- United States

- /

- Oil and Gas

- /

- NYSE:PBF

Should PBF Energy’s (PBF) Q3 Recovery and Insurance Windfall Prompt Investor Action?

Reviewed by Sasha Jovanovic

- PBF Energy recently reported a significant turnaround for the third quarter of 2025, posting US$170.1 million in net income and receiving substantial insurance recoveries following the Martinez refinery fire, while announcing a US$0.275 dividend per share.

- This operational rebound was further supported by the company’s progress on refinery restarts, cost-saving initiatives, and the sale of non-core assets.

- We'll examine how the financial recovery from insurance proceeds and operational improvements shape PBF Energy's updated investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

PBF Energy Investment Narrative Recap

To be a PBF Energy shareholder, you need to believe in the company’s ability to deliver sustained improvements in operational performance and cash flow despite cyclical commodity markets and regulatory pressure, with the full restart of the Martinez refinery representing the most important short-term catalyst. The recent return to net income and insurance recoveries meaningfully reduce near-term liquidity concerns, but risks around future disruptions and regulatory headwinds at key refineries remain material and require ongoing monitoring.

The company’s October announcement of a US$0.275 per share dividend stands out in this context, as it signals management’s confidence in PBF’s financial stability following significant insurance payouts and asset sales, and ties directly to the company’s focus on capital returns as Martinez operations approach full restoration.

By contrast, investors should be mindful of ongoing operational and regulatory risks at Martinez and how future incidents might impact cash flow resilience...

Read the full narrative on PBF Energy (it's free!)

PBF Energy's narrative projects $33.5 billion in revenue and $71.3 million in earnings by 2028. This requires 3.4% yearly revenue growth and a $1,053.6 million increase in earnings from the current level of -$982.3 million.

Uncover how PBF Energy's forecasts yield a $28.00 fair value, a 18% downside to its current price.

Exploring Other Perspectives

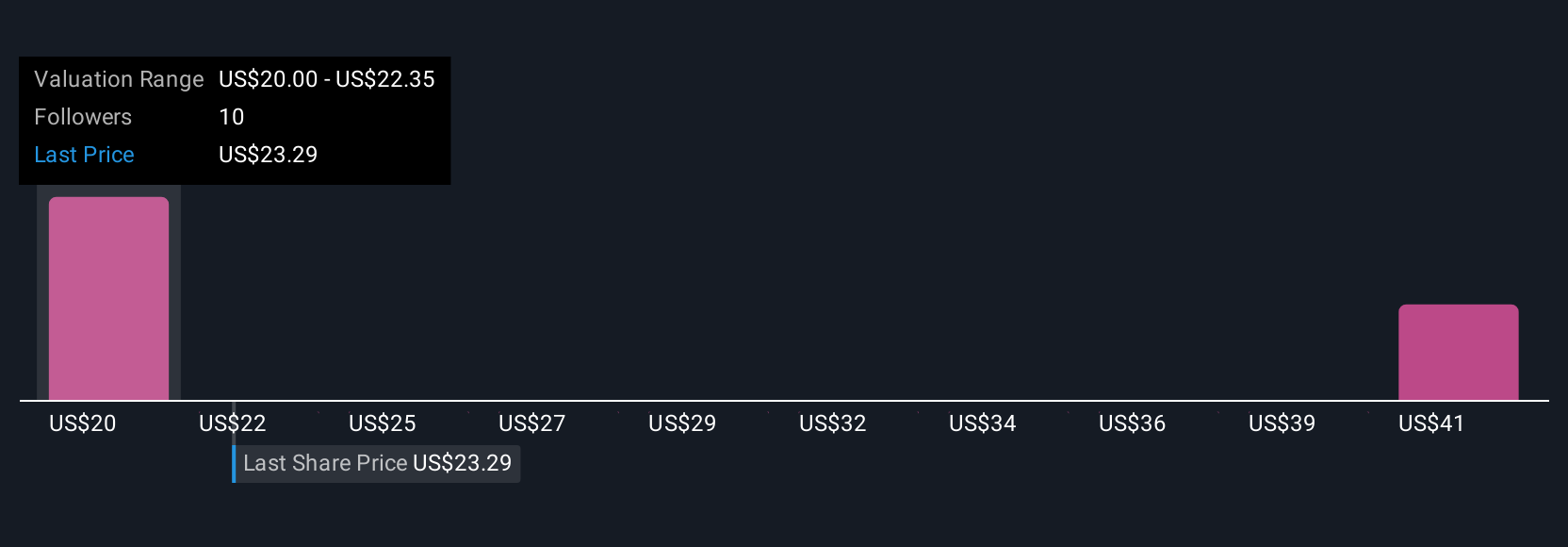

Five members of the Simply Wall St Community estimated PBF Energy’s fair value from as low as US$20 to as high as US$350.33. While these opinions vary widely, the company’s reliance on successfully restoring and operating key refineries remains a focal point for future results, consider how this affects your outlook when comparing alternative views.

Explore 5 other fair value estimates on PBF Energy - why the stock might be worth 41% less than the current price!

Build Your Own PBF Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PBF Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PBF Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives