- United States

- /

- Energy Services

- /

- NYSE:NOV

Is NOV’s (NOV) AI Ambition and Leadership Shift Pointing to a New Competitive Strategy?

Reviewed by Sasha Jovanovic

- In recent days, NOV Inc. announced the upcoming retirement of CEO Clay Williams, with current President and COO Jose Bayardo set to take over as Chairman, President, and CEO on January 1, 2026, alongside a regular quarterly cash dividend declaration of $0.075 per share payable in December 2025.

- Additionally, Armada disclosed a collaboration with NOV to launch Beacon, a ruggedized, AI-powered edge device designed for real-time analytics and automation in challenging industrial environments such as offshore oil rigs and mining sites.

- We'll explore how the CEO succession and NOV’s focus on industrial AI solutions may influence the company’s longer-term investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NOV Investment Narrative Recap

Owning NOV stock today means having confidence in a recovery of offshore oil and gas activity and the company’s ability to drive future growth through digital and automation technologies. The announcement of CEO succession and regular dividend affirmation does not appear to materially alter the main short-term catalyst, which remains the pace of international and offshore project recovery; however, the risk of continued weak aftermarket and capital equipment spending by customers persists.

The recent launch of the Beacon AI-powered edge device, through collaboration with Armada, stands out as particularly relevant. This move underscores NOV’s push into software-driven and automation solutions, which could support higher-margin recurring revenue streams if industry adoption accelerates, an important element as the company aims to offset cyclicality and margin risks in its traditional equipment businesses.

On the other hand, investors should be aware that any prolonged softness in key markets or delayed offshore recovery could...

Read the full narrative on NOV (it's free!)

NOV's outlook forecasts $9.0 billion in revenue and $546.3 million in earnings by 2028. This is based on a 0.7% annual decline in revenue and a $75.3 million increase in earnings from the current $471.0 million.

Uncover how NOV's forecasts yield a $16.15 fair value, a 7% upside to its current price.

Exploring Other Perspectives

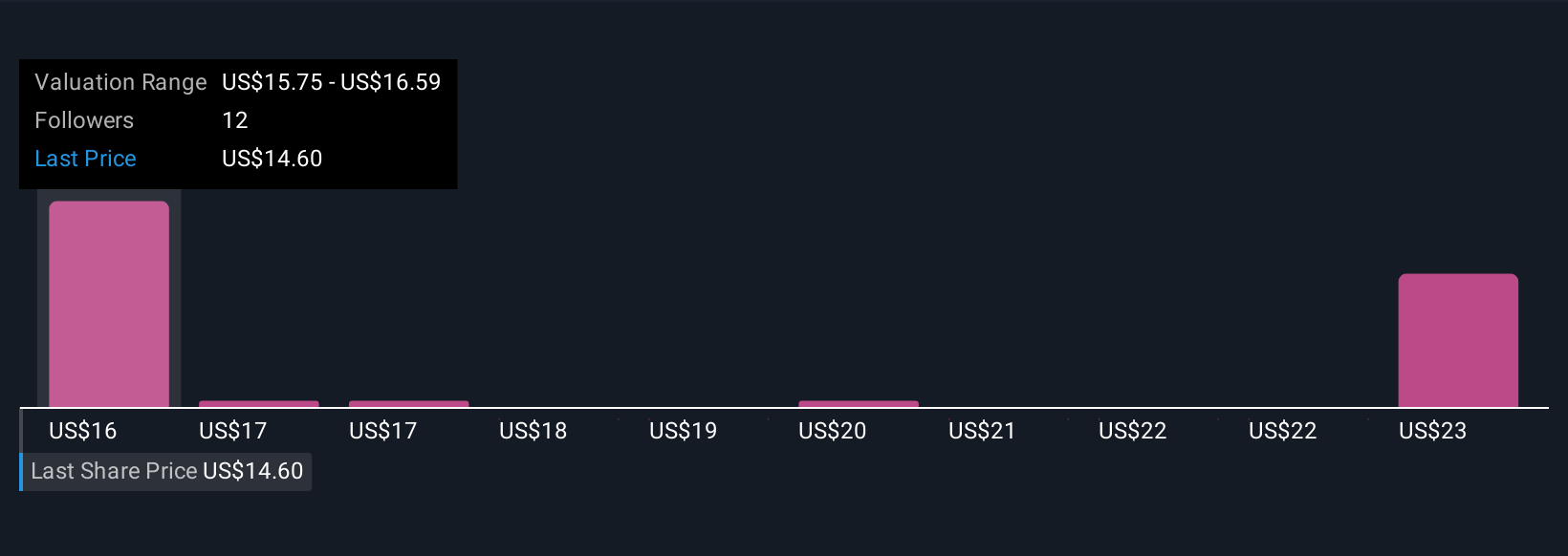

Six fair value estimates from the Simply Wall St Community span from US$16.15 to US$27.83 per share. While views differ widely, uncertainty around the pace of sector recovery continues to shape overall sentiment and expectations for NOV’s future performance.

Explore 6 other fair value estimates on NOV - why the stock might be worth as much as 85% more than the current price!

Build Your Own NOV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOV research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NOV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOV's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOV

NOV

Designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success