- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Does Occidental’s Chemicals Sale and Debt Cut Shift the Investment Outlook for OXY?

Reviewed by Sasha Jovanovic

- Occidental Petroleum recently announced the divestment of its Chemicals division to reduce debt by around US$6.5 billion and lower annual interest expenses by about US$350 million, coinciding with favorable U.S. sanctions on Russian oil companies supporting crude prices.

- This move has enhanced investor optimism surrounding Occidental’s financial strength, while exposure to changing oil prices remains a core consideration for the company's outlook.

- We'll look at how Occidental's balance sheet improvements and shifting oil fundamentals influence its forward-looking investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Occidental Petroleum Investment Narrative Recap

To invest in Occidental Petroleum, shareholders need to be comfortable with significant oil price exposure, balanced by a thesis that global oil demand and effective debt reduction will support long-term value. The recent divestment of the Chemicals division meaningfully improves leverage and interest costs but does little to insulate Occidental from the largest short-term driver and risk: persistent oil price volatility.

Among this month's announcements, the progress on the STRATOS Direct Air Capture facility stands out. While Occidental aims to position itself for future growth through carbon solutions, the company’s near-term results and share price remain closely tied to oil market dynamics and how quickly balance sheet measures can offset commodity-driven swings.

By contrast, investors should be aware that even with strengthened finances, Occidental’s sensitivity to sudden oil market downturns is still considerable…

Read the full narrative on Occidental Petroleum (it's free!)

Occidental Petroleum's narrative projects $29.0 billion in revenue and $3.7 billion in earnings by 2028. This requires 2.2% yearly revenue growth and a $2.0 billion earnings increase from $1.7 billion today.

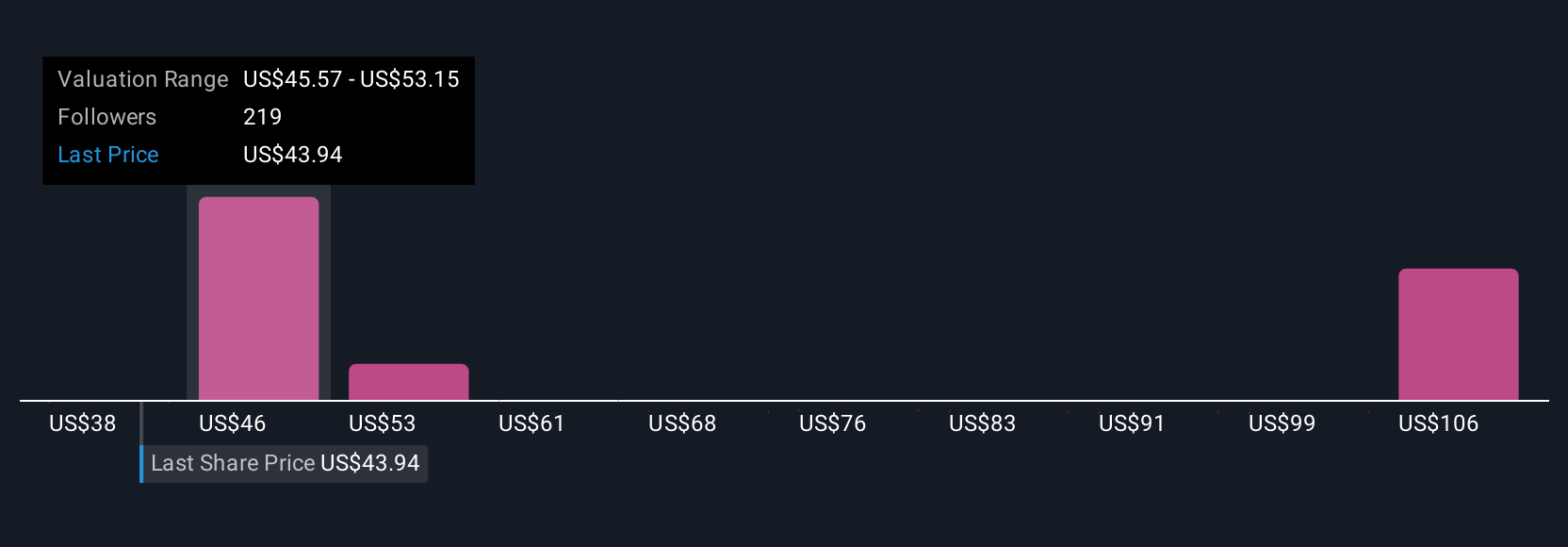

Uncover how Occidental Petroleum's forecasts yield a $50.48 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 25 Simply Wall St Community members span US$31.19 to US$63.64. While opinions diverge, oil price dependence remains the key swing factor for Occidental’s performance, so consider a range of market perspectives.

Explore 25 other fair value estimates on Occidental Petroleum - why the stock might be worth 24% less than the current price!

Build Your Own Occidental Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Occidental Petroleum research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Occidental Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Occidental Petroleum's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives