The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Transocean Ltd. (NYSE:RIG) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Transocean

What Is Transocean's Net Debt?

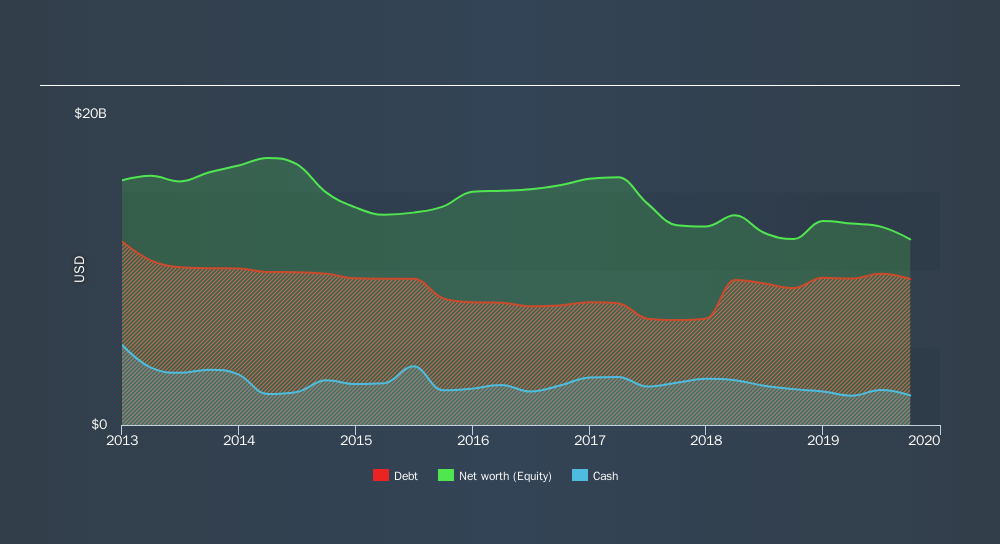

The chart below, which you can click on for greater detail, shows that Transocean had US$9.39b in debt in September 2019; about the same as the year before. However, it does have US$1.91b in cash offsetting this, leading to net debt of about US$7.48b.

How Healthy Is Transocean's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Transocean had liabilities of US$1.49b due within 12 months and liabilities of US$11.0b due beyond that. Offsetting this, it had US$1.91b in cash and US$674.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$9.93b.

This deficit casts a shadow over the US$2.95b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Transocean would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Transocean can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Transocean wasn't profitable at an EBIT level, but managed to grow its revenue by5.9%, to US$3.0b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Transocean had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost US$62m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost US$1.4b in just last twelve months, and it doesn't have much by way of liquid assets. So while it will probably survive, we think it's risky; we'd treat it like chicken pox and try to avoid it. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting Transocean insider transactions.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives