- United States

- /

- Oil and Gas

- /

- NYSE:OKE

The Bull Case for ONEOK (OKE) Could Change Following Acquisition Synergies and Revised 2026 Outlook—Learn Why

Reviewed by Sasha Jovanovic

- Earlier this year, ONEOK reported better-than-expected third-quarter results, highlighting nearly US$500 million in acquisition-related synergies and increased operational capacity from new projects.

- An interesting insight is that management’s moderation of its 2026 outlook due to commodity price pressures has been offset by these realized synergies, reinforcing confidence in the company's cash flow stability and growth initiatives.

- We'll examine how ONEOK's successful delivery of acquisition synergies influences the company's investment narrative and future growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

ONEOK Investment Narrative Recap

For investors to feel confident owning ONEOK stock, they typically need to believe in the resilience of U.S. natural gas and NGL demand, as well as the company's ability to realize operational and financial synergies from recent acquisitions. The latest better-than-expected third-quarter results reinforce the importance of acquisition synergies as the key short-term catalyst; however, they do not materially reduce the ongoing risk from commodity price pressures, which remain a significant variable for future earnings and cash flow. ONEOK’s recent update on achieving nearly US$500 million in acquisition-related synergies is particularly relevant to its narrative of operational efficiency and cash flow stability. These synergies are increasingly important for offsetting the risks from lower commodity price spreads and provide an incremental buffer as management addresses a more cautious 2026 outlook. However, despite these improvements, investors should be aware that if commodity price volatility persists, the company’s earnings outlook could still face pressure from...

Read the full narrative on ONEOK (it's free!)

ONEOK's outlook points to $34.0 billion in revenue and $4.2 billion in earnings by 2028. This is based on analysts’ assumptions of 6.7% annual revenue growth and a $1.1 billion increase in earnings from the current $3.1 billion.

Uncover how ONEOK's forecasts yield a $89.32 fair value, a 26% upside to its current price.

Exploring Other Perspectives

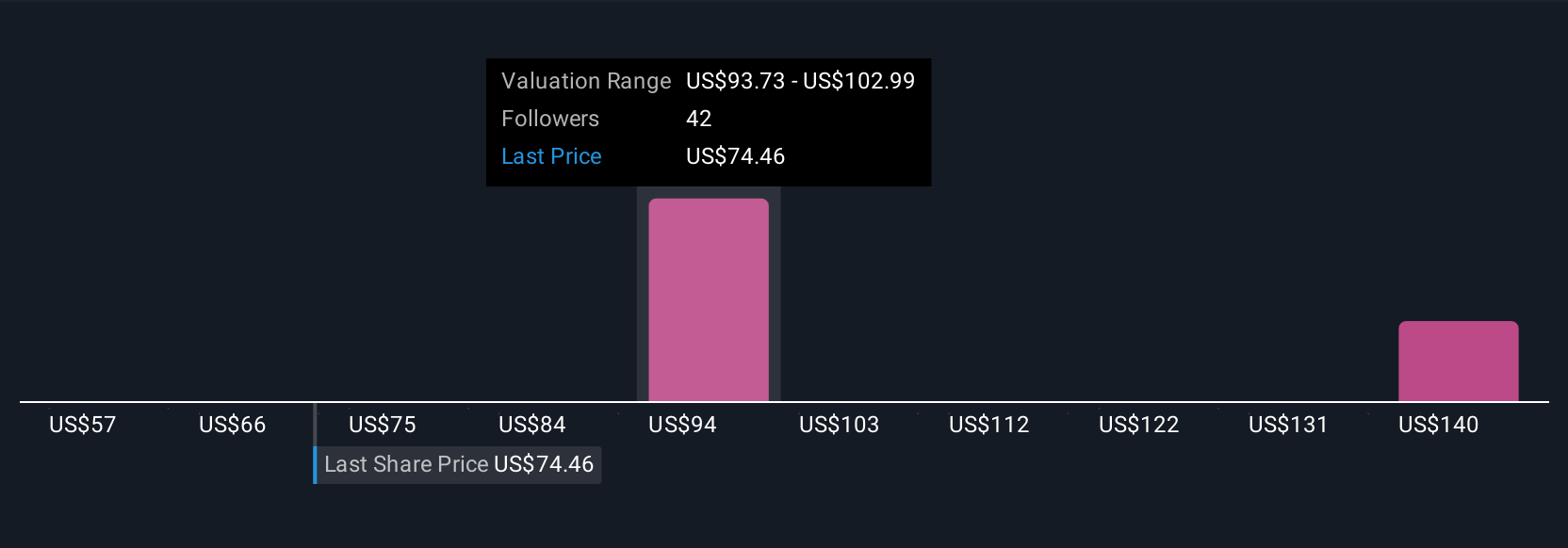

Fair value estimates from 9 Simply Wall St Community members range widely from US$65 to US$140.98 per share. While some see sizable upside, ongoing earnings sensitivity to volatile commodity prices continues to influence expectations and could impact the company's future returns, so consider a range of views before making your own assessment.

Explore 9 other fair value estimates on ONEOK - why the stock might be worth 8% less than the current price!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success