- United States

- /

- Oil and Gas

- /

- NYSE:PBF

PBF Energy (PBF): Low Valuation Reinforces Bull Case as Earnings Forecast to Surge 71.6% Per Year

Reviewed by Simply Wall St

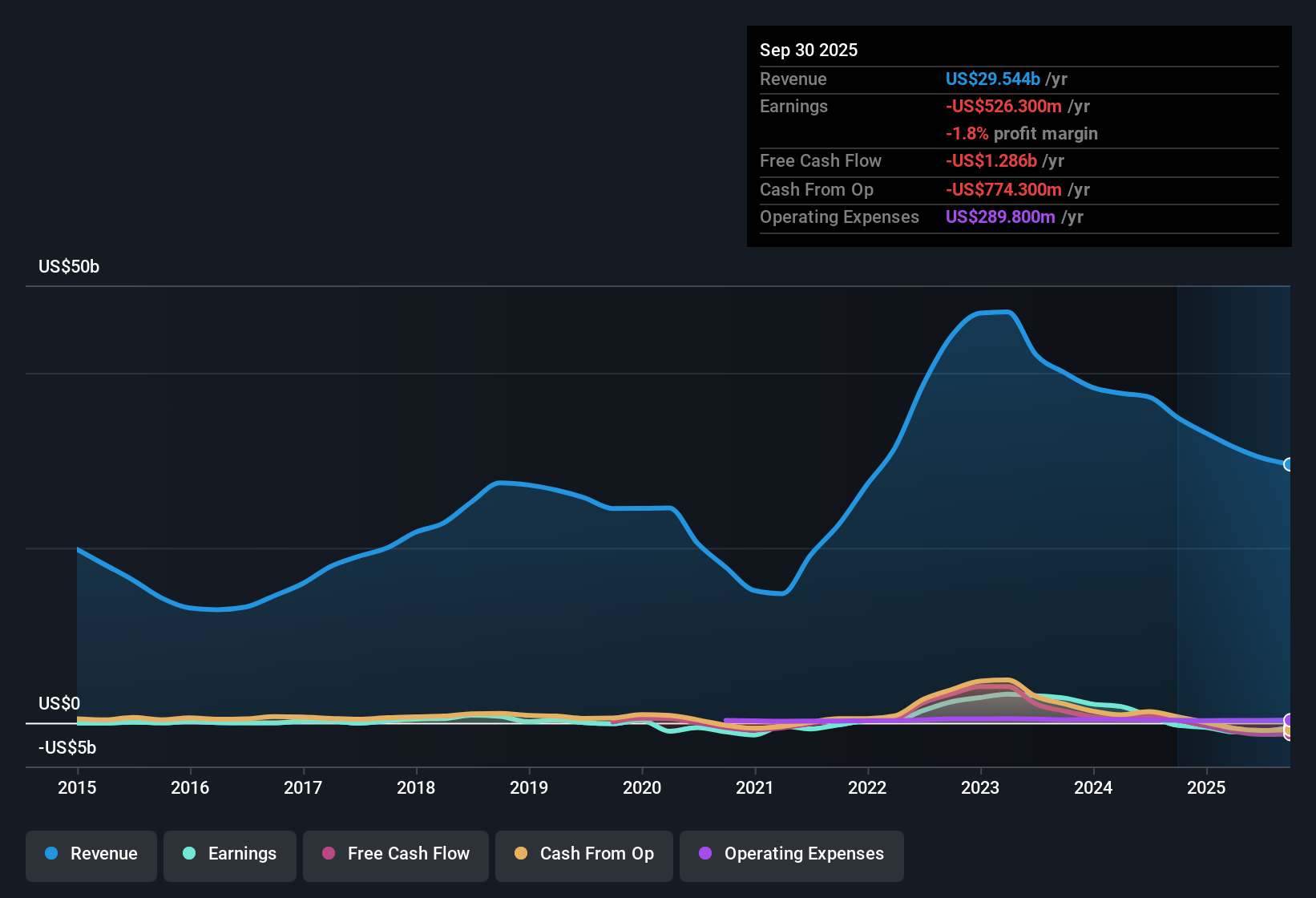

PBF Energy (PBF) is still unprofitable, but earnings are forecast to climb 71.63% per year. Analysts expect the company to reach profitability within three years. Revenue is projected to grow at 6.4% annually, which is slower than the broader US market's expected 10.3% pace. Losses have narrowed by 12.7% per year over the last five years. Investors will likely focus on the mix of robust projected earnings growth and an attractively low Price-to-Sales ratio compared to industry peers.

See our full analysis for PBF Energy.Next, we'll see how these results stack up against some of the key narratives that drive sentiment around PBF Energy, highlighting where expectations and reality may converge or diverge.

See what the community is saying about PBF Energy

Cost Cuts Set Up Margin Recovery

- PBF's cost-reduction and business improvement initiatives are expected to deliver $230 million in annualized savings by end-2025 and $350 million by end-2026, mostly from lower operating and capital expenditures. This sets up the company to potentially achieve net margins of 0.2% in three years, up from -3.2% today.

- Pushing deeper into margin expansion, the consensus narrative highlights that a full restart and upgrades at the Martinez refinery, along with efforts to ramp up renewable diesel output, are aiming to open new revenue streams and take advantage of policy incentives.

- Analysts expect renewable diesel output to ramp to between 16,000 and 18,000 barrels per day, signaling a near-term boost in volumes and supporting higher-margin growth as regulators increasingly reward low-carbon fuels.

- The company’s strong liquidity and improving free cash flow flexibility could fuel further reinvestment in its asset base, reinforcing both operational resilience and long-term shareholder value, according to the consensus narrative.

The consensus narrative notes that execution on these cost and capacity measures could quickly alter the outlook as the structural supply backdrop tightens. Further details feature in the full consensus case below. 📊 Read the full PBF Energy Consensus Narrative.

Exposure to Regulation and Fuel Demand Pressures

- PBF remains heavily dependent on US East and West Coast refined product markets, which exposes the firm to heightened regulatory and compliance risks. These regions face aggressive policy changes that could impact future margin stability and profitability.

- Critics highlight that, despite some moves into renewables, the renewable diesel unit (SBR) is currently running at breakeven, which challenges the company's efforts to diversify and respond to global decarbonization trends.

- Bearish commentators argue that any misstep in securing permits, controlling costs on refinery upgrades, or adapting to carbon rules could result in volatile revenues and erode the potential benefits from other initiatives.

- Analysts warn that persistent operational and regulatory hurdles at sites like Martinez may pressure repair and maintenance capital expenditure, destabilizing free cash flow growth long term and pushing back margin improvement aims.

Valuation Discount Despite Analyst Target Range

- PBF trades at a Price-to-Sales ratio of 0.1x, which is well below both its industry average (1.5x) and peer average (0.4x). Its current share price of $34.57 sits above the official analyst price target of $27.17, signaling either undervalued potential or skepticism among analysts about upside from these levels.

- The consensus narrative underscores that even with the forecast that PBF becomes profitable by 2026, the required PE ratio for the 2028 earnings target (46.6x) remains far above the US Oil and Gas industry average of 12.8x. This implies that significant growth and margin expansion must materialize to justify present trading levels.

- The relatively narrow gap between current price and price target suggests analysts see the shares as fairly valued, but further earnings delivery or shifts in investor sentiment could quickly change that picture.

- The low valuation multiples reflect cautious optimism but also highlight investor concerns about the firm's ability to convert operating improvements and market opportunities into sustained profit growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PBF Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the numbers in a unique way? In just a few minutes, share your outlook and shape the conversation. Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PBF Energy’s path to profitability relies on aggressive cost cuts and margin recovery. However, lingering regulatory risk and valuation pressures create uncertainty around future growth.

For investors seeking more compelling value and steadier long-term prospects, take a closer look at these 850 undervalued stocks based on cash flows where companies show stronger fundamentals and trade at more attractive levels.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives