- United States

- /

- Energy Services

- /

- NYSE:RES

Will Higher Sales but Lower Profits Reshape RPC's (RES) Investment Narrative?

Reviewed by Sasha Jovanovic

- RPC, Inc. recently reported third quarter 2025 earnings, revealing US$447.1 million in sales, a year-over-year increase, but a decrease in net income to US$12.96 million compared to US$18.8 million a year earlier.

- While sales growth was strong, the decline in profitability stands out, as it signals higher operating costs or margin pressures despite revenue gains.

- We'll examine how RPC's latest earnings, marked by higher sales but lower profits, reshape the company's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

RPC Investment Narrative Recap

To be a shareholder in RPC, Inc., you need to believe that its investments in technology, diversification, and cleaner service lines are positioning it for long-term, stable growth despite volatility and cyclical pressures in the energy services market. The recent earnings report, showing higher sales but lower profits, does not materially change the central short-term catalyst, which is operational innovation driving client demand, but it does reinforce that margin pressure is the key risk facing the business right now.

Of the recent company announcements, the affirmation of a regular quarterly dividend at US$0.04 per share stands out. This steady payout, despite earnings compression, will matter to income-seeking investors, but it does not alter the fact that margin pressures and rising costs continue to weigh on near-term profitability.

On the other hand, investors should be aware of the potential for increased competition and pricing pressure to...

Read the full narrative on RPC (it's free!)

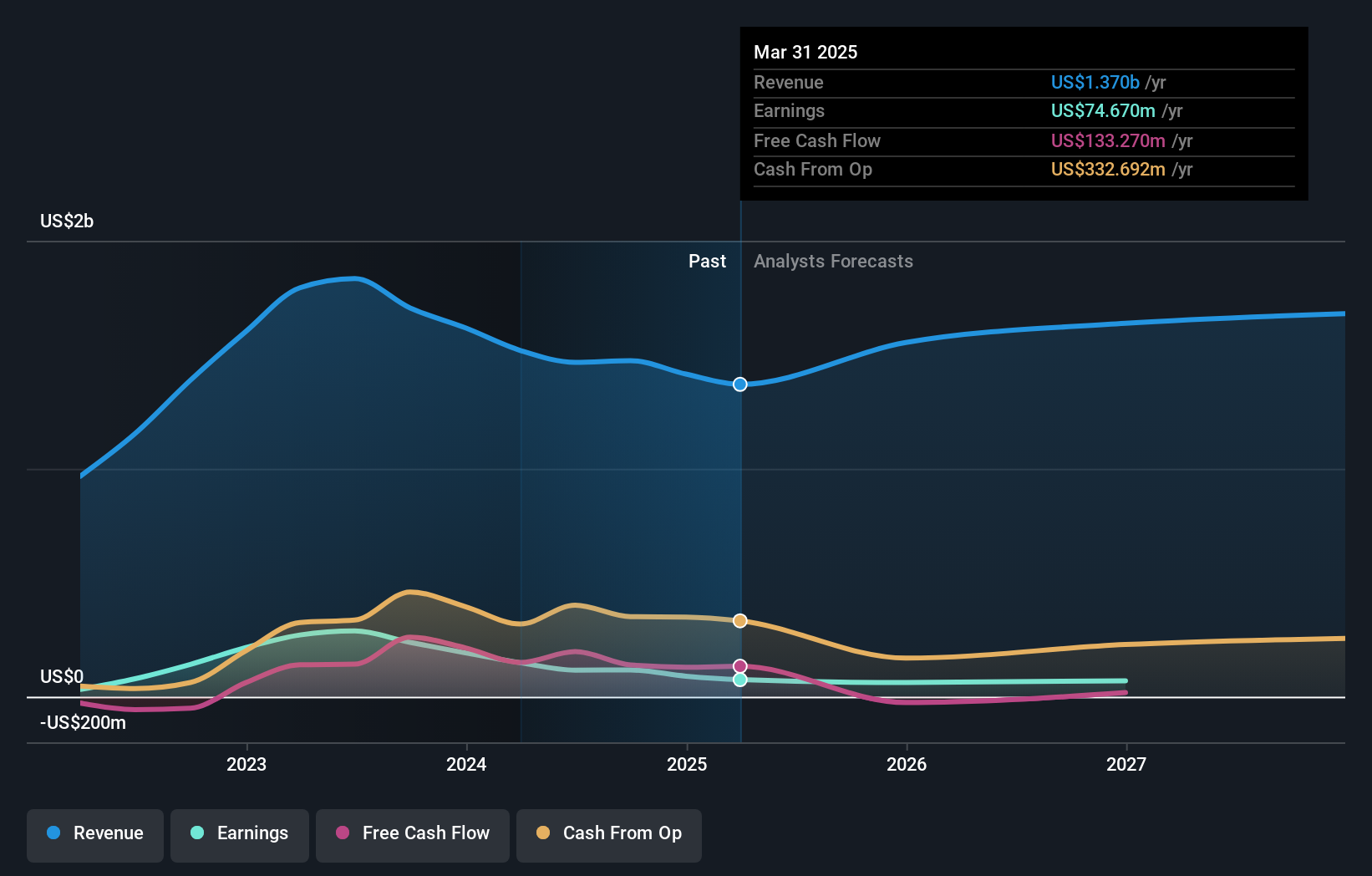

RPC's narrative projects $1.7 billion revenue and $72.9 million earnings by 2028. This requires 5.4% yearly revenue growth and a $20 million earnings increase from $52.9 million today.

Uncover how RPC's forecasts yield a $5.66 fair value, in line with its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community for RPC, Inc. span from US$4.08 to US$8 per share. As market participants debate future growth and margin risks, you can compare multiple views before making your own judgment.

Explore 3 other fair value estimates on RPC - why the stock might be worth as much as 41% more than the current price!

Build Your Own RPC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RPC research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free RPC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RPC's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RES

RPC

Engages provision of a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives