- United States

- /

- Energy Services

- /

- NYSE:RIG

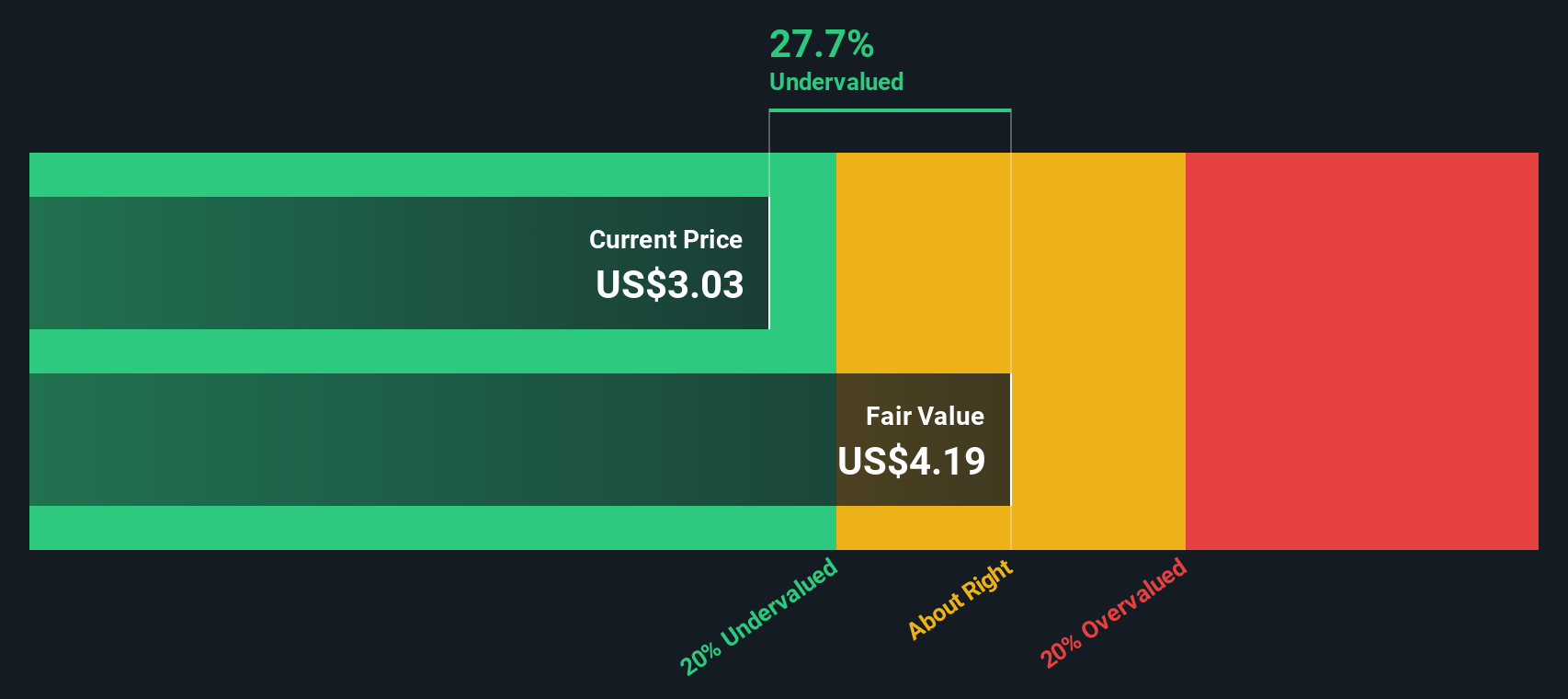

How Does Transocean’s Recent 27% Surge Impact Its True Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Transocean is a bargain or overpriced right now? You are not alone, as questions about value are front of mind for many investors keeping an eye on this offshore drilling specialist.

- Transocean's shares have been on the move lately, jumping 26.7% in the past month but still down 1.7% over the last year, highlighting both volatility and changing risk perceptions.

- Industry headlines have been focused on shifting energy markets, renewed interest in offshore drilling, and increased investor attention fueled by sector-wide developments. All of these factors help explain the recent price swings in Transocean's stock.

- On traditional valuation metrics, Transocean scores a 2 out of 6 for undervaluation, so a surface-level check does not make it a clear value play. However, exploring different valuation approaches may reveal more, and the final verdict may not be so simple.

Transocean scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Transocean Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to reflect what they are worth today. This approach is often used to get an intrinsic sense of whether a stock is a bargain, overvalued, or roughly in line with its current trading value.

For Transocean, the current Free Cash Flow (FCF) stands at $141.5 million. According to analyst expectations and extrapolated estimates, the company's FCF is projected to grow over the coming years. By 2027, projections indicate annual FCF could reach $680 million, with a gradual increase to nearly $740 million by 2035 based on extended forecasts.

Applying the DCF method, the intrinsic value per share is calculated at $9.06. With the current market pricing, the stock appears 54.4% undervalued on this basis, suggesting a sizable margin of safety for investors who put confidence in the underlying projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Transocean is undervalued by 54.4%. Track this in your watchlist or portfolio, or discover 905 more undervalued stocks based on cash flows.

Approach 2: Transocean Price vs Sales

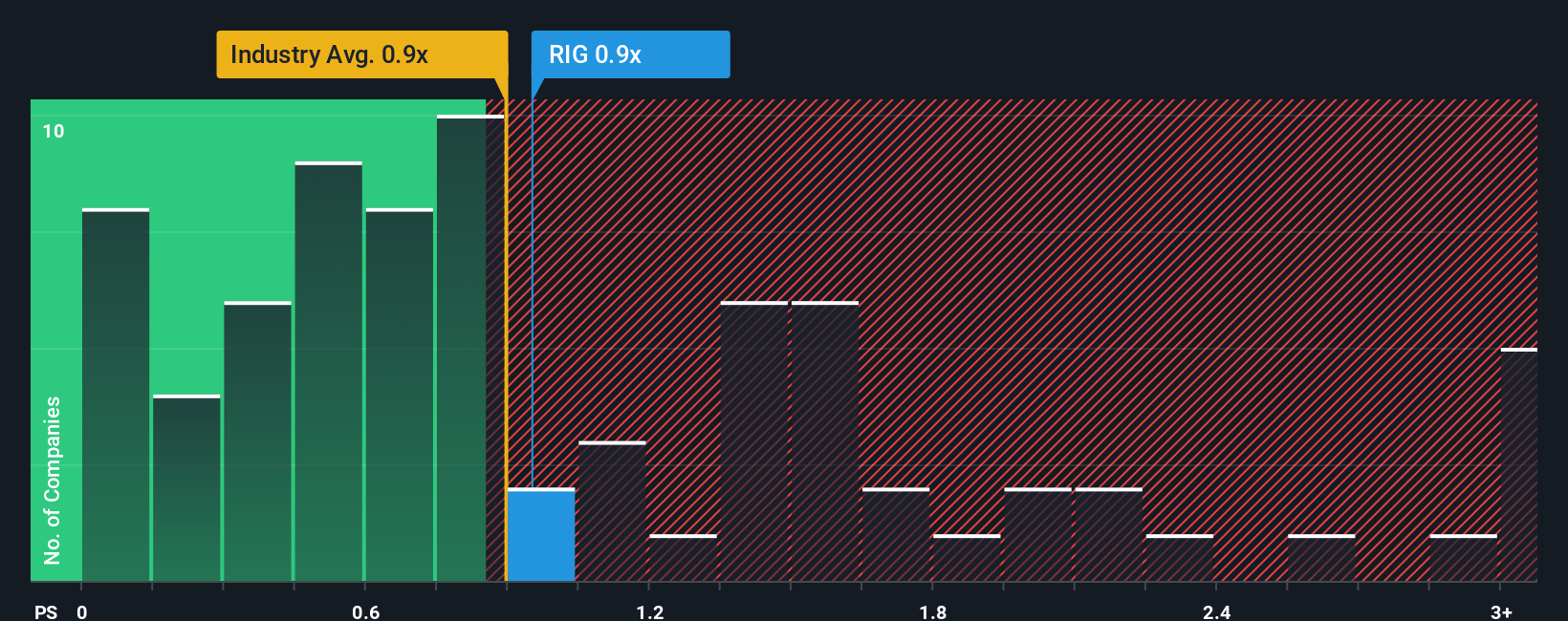

The Price-to-Sales (P/S) ratio is often favored for valuing companies in capital-intensive sectors like energy services, especially when earnings can be volatile or negative. This metric compares a company’s stock price to its revenues, making it a useful indicator when profits are uneven but sales remain steady. A lower P/S ratio can signal a potential bargain, while a higher ratio may point to overvaluation. However, context is key.

Determining what constitutes a fair P/S ratio depends on factors like growth expectations and perceived risk. Higher growth potential or lower perceived risk typically allows for a higher “normal” P/S ratio. On the other hand, mature or riskier companies generally deserve lower multiples. For Transocean, the current P/S stands at 1.17x, which is just above the average for industry peers at 1.07x and the broader energy services sector at 1.02x.

Simply Wall St’s proprietary “Fair Ratio” advances beyond basic peer or industry averages by factoring in earnings growth, profit margins, market capitalization, and risk. For Transocean, the Fair Ratio is 0.98x, slightly below its current P/S. This approach offers a more precise benchmark for today’s market conditions and Transocean’s unique characteristics, providing a rounded sense of whether the stock is appropriately valued.

Since the difference between the actual P/S and the Fair Ratio is less than 0.10, Transocean’s valuation appears to be about right based on sales.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1416 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Transocean Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives, a smarter, more dynamic approach to investing available on Simply Wall St’s Community page.

A Narrative is simply your story for a company. It connects what you know about a business with your own assumptions for future revenue, profit, and margins, and links these to a fair value estimate. Narratives empower you to turn your market perspective into a financial forecast, allowing you to see not just the numbers, but the story behind them.

This tool gives investors an easy and accessible way to compare their fair value to the market price, making it clear when the numbers suggest a buy or sell. Better yet, Narratives update automatically as new earnings data or major news arrives, so your view stays current without any extra work.

For example, with Transocean, some investors may have a bullish Narrative, focusing on rising demand and projecting a fair value over $5.5 per share. Others may be more cautious, emphasizing industry risks and arriving at a fair value nearer to $2.5. No matter your view, Narratives let you customize your investment thesis and see in real time how your story stacks up against fresh information and market movement.

Do you think there's more to the story for Transocean? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives