- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Occidental Petroleum (OXY): Evaluating Valuation After Strong Production Update and Downbeat Quarterly Earnings

Reviewed by Simply Wall St

Occidental Petroleum (OXY) recently increased its fourth-quarter production guidance after delivering stronger-than-expected output. However, its latest earnings and revenue came in lower than last year. Investors are tuning in to see what this operational momentum could mean for the stock.

See our latest analysis for Occidental Petroleum.

Following its upbeat production update, Occidental Petroleum’s share price hasn’t reflected much optimism yet, closing at $41.21 and posting a 1-year total shareholder return of -18.4%. Short-term price moves have been mixed, but longer-term performance tells a different story, with a strong five-year total shareholder return of over 160%. While recent results have kept sentiment cautious, this operational momentum could catch more eyes if the trend continues.

If you’re looking for fresh ideas as the energy space evolves, now is a good moment to widen your watchlist and discover fast growing stocks with high insider ownership

So with shares underperforming recently, yet valuation screens pointing to a discount and production momentum exceeding expectations, is there a genuine buying opportunity here, or has the market already priced in Occidental’s next chapter?

Most Popular Narrative: 25.1% Undervalued

According to the narrative by Dzitkowskik, Occidental Petroleum’s fair value is set at $55.05, a sizable premium to the last closing price of $41.21. This narrative values OXY as significantly discounted compared to its strategic growth ambitions and shifting business mix.

"OXY is a pioneer in CCS, investing heavily in Direct Air Capture (DAC) technology and related infrastructure (for example, STRATOS facility in West Texas). They aim to make CCS a substantial part of their business.

OXY believes CCS could be a multi-trillion-dollar global industry. Their early leadership positions them to capture a meaningful share of this market if it develops as they anticipate."

Want to uncover why this narrative bets on OXY’s future? The fair value here is driven by bold assumptions tied to a coming decarbonization boom and aggressive profit margin expectations. Curious which future revenue sources play the biggest role? Dive in to see what numbers might power the path to this premium valuation.

Result: Fair Value of $55.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, oil price volatility or setbacks in scaling commercial CCS could quickly shift sentiment and challenge the optimistic outlook that supports this valuation.

Find out about the key risks to this Occidental Petroleum narrative.

Another View: Valuation Through Earnings Multiples

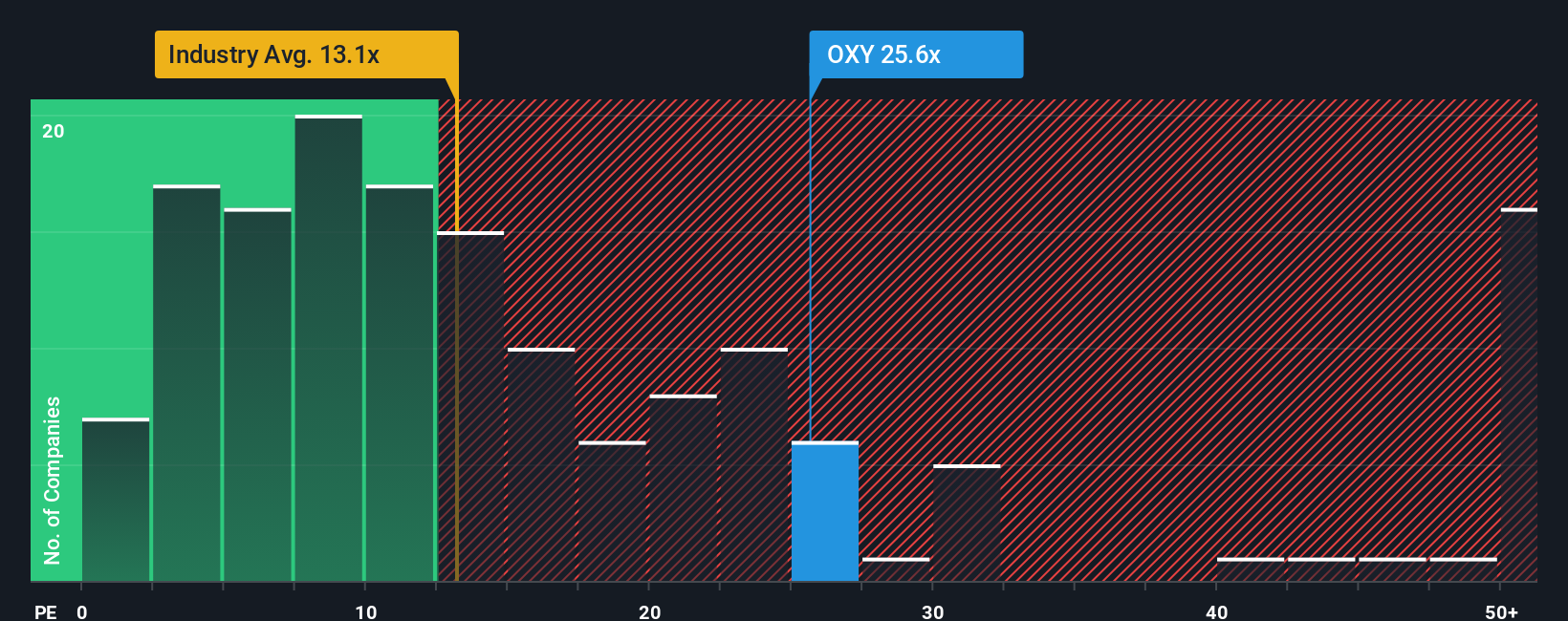

Looking at Occidental Petroleum through its price-to-earnings ratio raises a different concern. Shares currently trade at 27.8x earnings, which is not just higher than the US oil and gas industry average of 13.3x and the peer average of 24.4x, but also above the fair ratio of 18.8x. This indicates that investors are already paying a premium, signaling potential valuation risk if market expectations change. Could this premium price be justified, or does it leave OXY exposed if growth falls short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Occidental Petroleum Narrative

If you see things differently or want to dig deeper into the numbers, it’s quick and easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Occidental Petroleum research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means staying ahead of the curve, so don’t overlook game-changing companies shaping tomorrow’s markets. Give yourself an edge and check out these promising investments before they take off:

- Accelerate your portfolio growth by exploring these 918 undervalued stocks based on cash flows that are trading below their intrinsic value right now.

- Capitalize on rapid disruption in healthcare by considering these 30 healthcare AI stocks transforming industries with advanced artificial intelligence.

- Boost your income stream and resilience by targeting these 16 dividend stocks with yields > 3% offering attractive yields and steady financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives