- United States

- /

- Trade Distributors

- /

- NYSE:NPKI

Pinning Down Newpark Resources, Inc.'s (NYSE:NR) P/S Is Difficult Right Now

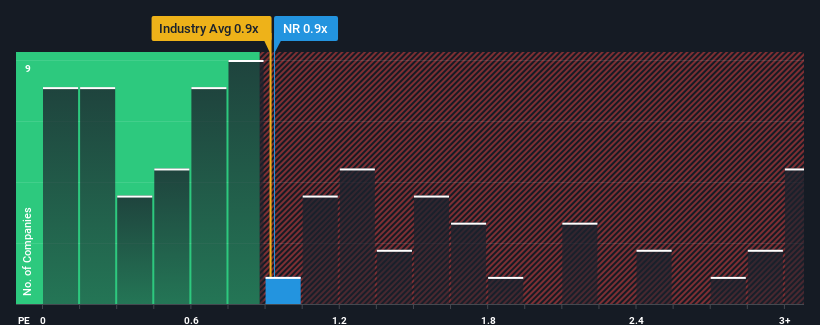

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Energy Services industry in the United States, you could be forgiven for feeling indifferent about Newpark Resources, Inc.'s (NYSE:NR) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Newpark Resources

How Newpark Resources Has Been Performing

While the industry has experienced revenue growth lately, Newpark Resources' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Newpark Resources' future stacks up against the industry? In that case, our free report is a great place to start.How Is Newpark Resources' Revenue Growth Trending?

In order to justify its P/S ratio, Newpark Resources would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Even so, admirably revenue has lifted 53% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 1.5% during the coming year according to the four analysts following the company. Meanwhile, the broader industry is forecast to expand by 11%, which paints a poor picture.

In light of this, it's somewhat alarming that Newpark Resources' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Newpark Resources' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that Newpark Resources currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Newpark Resources with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Newpark Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NPK International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPKI

NPK International

A temporary worksite access solutions company, manufactures, sells, and rents recyclable composite matting products.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives