- United States

- /

- Oil and Gas

- /

- NYSE:SBOW

SilverBow Resources, Inc.'s (NYSE:SBOW) Share Price Boosted 27% But Its Business Prospects Need A Lift Too

SilverBow Resources, Inc. (NYSE:SBOW) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 53%.

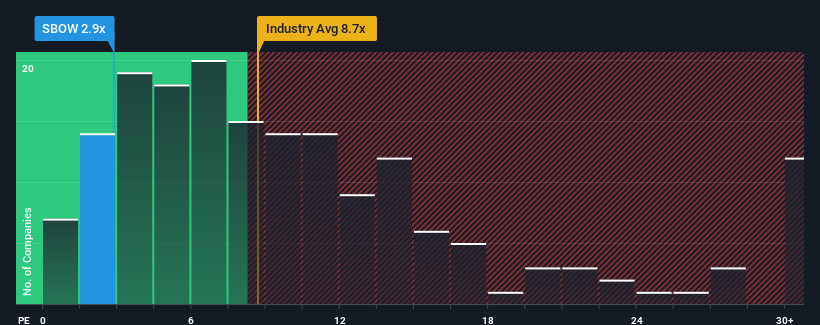

In spite of the firm bounce in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may still consider SilverBow Resources as a highly attractive investment with its 2.9x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, SilverBow Resources has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for SilverBow Resources

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as SilverBow Resources' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 3.7% per year as estimated by the six analysts watching the company. That's not great when the rest of the market is expected to grow by 10% each year.

With this information, we are not surprised that SilverBow Resources is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Even after such a strong price move, SilverBow Resources' P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that SilverBow Resources maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware SilverBow Resources is showing 4 warning signs in our investment analysis, and 2 of those are significant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SBOW

SilverBow Resources

An independent oil and gas company, exploration, develops, acquires, and operates oil and natural gas properties in the Eagle Ford shale and Austin Chalk located in South Texas.

Very undervalued slight.

Similar Companies

Market Insights

Community Narratives