- United States

- /

- Energy Services

- /

- NYSE:PUMP

A Look at ProPetro Holding’s (PUMP) Valuation After Strong Earnings Beat and New Data Center Contract

Reviewed by Simply Wall St

ProPetro Holding, fresh off its latest quarterly results, caught investors' attention after delivering earnings that beat expectations, even as revenue tapered. The company also secured a long-term energy contract with a major data center operator.

See our latest analysis for ProPetro Holding.

After posting quarterly numbers that exceeded forecasts, ProPetro Holding’s share price surged, delivering an eye-catching 113.8% gain over the past 90 days. Even with revenue headwinds, the strong operational update and a promising energy contract have clearly shifted sentiment. Momentum has rapidly built compared to earlier in the year, reflected in a 1-year total shareholder return of 56.9% and a five-year total return standing at 180%.

If this kind of turnaround story sparks your curiosity, it could be the perfect time to discover fast growing stocks with high insider ownership.

With shares having staged such a dramatic rebound, the key question now is whether ProPetro remains undervalued based on its recent results and opportunities, or if the market has already priced in the next phase of growth.

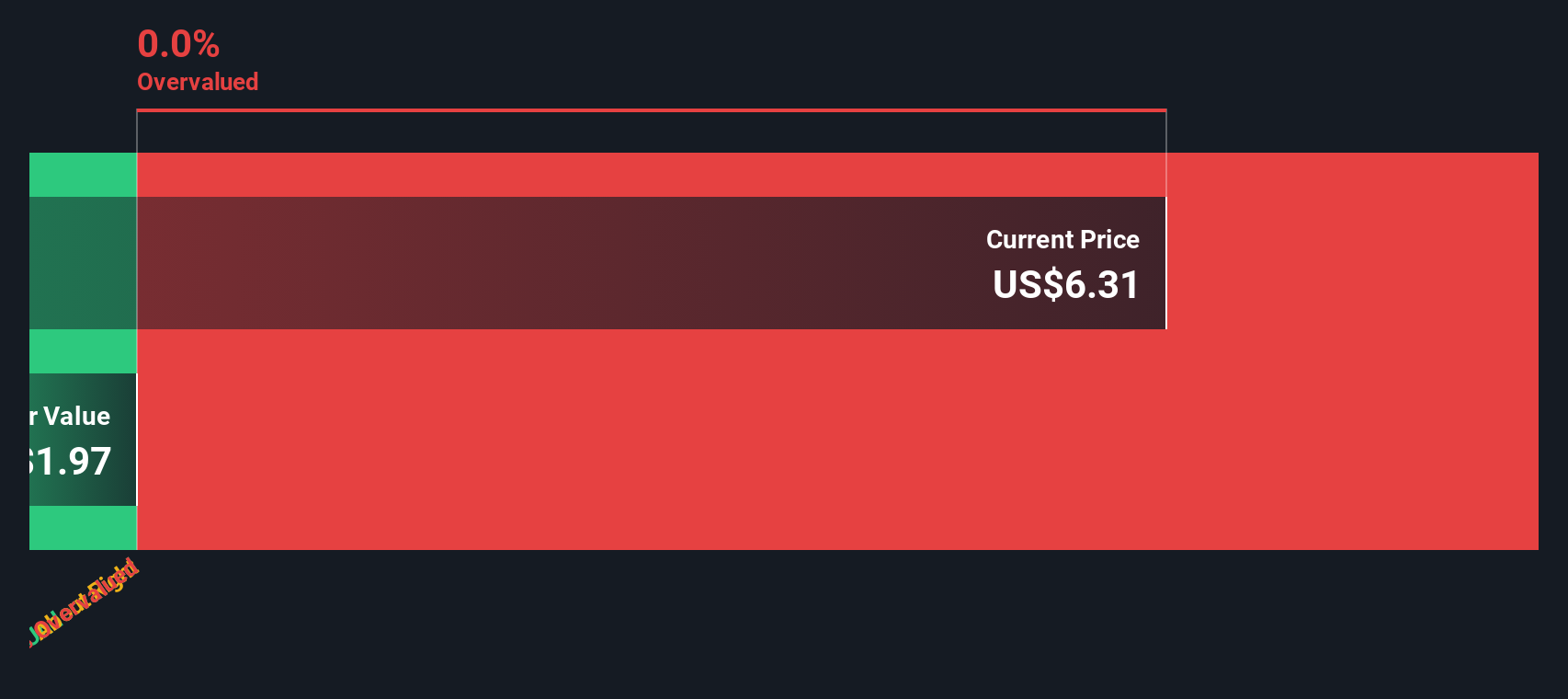

Most Popular Narrative: 57% Overvalued

ProPetro Holding's most popular narrative assigns a fair value of $6.89, which is substantially below the last close price of $10.84. This sizable gap fuels debate on whether the optimism from recent momentum justifies the current stock price, especially as sector conditions evolve.

The company's accelerated transition to next-generation, dual-fuel and electric fleets, now comprising about 75% of its total fleet, positions ProPetro to capture premium contract pricing, win longer-term agreements, and benefit from rising ESG and efficiency standards. This transition may improve net margins as older diesel competitors exit or are forced to idle capacity.

Why are analysts calling for such a sharp disconnect between narrative fair value and the market price? This storyline hinges on bold projections for revenue resilience and shifting sector profit margins. The surprising piece: the narrative’s case is built on transformation bets and strategic contract wins. Want to uncover the full playbook? See which financial and industry catalysts drive this valuation. One pivotal assumption could change it all.

Result: Fair Value of $6.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market oversupply or rapid pullbacks from key customers could quickly undermine ProPetro’s recovery and challenge the optimistic outlook ahead.

Find out about the key risks to this ProPetro Holding narrative.

Another View: What Does Our DCF Model Say?

While the popular narrative sees ProPetro as overvalued using market pricing, our SWS DCF model takes a different approach. Based on projected future cash flows, it currently suggests the stock is actually undervalued, trading well below its estimated fair value. Does this gap signal a hidden opportunity, or could those growth assumptions prove too optimistic as industry headwinds persist?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ProPetro Holding Narrative

If you think there’s more to the story, or you want to dig into the numbers yourself, you can build your own narrative in just a few minutes and see where your analysis leads you. Do it your way.

A great starting point for your ProPetro Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your portfolio; supercharge your strategy by finding stocks that match your ambitions. Make your next move with these standout market opportunities.

- Boost your passive income by tapping into these 24 dividend stocks with yields > 3% with impressive yields above 3% for income-focused investors.

- Spot the industry’s future disruptors and tune into high-potential breakthroughs through these 26 AI penny stocks shaping the global AI landscape.

- Catch growth early by pursuing these 3579 penny stocks with strong financials with robust fundamentals and the potential to become tomorrow’s stars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PUMP

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives