- United States

- /

- Oil and Gas

- /

- NYSE:RRC

Range Resources (RRC): Margins Hold Near 20% as Growth Slows, Challenging Bullish Narratives

Reviewed by Simply Wall St

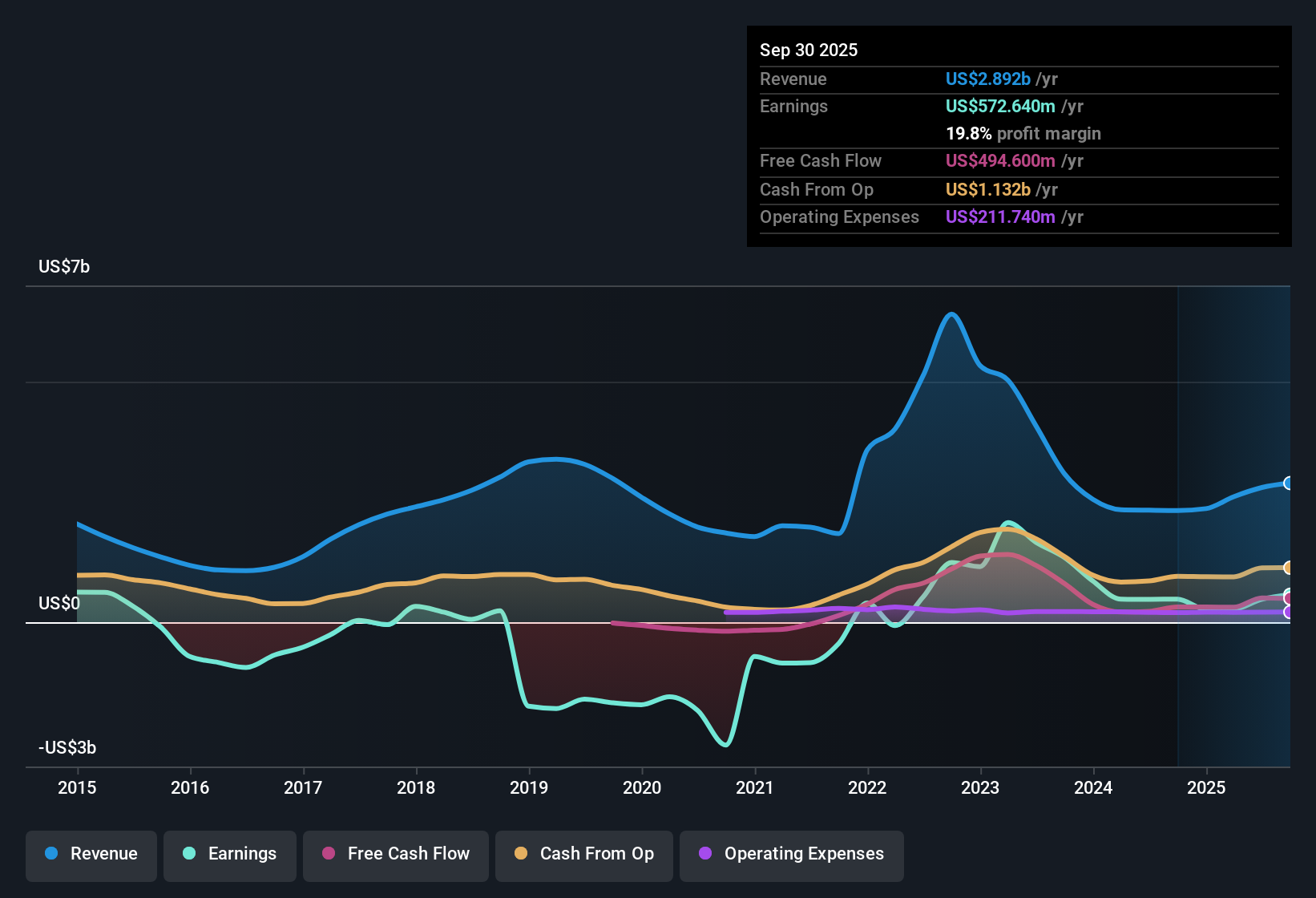

Range Resources (RRC) posted revenue growth forecasts of 11.6% annually, outpacing the broader US market's 10.2% estimate. EPS is expected to rise by 13.6% per year, which is a bit slower than the national average of 15.6%. Over the last five years, the company turned profitable with earnings increasing at a 42.1% annual rate, though the latest year saw a more moderate 20.1% gain. Shares are currently trading at $34.99, well below an estimated fair value of $77.56. Profit margins remain robust at 20%, only slightly lower than last year's 20.4%, highlighting sustained operational strength but with a moderation in growth rates.

See our full analysis for Range Resources.Next, we’ll see how these results match up against the narratives that investors have been following. Some common assumptions may be confirmed, while others could get a reality check.

See what the community is saying about Range Resources

Margins Stay Strong Near 20%

- Profit margins are holding at 20%, just a touch below last year's 20.4%, even as revenue and earnings growth moderate from their multi-year highs.

- Analysts' consensus view highlights that operational efficiencies, disciplined capital spending, and Range's leadership in producing low-emission gas help explain why margins remain resilient.

- Historically rapid earnings growth has given way to steadier gains. Improved drilling techniques and reduced per-well costs have kept margins healthy.

- Margin strength also reflects the company’s focus on exporting to premium markets. Expanded LNG export capacity is expected to further support profit levels as global demand rises.

- Consensus narrative says the ability to sustain margins around 20% is crucial, as it cushions against market volatility and reinforces Range's position as a top-tier operator compared to peers.

- Consensus narrative: see how these profit drivers weigh in against the consensus outlook. 📊 Read the full Range Resources Consensus Narrative.

Buybacks Beat: Fewer Shares, Higher Per-Share Growth

- Analysts expect Range Resources to reduce shares outstanding by about 1.28% annually over the next three years, boosting earnings per share growth beyond simple net income gains.

- Analysts' consensus view notes that aggressive buybacks, rapid deleveraging, and lower interest expense are compounding per-share gains for investors.

- $120 million in repurchase activity this year alone indicates capital is flowing back to shareholders, not just into drilling.

- This capital discipline reinforces Range’s commitment to shareholder returns even as other producers hesitate on buybacks in volatile markets.

Valuation Discount Versus Fair Value and Targets

- Range’s share price of $34.99 is well below its DCF fair value of $77.56 and also trades at a 16% discount to the analyst price target of $41.78. This reflects the market’s skepticism toward its multi-year outlook despite ongoing profitability.

- Analysts' consensus view sees Range as relatively undervalued compared to peers. Its current Price-to-Earnings ratio is above the broader U.S. oil and gas sector but below the peer average.

- This valuation gap suggests investors remain unconvinced that Range can fully capture new demand from AI data centers and LNG exports, even as forecasts call for revenue and margin improvements.

- For the discount to close, the company will need to deliver on both growth and capital return promises while managing risks around regulation and commodity prices.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Range Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data points to a different story? You can quickly shape your own narrative and share your outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Range Resources.

See What Else Is Out There

Despite resilient profit margins, investors remain skeptical about Range’s ability to capture new growth opportunities. This has kept its share price well below fair value.

If sustained skepticism and valuation discounts concern you, use these 848 undervalued stocks based on cash flows to discover companies the market may be mispricing with stronger upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives