- United States

- /

- Oil and Gas

- /

- NYSE:OKE

Does ONEOK’s 36.8% Drop Signal a Missed Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if ONEOK might be a hidden value in the energy sector? Let’s dig into whether the numbers back up that gut feeling, especially if you are looking for opportunities others might have missed.

- The stock has had a rough patch recently, sliding 6.9% over the past week and 11.8% over the last month, with a year-to-date drop of 36.8% and a one-year loss of 31.4%. Looking at a longer timeline, over five years shares are still up an impressive 164.5%.

- Some of the recent price movement follows headlines around shifting energy demand and new regulatory developments affecting pipeline operators like ONEOK. Analysts and investors have responded to news about infrastructure investments and broader sentiment shifts within the midstream sector, which colors both the risks and opportunities facing the company.

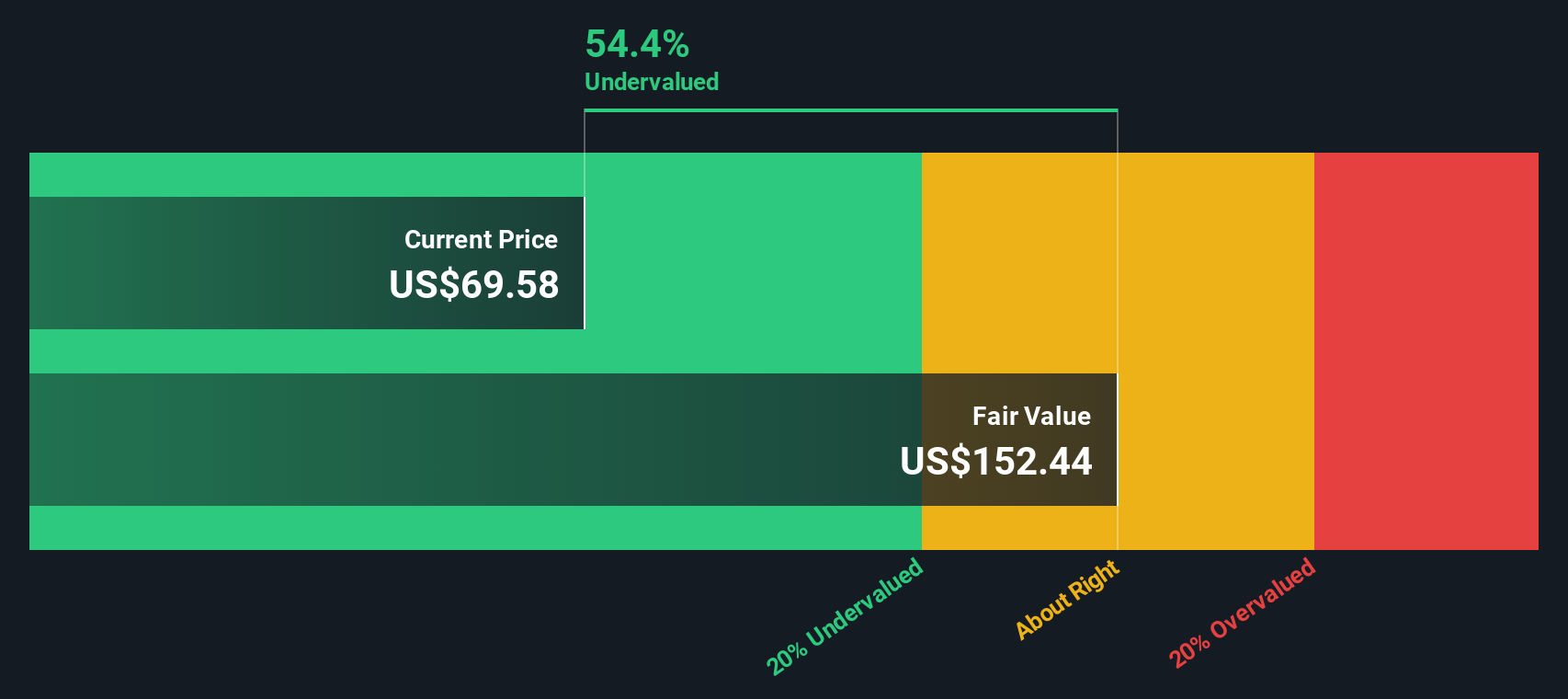

- On a pure numbers basis, ONEOK earns a valuation score of 6 out of 6 on our value checks, suggesting real potential for undervaluation. We will examine the major valuation methods in a moment, but stay tuned because there is an even more insightful way to assess fair value coming up at the end of the article.

Find out why ONEOK's -31.4% return over the last year is lagging behind its peers.

Approach 1: ONEOK Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's dollars. This approach reflects what those future dollars are worth in the present, taking into account risks and the time value of money.

For ONEOK, the most recent twelve months saw Free Cash Flow (FCF) of $2.87 Billion. Analyst estimates project FCF to grow, reaching as high as $4.50 Billion by the end of 2029. Beyond the first five years of forecasts, projections are extended by Simply Wall St using industry benchmarks and historical performance to provide a full ten-year outlook. These growing cash flows are the backbone of the valuation model, which uses a 2 Stage Free Cash Flow to Equity method to capture both the medium-term surge and longer-term steady state.

Based on these calculations, the estimated intrinsic value of ONEOK’s shares is $135.16. Compared to its current share price, this implies the stock is trading at a 52.4% discount to its intrinsic value. This suggests it is significantly undervalued by the market right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ONEOK is undervalued by 52.4%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: ONEOK Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic valuation metric, especially relevant for profitable companies like ONEOK. It reflects how much investors are willing to pay for each dollar of earnings and is a direct way to compare profitability and market sentiment.

What constitutes a “fair” PE ratio often depends on expectations for future growth and the risks associated with the business. Fast-growing companies typically justify a higher PE, while those with steady or lower growth often trade at lower multiples.

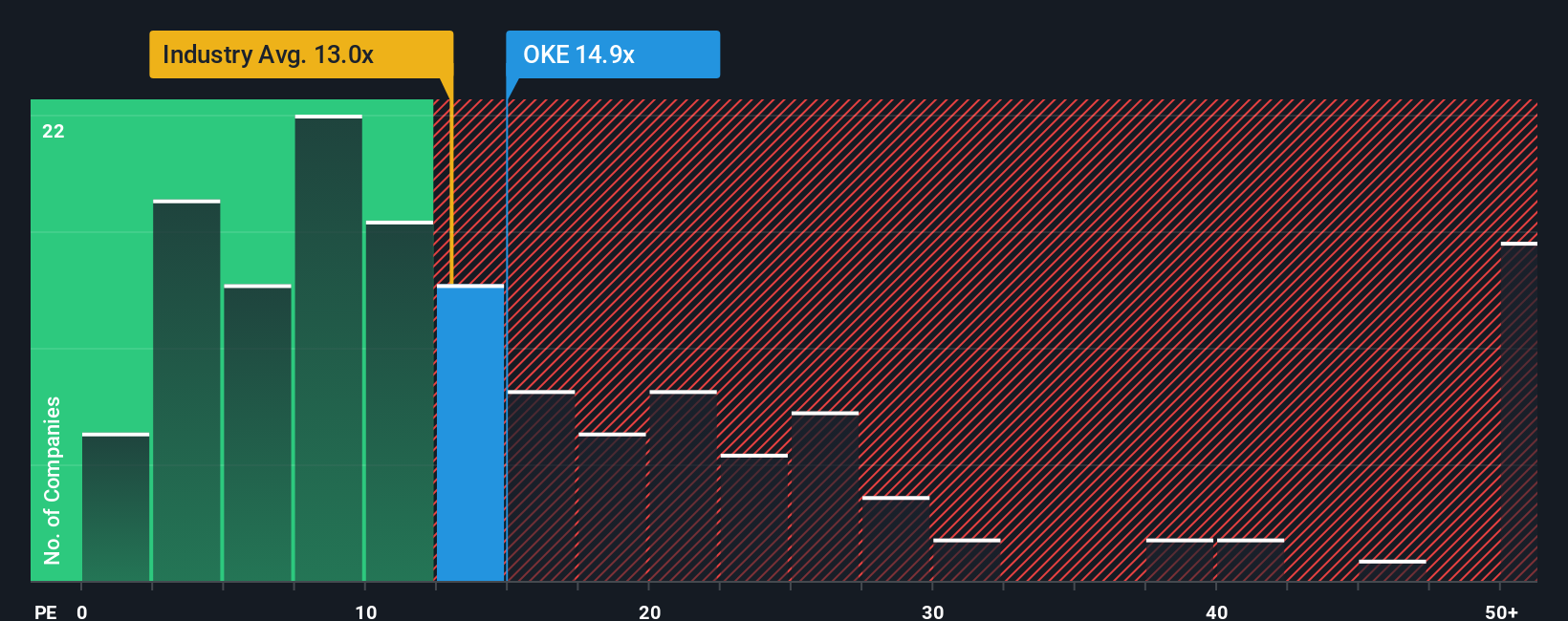

ONEOK’s current PE ratio stands at 12.1x. For context, this is just below the Oil and Gas industry average of 12.7x and also lower than its peer group average of 14.2x. This may suggest modestly discounted expectations from the market, or perhaps that some risks are already factored in.

Simply Wall St introduces the concept of a “Fair Ratio,” in this case calculated as 18.6x for ONEOK. Unlike simple peer or industry comparisons, the Fair Ratio incorporates multiple company-specific factors including earnings growth outlook, profit margins, market capitalization, industry trends, and risk profile. By blending these factors, it provides a more tailored and forward-looking measure of value.

Looking at the numbers, ONEOK’s actual PE (12.1x) is well below its Fair Ratio (18.6x). This suggests the stock is attractively priced considering its growth prospects and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ONEOK Narrative

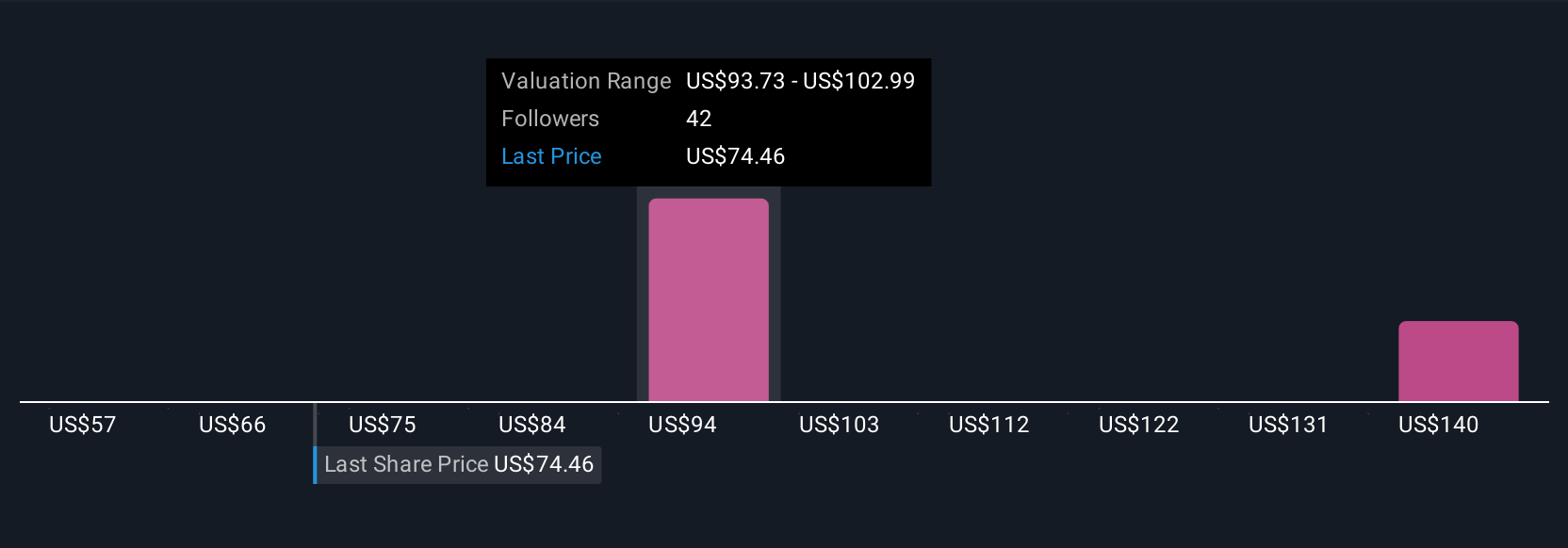

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful framework that lets you tell the story behind the numbers. It combines your personal perspective on ONEOK’s business and your expectations for its future revenue, earnings, and margins into a concrete financial forecast and calculated fair value.

Unlike traditional analysis, Narratives connect ONEOK’s business story to a dynamic model that reveals what you believe its shares are really worth and why. They are accessible and easy to use right on the Simply Wall St platform’s Community page, where millions of investors share their views.

Narratives help you decide: “Does the fair value in my story say ONEOK is a buy, hold, or sell at today’s market price?” And since Narratives dynamically update as news or fresh company results come in, your view can always stay relevant and informed.

To illustrate, some investors believe ONEOK could reach as high as $126 per share, based on robust infrastructure expansion and rising export demand. Others see a more cautious value near $82 per share, given regulatory risks and earnings volatility. Narratives empower you to compare these outlooks and build your own, all in one place.

Do you think there's more to the story for ONEOK? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

Very undervalued 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives