- United States

- /

- Oil and Gas

- /

- NYSE:NVGS

How Does Navigator Holdings' (NVGS) Buyback Reflect Its Long-Term Capital Allocation Strategy?

Reviewed by Simply Wall St

- Navigator Holdings recently reported its second quarter and half-year 2025 results, showing a year-over-year decline in quarterly revenue and net income, but modest improvements for the six-month period, alongside the completion of a US$50 million share buyback and a dividend declaration of US$0.05 per share.

- The company's sizeable share repurchase and continued return of capital to shareholders through dividends present a contrast to the mixed operating performance for the quarter, reflecting management's focus on shareholder value.

- We will explore how the completed buyback and dividend decision influence Navigator Holdings' investment outlook in light of the latest results.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Navigator Holdings Investment Narrative Recap

To be a Navigator Holdings shareholder, you likely believe in the growing need for global liquefied gas transport, ongoing expansion in U.S. export infrastructure, and the company's positioning in clean energy shipping. The recent results showed revenue and profit weakness for the quarter, but these don't materially shift the core catalyst: global trade and demand for cleaner fuels supporting fleet utilization; the most near-term risk remains geopolitical and trade-driven disruptions, unchanged by the latest news.

Among Navigator’s latest announcements, the completed US$50 million share buyback, retiring nearly 5% of shares, stands out most. While this capital return signals management’s commitment to shareholders, it does not directly offset risks tied to exposure to volatile charter rates and ongoing macro uncertainty, both of which remain front of mind for investors focused on operational stability.

However, while returns to shareholders grab headlines, investors should not overlook the ongoing risks tied to shifting trade flows and geopolitics that affect utilization and rates...

Read the full narrative on Navigator Holdings (it's free!)

Navigator Holdings' narrative projects $496.7 million revenue and $116.4 million earnings by 2028. This requires a 4.3% annual revenue decline and a $28.2 million increase in earnings from $88.2 million.

Uncover how Navigator Holdings' forecasts yield a $21.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

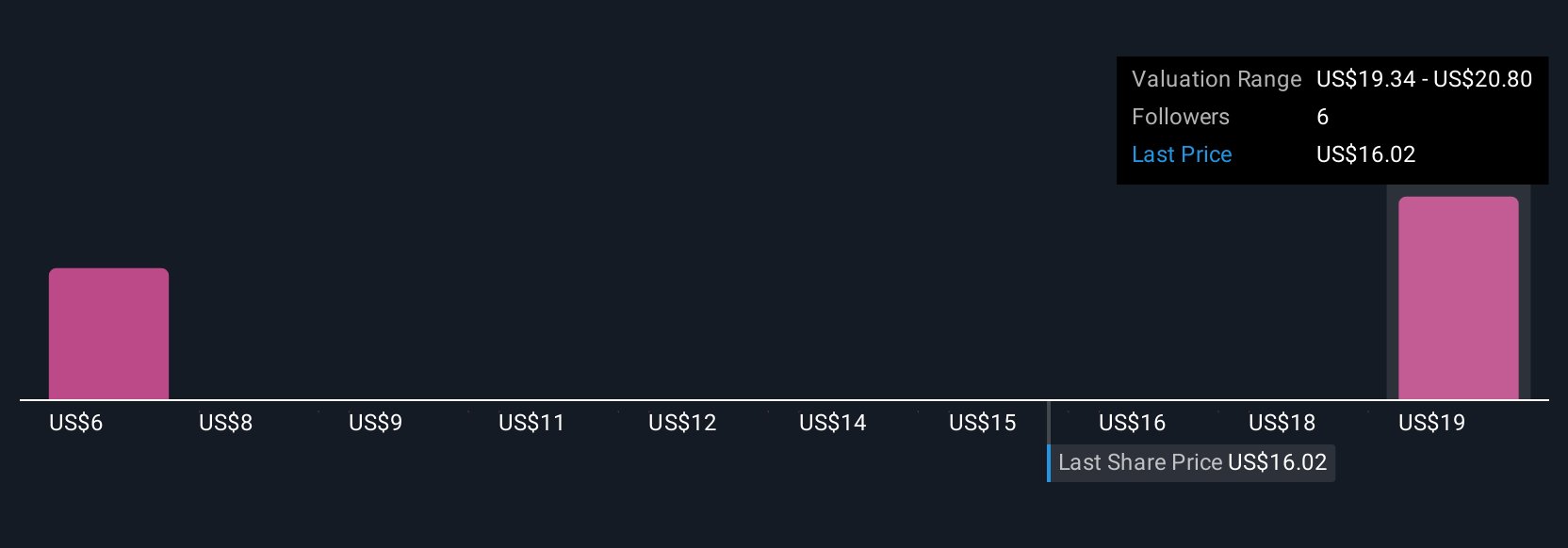

Simply Wall St Community members provided two fair value estimates for Navigator ranging from US$11.35 to US$21.00 per share. As concerns remain around geopolitical disruptions to trade and fleet utilization, you’ll find sharply differing views on the company’s future, explore these perspectives to inform your own outlook.

Explore 2 other fair value estimates on Navigator Holdings - why the stock might be worth 31% less than the current price!

Build Your Own Navigator Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navigator Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Navigator Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navigator Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVGS

Navigator Holdings

Owns and operates a fleet of liquefied gas carriers worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives