- United States

- /

- Oil and Gas

- /

- NYSE:SFL

A Look at SFL Corp (NYSE:SFL) Valuation After Analyst Upgrades and Strong Q3 Earnings

Reviewed by Simply Wall St

SFL (NYSE:SFL) caught fresh attention as its third-quarter earnings beat expectations and the company kept its dividend steady. Recent analyst upgrades reflect growing optimism, driven in part by continued share repurchases.

See our latest analysis for SFL.

Following the recent dividend affirmation and a notable round of share buybacks, SFL's 1-month share price return of nearly 18% signals renewed momentum. However, its year-to-date share price return remains down about 21%. Over the longer run, the 5-year total shareholder return stands out at almost 83%, showing the stock has rewarded patient investors despite some recent volatility.

If SFL’s resilient performance has piqued your interest, now is an opportune moment to look beyond and discover fast growing stocks with high insider ownership

With SFL drawing fresh praise from analysts and outperforming on earnings, investors are left to wonder if the recent rally is pointing to lasting value or if future gains are already reflected in the share price.

Most Popular Narrative: 12.5% Undervalued

At $8.25 per share, SFL is trading below its narrative fair value estimate of $9.43, setting up a possible upside that draws attention to the company’s long-term potential.

SFL's ongoing investment in modern, fuel-efficient, and LNG-capable vessels, along with substantial efficiency upgrades, positions the company to benefit from tightening environmental regulations and growing demand for lower-emission shipping. This supports higher utilization rates, improved charter terms, and strengthening net margins and long-term earnings stability.

Intrigued by what’s fueling this upside forecast? The secret recipe behind the narrative rests on bold moves in fleet renewal and a profit surge that challenges sector norms. Want to know which pivotal assumptions transform cautious outlooks into upside projections? Dig into the full narrative to see what could drive SFL beyond its current price.

Result: Fair Value of $9.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as weaker shipping demand or further margin pressures could quickly overshadow the current bullish outlook and shift the value narrative for SFL.

Find out about the key risks to this SFL narrative.

Another View: Multiple-Based Valuation

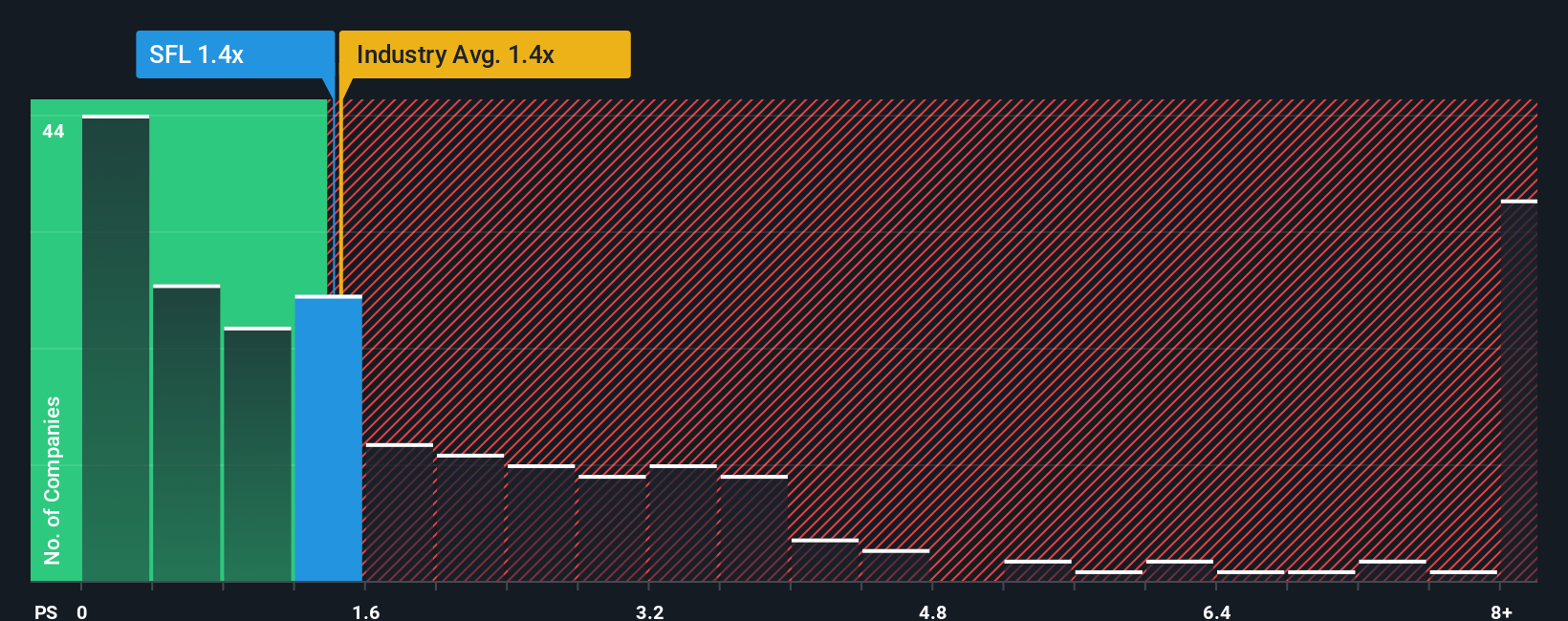

Looking at SFL's valuation from a different perspective, its price-to-sales ratio stands at 1.4x. This matches the industry average but is noticeably higher than the fair ratio of 1.2x for the company. While SFL appears in line with peers, is the market pricing in too much optimism or is there still room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SFL Narrative

If the story above doesn’t fit your view or you’d rather dig into the numbers firsthand, you can craft your own take in just a few minutes: Do it your way

A great starting point for your SFL research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize today’s momentum and broaden your search to reveal high-potential stocks and themes other investors may overlook. Don’t let these unique opportunities pass you by.

- Tap into growth with these 25 AI penny stocks as they transform industries through powerful machine learning, automation, and real-world artificial intelligence applications.

- Hunt for steady income by checking out these 17 dividend stocks with yields > 3% which deliver robust yields and reliable cash flow in a changing market.

- Spot undervalued gems by searching for these 920 undervalued stocks based on cash flows featuring strong cash flow potential and attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFL

SFL

A maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives