- United States

- /

- Energy Services

- /

- NYSE:SEI

A Look at Solaris Energy Infrastructure's Valuation After Strong Q3 Growth and Dividend Confirmation

Reviewed by Simply Wall St

Solaris Energy Infrastructure (SEI) delivered third quarter earnings that showed sharp growth in sales and profitability, while also confirming another quarterly dividend. These events give investors plenty to consider right now.

See our latest analysis for Solaris Energy Infrastructure.

SEI's year-to-date share price has surged 72.2% to $50.71, with momentum accelerating over the last three months due to standout results and another dividend confirmation. The long-term story is even more impressive, highlighted by a 201% one-year total shareholder return and a remarkable 856% five-year total return, signaling strong gains for dedicated investors.

If this kind of rapid transformative growth gets you interested in what other companies are achieving, now is a great time to broaden your investing universe and discover fast growing stocks with high insider ownership

But with shares up more than 70% this year and trading at a significant premium to recent analyst targets, investors are left to wonder if Solaris Energy Infrastructure still offers substantial upside or if expectations for future growth are already fully reflected in the stock price.

Most Popular Narrative: 18.2% Undervalued

Solaris Energy Infrastructure’s most widely followed valuation narrative places fair value at $62 per share, well above the last close of $50.71. This significant gap has caught investors’ attention and now all eyes are on what is fueling such a bullish perspective.

The shift to higher-margin owned assets and continued technology investment are set to boost profitability, strengthen customer relationships, and expand Solaris's market reach.

Want to know why this growth story stands out? The narrative hinges on major jumps in profit margins and eye-opening future earnings assumptions. Which bold moves and financial forecasts are driving such a high fair value? Dig in to see what analysts believe justifies such optimism.

Result: Fair Value of $62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if projected profit margins or expansion plans falter. This could quickly undermine the current bullish outlook for Solaris Energy Infrastructure.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: Multiples Suggest Caution

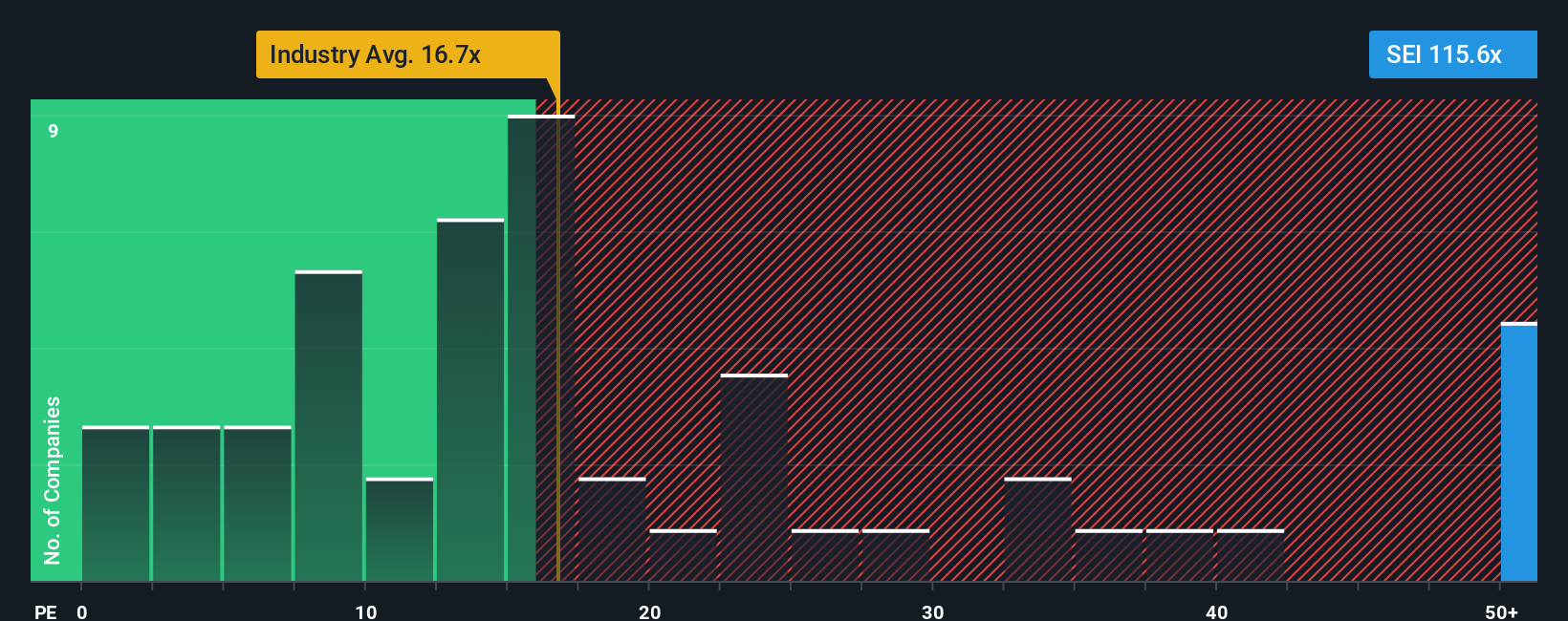

While many see Solaris Energy Infrastructure as undervalued, the company’s price-to-earnings ratio is a hefty 63.5x, far above the US Energy Services industry average of 16.3x and the peer average of 19.2x. Even the fair ratio estimate is just 23.2x. Such a wide gap poses significant valuation risk if growth expectations slip. How much extra are investors really paying for this story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see things differently, or want to dive deeper and form your own perspective, you can craft a unique investment story in minutes: Do it your way

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big winner slip through your fingers. Make your portfolio stand out by seizing top opportunities the majority are missing today.

- Tap into tomorrow’s breakthroughs with these 25 AI penny stocks and see which innovators are redefining artificial intelligence right now.

- Unlock value in markets others have overlooked by starting with these 874 undervalued stocks based on cash flows focused on strong cash flows and hidden growth potential.

- Step up your income game and target impressive yields from these 16 dividend stocks with yields > 3% offering excellent returns above 3% and solid track records.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives