- United States

- /

- Energy Services

- /

- NYSE:OIS

Oil States International (OIS) Profitability Milestone Reinforces Bull Narratives Despite One-Off Gain

Reviewed by Simply Wall St

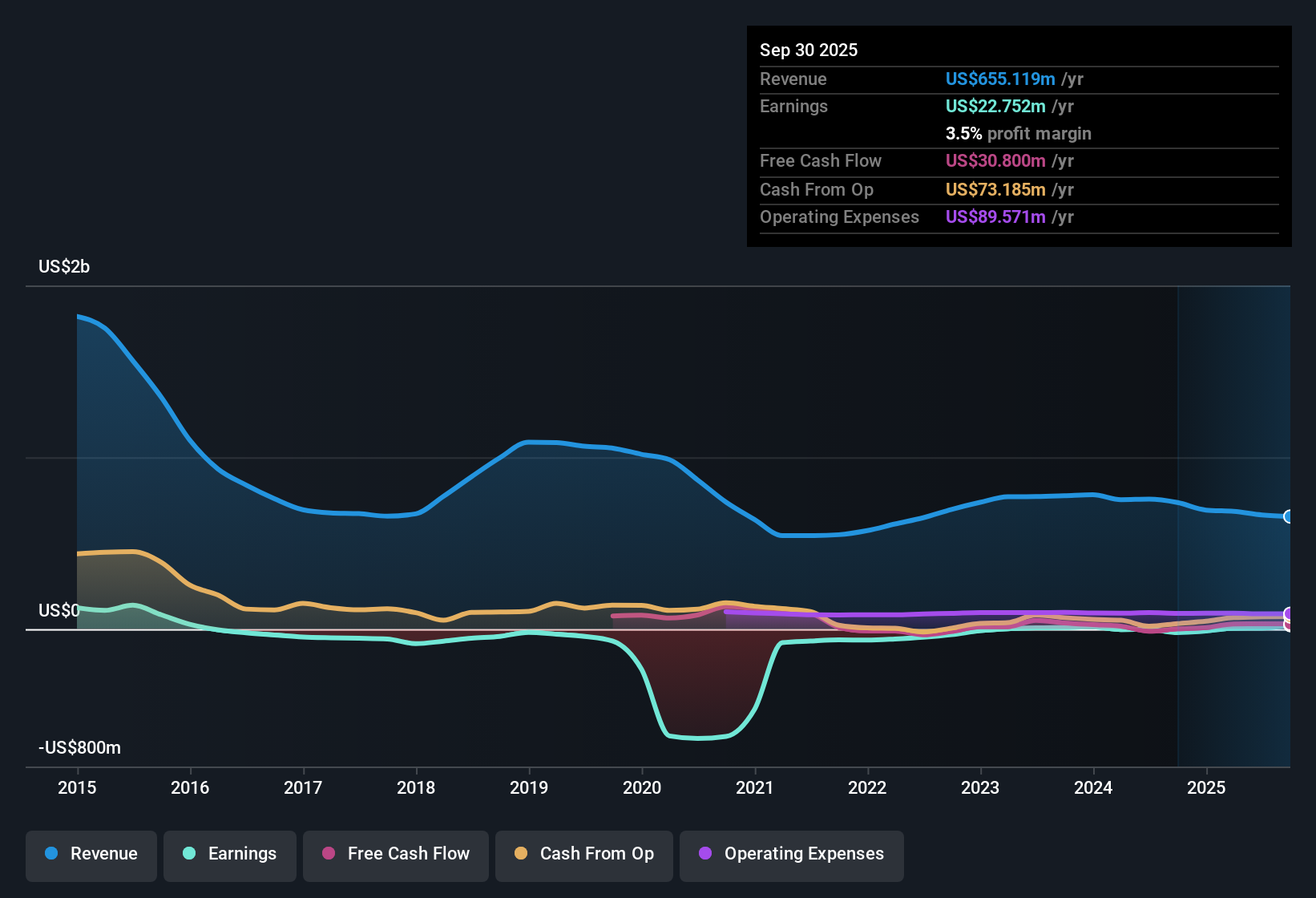

Oil States International (OIS) turned profitable in the past year as its net profit margin swung into positive territory, with average annual earnings growth hitting an impressive 89.8% over the last five years. Looking forward, earnings are forecast to rise 19.6% per year, outpacing the broader US market's expected growth rate of 15.9%. However, revenue growth is projected at a slower 4.2% per year compared to the 10.3% US market average. Notably, reported results included a one-off $2.6 million gain, so investors will be weighing the quality of earnings against these headline numbers and the company’s rich price-to-earnings ratio.

See our full analysis for Oil States International.The next section will break down how these latest results measure up to the widely followed narratives about Oil States International, highlighting where the numbers back up expectations and where there may be surprises.

See what the community is saying about Oil States International

Profit Margin Set to Grow Over 6% in Three Years

- Analysts project profit margins will rise from the current 1.0% to 6.3% within three years, marking a major improvement in operational efficiency.

- According to the analysts' consensus view, this margin expansion is seen as sustainable because of the company’s shift toward higher-margin offshore projects and continued investments in innovation.

- Consensus also notes that cost optimization and restructuring efforts are expected to support greater earnings stability, helping protect profits against industry volatility.

- However, reliance on traditional oil and gas means that revenue stability could still be vulnerable to broader energy market shifts in the long run.

See how analysts think these improving margins stack up against industry rivals in the full consensus narrative. 📊 Read the full Oil States International Consensus Narrative.

30-Point Gap Between P/E Ratio and Industry Average

- Oil States International trades at a price-to-earnings ratio of 55.1x, which is around 30 points above the US Energy Services industry average of 14.6x, making it look expensive despite recent profitability gains.

- Analysts' consensus view highlights that although the stock appears costly on today’s earnings, the forward P/E multiple is expected to decline significantly over the next few years as earnings ramp up.

- This optimism is grounded in the forecasted jump in earnings from $6.6 million now to $48.1 million by 2028, a change that should compress the P/E to below industry norms if realized.

- Still, the risk remains that if profit growth slows or non-recurring gains disappear, the valuation premium will be harder to justify.

Backlog and Book-to-Bill Trends Support Revenue Visibility

- Rapid growth in the Offshore/Manufactured Products segment and a decade-high backlog are highlighted in the consensus as important drivers for near-term and future revenue visibility.

- According to the analysts’ consensus narrative, the strength in book-to-bill ratios and order backlog supports stable cash flow outlooks and margin expansion, but slow diversification away from oil markets is a potential headwind.

- Bears warn that an overdependence on lengthy offshore and international projects may increase earnings volatility if projects are delayed or canceled in response to global decarbonization or industry downcycles.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Oil States International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the data in a unique way? In just a few minutes, you can shape your own narrative from the latest results. Do it your way

A great starting point for your Oil States International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite recent profitability gains, Oil States International still trades at a steep valuation premium and faces revenue uncertainty due to its reliance on volatile energy markets.

If you want to sidestep valuation risks, uncover better value by focusing on these 834 undervalued stocks based on cash flows, where stocks trade at more reasonable prices relative to their fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and consumable products for energy, industrial, and military sectors worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives