- United States

- /

- Oil and Gas

- /

- NYSE:OVV

Ovintiv (OVV): Assessing Valuation After Fresh Analyst Optimism and Reaffirmed Buy Ratings

Reviewed by Simply Wall St

Ovintiv (OVV) is back in the spotlight after several analysts reiterated Buy ratings, reflecting ongoing confidence in the company’s operational performance and outlook. This wave of analyst optimism has attracted investor attention.

See our latest analysis for Ovintiv.

Ovintiv’s year has seen some ups and downs, with a 30-day share price return of -8.6% and shares currently trading at $36.89. While short-term momentum has faded, the bigger picture remains impressive, as the company boasts a five-year total shareholder return of 336%. This indicates that long-term shareholders have been well rewarded even through market swings.

If Ovintiv’s long-term turnaround sparks your curiosity, this could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With several analysts projecting significant upside and a price target well above current levels, the question remains: Is Ovintiv still undervalued, or is the market already factoring in all future growth potential?

Most Popular Narrative: 29% Undervalued

With Ovintiv closing at $36.89 and the most widely followed narrative placing fair value around $51.82, there is a significant gap between market price and what analysts calculate. This difference is catching the eye of observers who want to understand what justifies such a bullish outlook.

Deep premium drilling inventory in high-return shale plays (Permian, Montney, Anadarko) underpins sustainable production growth, scale-driven cost advantages, and long-term top-line growth potential.

What is the secret behind these projections? The narrative hinges on unique advantages in resource quality and the expectation of long-term margin expansion. Want to know what underlying industry trends and internal strategies support this sizable upside?

Result: Fair Value of $51.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on North American shale, along with evolving energy regulations, could undermine Ovintiv’s margin growth and long-term competitive advantage.

Find out about the key risks to this Ovintiv narrative.

Another View: Are the Multiples Sending a Different Signal?

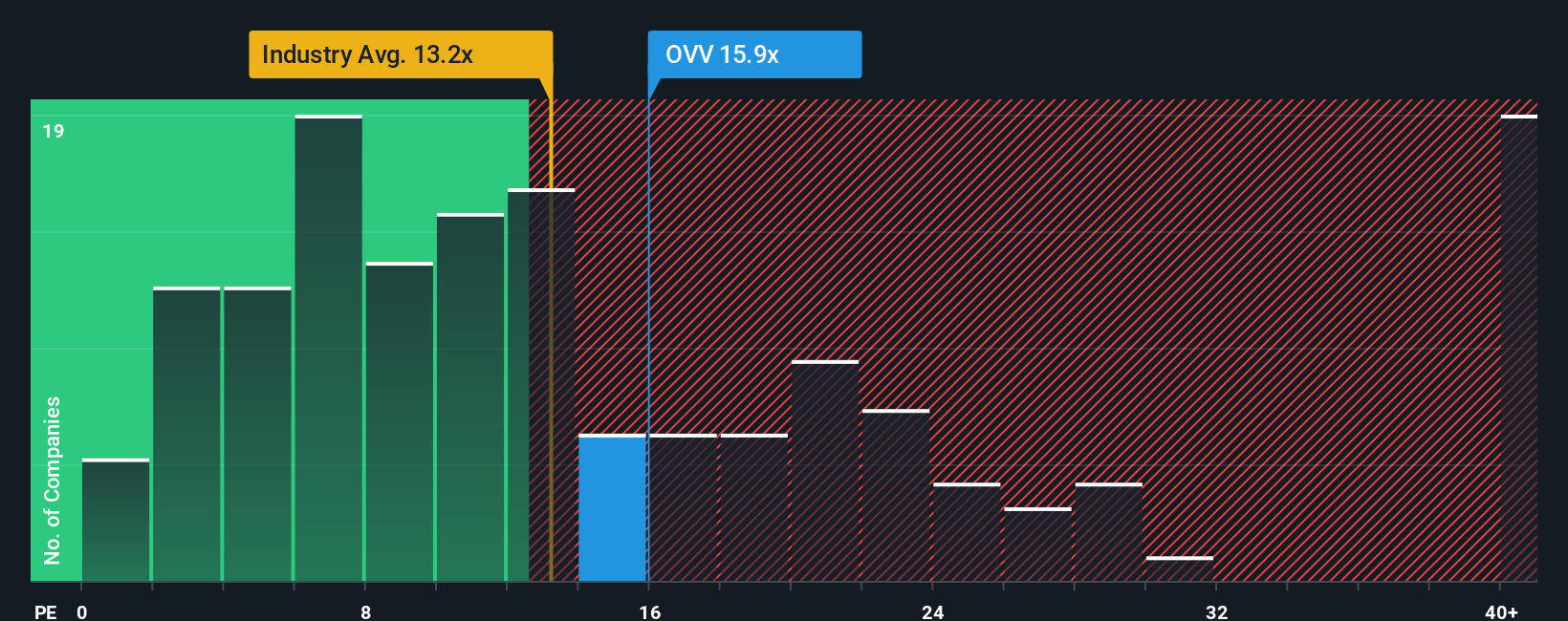

Looking at the widely followed price-to-earnings ratio, Ovintiv currently trades at 15.9x, which is more expensive than both the US Oil and Gas industry average of 12.8x and the peer average of 12.3x. While the fair ratio stands higher at 23.8x, the current premium suggests investors may be paying up for quality or growth expectations. However, it also adds an element of risk if future earnings do not materialize as projected. Does this mismatch in valuation ratios point to untapped upside, or is it a sign the market could revise its optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ovintiv Narrative

If you want to dig into the numbers yourself or believe your perspective deserves a spotlight, you can easily develop your own analysis in just a few minutes with Do it your way.

A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. Don’t let others get ahead. Uncover your next big idea using these powerful stock lists:

- Target real growth by browsing these 3575 penny stocks with strong financials that combine financial strength with significant upside potential.

- Tap into rapid innovation with these 26 AI penny stocks at the leading edge of artificial intelligence transformation.

- Capitalize on hidden value by reviewing these 833 undervalued stocks based on cash flows offering strong cash flow prospects at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives