- United States

- /

- Energy Services

- /

- NYSE:NINE

Lacklustre Performance Is Driving Nine Energy Service, Inc.'s (NYSE:NINE) 31% Price Drop

Nine Energy Service, Inc. (NYSE:NINE) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

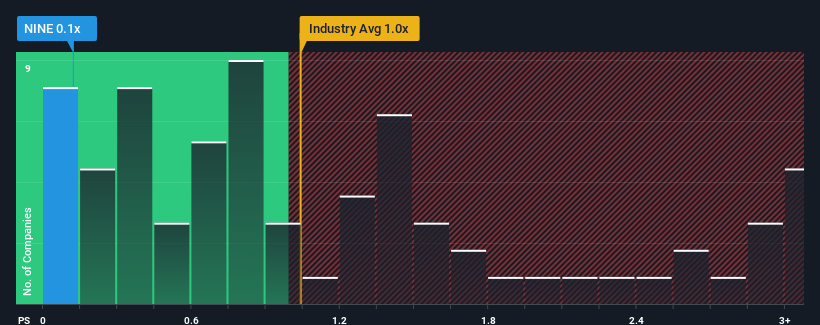

After such a large drop in price, considering around half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1x, you may consider Nine Energy Service as an solid investment opportunity with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Nine Energy Service

What Does Nine Energy Service's Recent Performance Look Like?

Nine Energy Service hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nine Energy Service.Is There Any Revenue Growth Forecasted For Nine Energy Service?

The only time you'd be truly comfortable seeing a P/S as low as Nine Energy Service's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.1%. Still, the latest three year period has seen an excellent 155% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 1.6% as estimated by the two analysts watching the company. With the industry predicted to deliver 11% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Nine Energy Service's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Nine Energy Service's P/S?

Nine Energy Service's recently weak share price has pulled its P/S back below other Energy Services companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As expected, our analysis of Nine Energy Service's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 4 warning signs for Nine Energy Service (1 is a bit concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nine Energy Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NINE

Nine Energy Service

Operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives