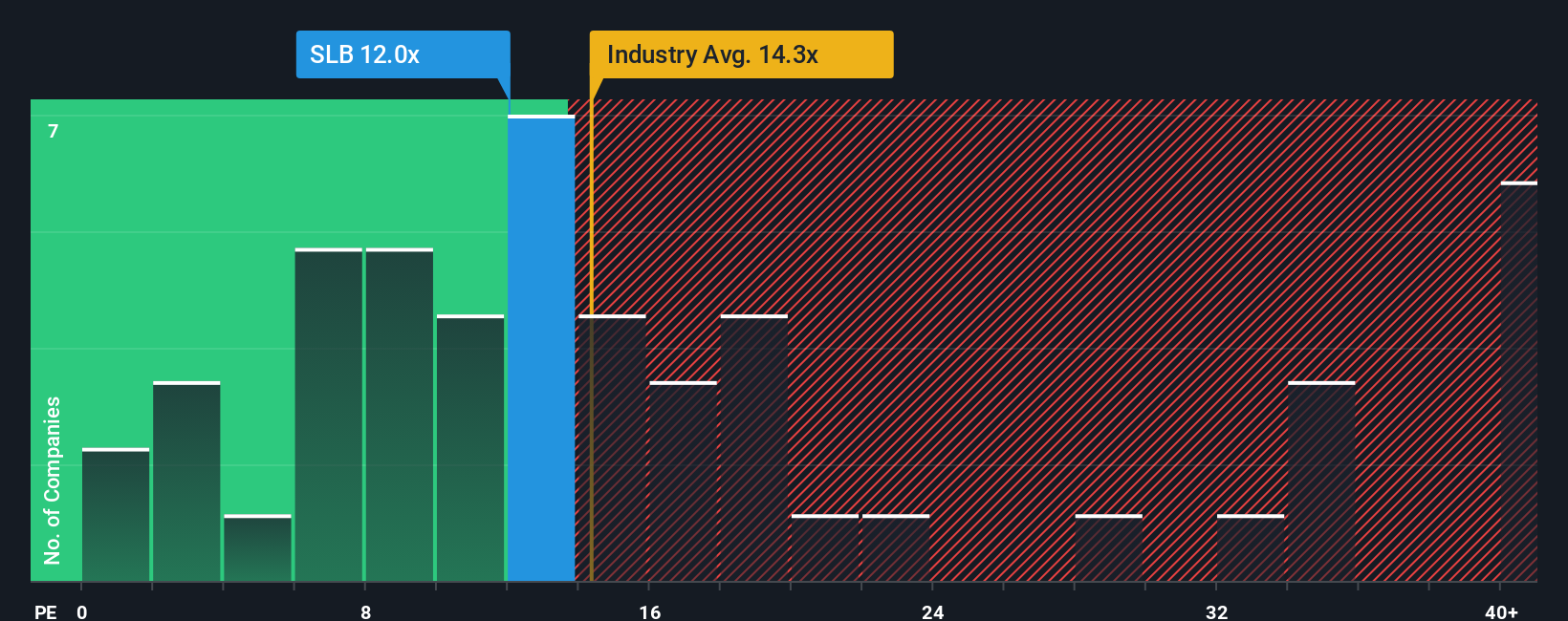

The Price-to-Earnings (P/E) ratio is a favored valuation metric when analyzing profitable companies like SLB because it directly relates the market price to the company's bottom-line earnings. This offers investors a clear sense of how much they are paying for every dollar of current profit.

It is important to note that what constitutes a “normal” or “fair” P/E ratio depends on broader market conditions, the company’s future growth prospects, and any risks on the horizon. Rapidly growing companies often command higher P/E ratios while elevated risks might justify lower multiples.

Currently, SLB’s P/E ratio sits at 15x. This is below both the industry average of 17.1x and the peer group average of 17.0x, signaling that the market may be valuing SLB more conservatively relative to its immediate competitors.

Simply Wall St’s proprietary “Fair Ratio” for SLB is 20.2x. This metric sets itself apart by considering not only traditional factors like industry benchmarks, but also SLB’s specific earnings growth, profit margin, risk profile, market cap, and other company-specific drivers. It is designed to capture a more complete and forward-looking view of a company’s fair value than simple peer or industry comparisons alone.

Comparing SLB’s current P/E of 15x with the Fair Ratio of 20.2x, the stock appears undervalued based on these tailored fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SLB Narrative

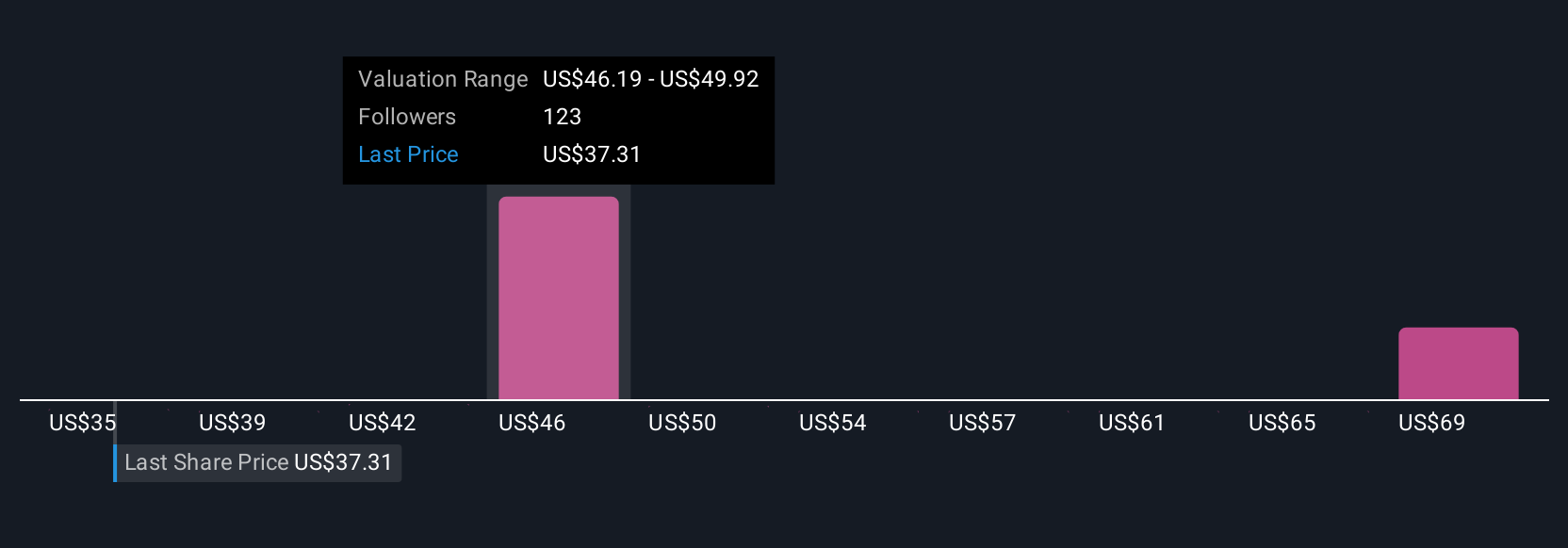

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story or perspective about a company, rooted in your assumptions about its future revenue, profits, and fair value. It connects what you believe to future numbers.

With Narratives, you link SLB’s underlying business story, such as digital growth, expansion into low-carbon initiatives, or market risks, to your own financial forecast and an estimated fair value, all in one place.

They are easy to use and available on Simply Wall St’s Community page, where millions of investors debate, share, and update their perspectives.

Narratives help you decide when to buy, sell, or hold by comparing what you believe SLB is worth (Fair Value) against the current market price. Since they are updated dynamically when new earnings, news, or industry changes are reported, you can stay informed.

For example, some investors see long-term upside in SLB due to its digital momentum and margin improvements, giving it a bullish price target of $63.00. Others believe market and integration risks justify a more conservative target of $36.00. With Narratives, both outlooks are easy to compare, update, and review in real time.

Do you think there's more to the story for SLB? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

SLB

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026