- United States

- /

- Energy Services

- /

- NYSE:SDRL

Seadrill (NYSE:SDRL) Valuation: Is There Hidden Upside After Recent Share Price Gains?

Reviewed by Simply Wall St

See our latest analysis for Seadrill.

Seadrill's recent 4% share price return over the past month hints at a rebound. However, the one-year total shareholder return of -20% shows momentum is still recovering after a tough stretch for offshore drillers. The stock has seen some positive movement lately, but the longer-term performance signals that sentiment and investor risk appetite are still finding their footing.

If this turnaround story has you scanning the horizon for other opportunities, now could be just the right moment to discover fast growing stocks with high insider ownership.

With shares still well below analyst targets, but recent gains suggesting renewed optimism, the key question is whether Seadrill is a bargain waiting to be realized or if the market already anticipates its next move.

Most Popular Narrative: 27.7% Undervalued

At $31.47, Seadrill’s stock price sits well below the dominant narrative’s $43.50 fair value. This suggests a meaningful gap between market expectations and projected future potential.

*A significant pickup in offshore exploration activity is expected, as major operators like TotalEnergies and BP commit to multi-year, high-volume drilling campaigns. Regulatory changes in the US Gulf and Brazil are also driving more lease sales. These factors could directly increase future revenue, fleet utilization, and dayrate potential from late 2026 onward.*

Want to see which future shifts in margins and earnings could be behind this bold fair value? The real story is in aggressive growth bets and profit leaps that would surprise even optimists. Ready to unpack the surprising analyst assumptions that push Seadrill’s price target far beyond today’s level? Dive in and see what everyone’s missing.

Result: Fair Value of $43.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, near-term market softness and increased competition could challenge Seadrill’s pricing power. This may potentially delay the anticipated turnaround in earnings growth.

Find out about the key risks to this Seadrill narrative.

Another View: Mind the Valuation Gap

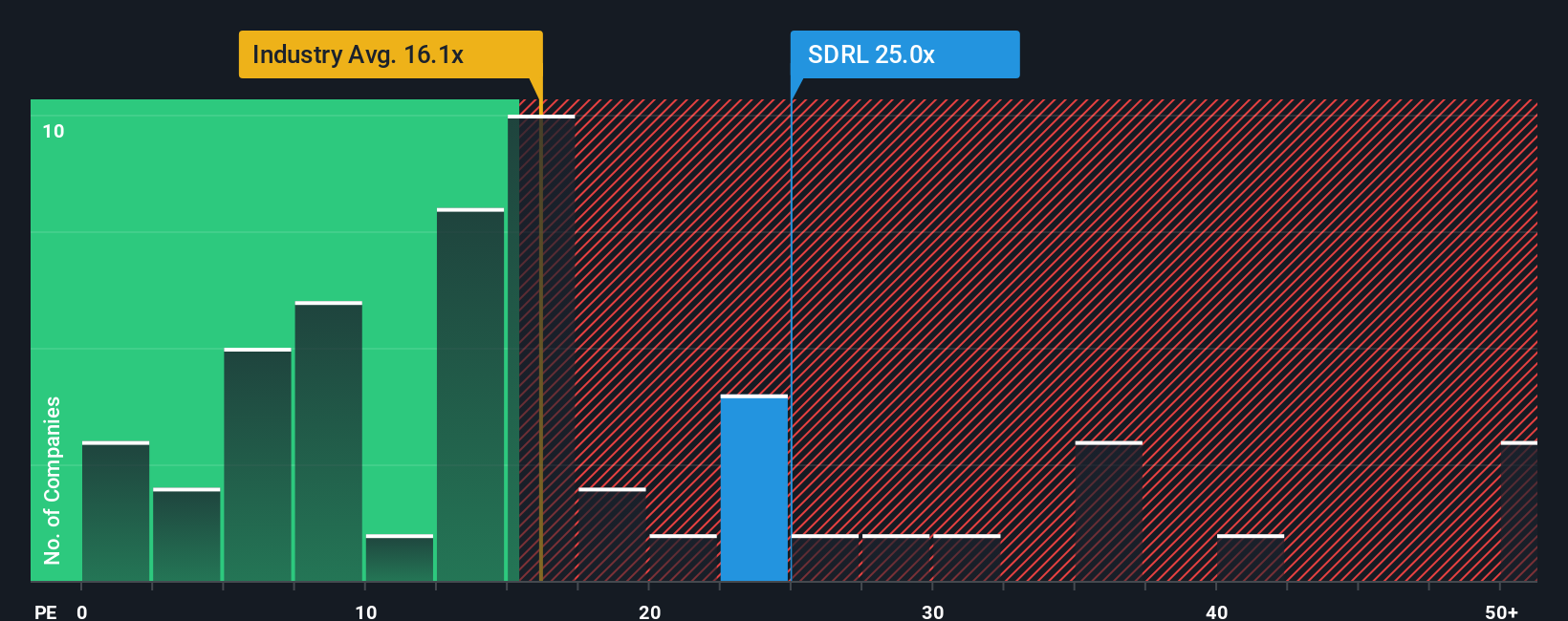

While the analyst consensus points to a fair value well above Seadrill’s market price, a look at its price-to-earnings ratio tells a different story. Trading at 25.4x earnings, Seadrill looks pricey compared to peers averaging 15.9x and the US Energy Services industry average at 16.5x. Still, the fair ratio suggests 28x could be justified if market optimism returns. Is this a warning signal or a window for risk-tolerant investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Seadrill Narrative

If you think there is another angle, or want to dig into the numbers on your own, why not craft your own view in just a few minutes by using Do it your way.

A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for the next great opportunity. Don’t let yourself fall behind. Shape your watchlist with handpicked investments that match your strategy.

- Tap into growth and stability with these 24 dividend stocks with yields > 3% for reliable returns and payouts beyond today's market volatility.

- Unlock tomorrow's breakthroughs by following these 28 quantum computing stocks, featuring companies driving advancements in quantum computing innovation.

- Catalyze your portfolio's upside with these 834 undervalued stocks based on cash flows and uncover equities offering strong fundamentals at attractive prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SDRL

Seadrill

Provides offshore drilling services to the oil and gas industry worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives