- United States

- /

- Oil and Gas

- /

- NYSE:OVV

Analyst Optimism on Diversified Strategy Could Be a Game Changer for Ovintiv (OVV)

Reviewed by Sasha Jovanovic

- In recent days, several analysts maintained Buy ratings and a positive outlook for Ovintiv, citing confidence in the company’s business prospects and operational approach.

- This renewed analyst support highlights the market’s recognition of Ovintiv’s diversified North American operations and ongoing focus on sustainable resource management and technological innovation.

- We’ll explore how this wave of positive analyst sentiment could impact Ovintiv’s investment narrative and market positioning.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Ovintiv Investment Narrative Recap

To own shares of Ovintiv, you need to believe in the staying power of North American oil and gas, the resilience of the company’s diversified production base, and its ongoing focus on operational efficiency. While recent analyst bullishness may boost sentiment, the biggest near-term catalyst remains the company’s ability to maintain cost discipline amid ongoing service and labor cost pressures, an area where the latest upgrades appear supportive but not materially game-changing. The greatest risk continues to be regional market volatility and cost inflation, which could impact margins if not offset by continued operational gains.

Among Ovintiv’s latest announcements, its $0.30 per share quarterly dividend stands out because it signals ongoing confidence in the company’s cash flow strength even as short-term earnings have been pressured. For investors, the sustainability of these payouts ties directly to the company’s ability to mitigate cost inflation and navigate basin-specific headwinds, two themes connecting directly to recent analyst commentary and expectations for future earnings growth.

Yet, in contrast to analyst optimism, cost pressures in key North American basins remain a factor investors should closely monitor...

Read the full narrative on Ovintiv (it's free!)

Ovintiv's outlook forecasts $8.6 billion in revenue and $2.3 billion in earnings by 2028. This scenario assumes a -1.5% annual revenue decline but a strong jump in earnings, up $1.7 billion from $595 million today.

Uncover how Ovintiv's forecasts yield a $51.82 fair value, a 38% upside to its current price.

Exploring Other Perspectives

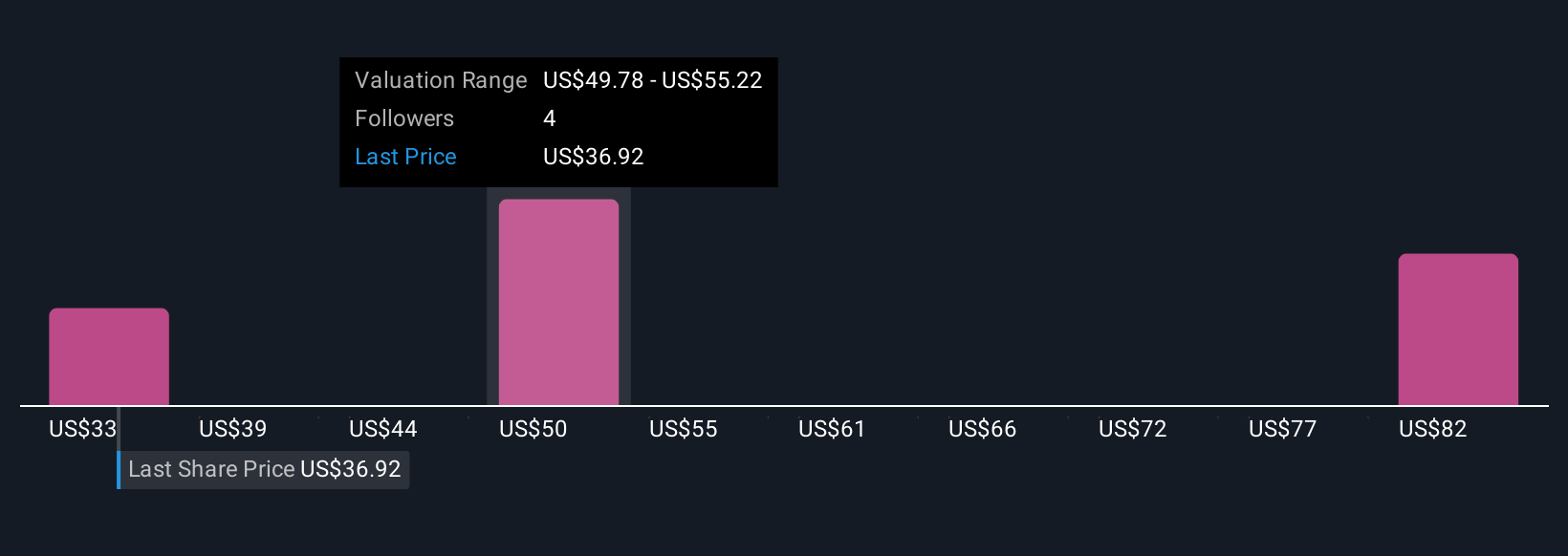

Five fair value estimates from the Simply Wall St Community spread from US$33.47 to US$75.95 per share, highlighting strong differences in outlook. As views diverge, maintaining cost efficiencies as a main catalyst could shape how Ovintiv delivers for shareholders amid regional volatility.

Explore 5 other fair value estimates on Ovintiv - why the stock might be worth 11% less than the current price!

Build Your Own Ovintiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ovintiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ovintiv's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives