- United States

- /

- Energy Services

- /

- NYSE:NOV

Can NOV’s (NOV) Argentina FLNG Win Offset Ongoing Margin Pressure and Revenue Uncertainty?

Reviewed by Sasha Jovanovic

- In recent days, NOV Inc. secured a major contract to provide its APL Submerged Swivel and Yoke system for Argentina’s first-ever offshore floating LNG project, with industry partners backing the initiative. This marks a key milestone for NOV as it enters Argentina’s FLNG sector, reinforcing its position in supporting emerging energy markets.

- At the same time, NOV is contending with a sharp drop in profitability, contracting margins, and fewer new orders, prompting management to signal ongoing near-term revenue declines and uncertainty about when offshore activity will recover.

- We'll review how the new Argentina FLNG contract and NOV’s financial headwinds could reshape expectations for future growth and margins.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

NOV Investment Narrative Recap

To believe in NOV Inc. as a shareholder today, you need conviction that the offshore recovery anticipated in 2026 will materialize and drive sustained demand for NOV’s technology, offsetting recent drops in profitability and uncertain bookings. The new Argentina FLNG contract marks an entry into a promising growth region, but does not materially shift the most critical short-term catalyst, which remains a pickup in global offshore activity, or address the prevailing risk of ongoing revenue and margin pressure from order delays and contracting customer spend.

Among recent developments, management's guidance for further short-term revenue declines is most relevant, highlighting ongoing market headwinds even as targeted contracts like the Argentina FLNG deal signal potential for long-term opportunities. The company’s latest quarterly results and cautious outlook indicate that while high-value project wins are important, they are not yet sufficient to counter the broader trend of shrinking margins and lower profitability.

By contrast, investors should be aware of the heightened risk that continued trade policy uncertainties and weak customer demand could further compress margins and pressure …

Read the full narrative on NOV (it's free!)

NOV's narrative projects $9.0 billion revenue and $546.3 million earnings by 2028. This requires a 0.7% annual revenue decline and an earnings increase of $75.3 million from $471.0 million.

Uncover how NOV's forecasts yield a $15.38 fair value, a 14% upside to its current price.

Exploring Other Perspectives

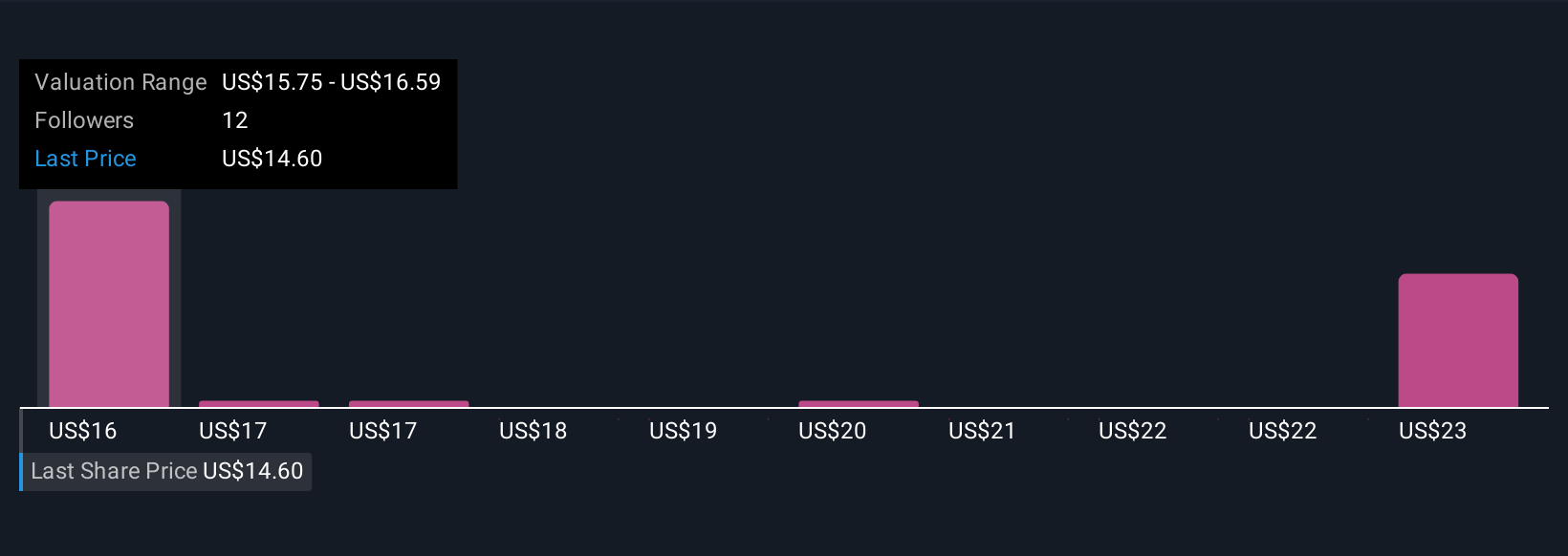

Eight individual investors in the Simply Wall St Community see fair value estimates for NOV Inc. ranging from as low as US$6 to as high as US$22.71 per share. While views vary widely, current analyst guidance reflects risks around volatile order cycles and near-term revenue declines, which could have broader consequences for NOV’s earnings expectations, see how these differing opinions might shape your own outlook.

Explore 8 other fair value estimates on NOV - why the stock might be worth less than half the current price!

Build Your Own NOV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NOV research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NOV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NOV's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 31 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOV

NOV

Designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives