- United States

- /

- Oil and Gas

- /

- NYSE:NGL

NGL Energy Partners (NGL): Losses Narrow 36% Annually, Market Price Far Exceeds DCF Value

Reviewed by Simply Wall St

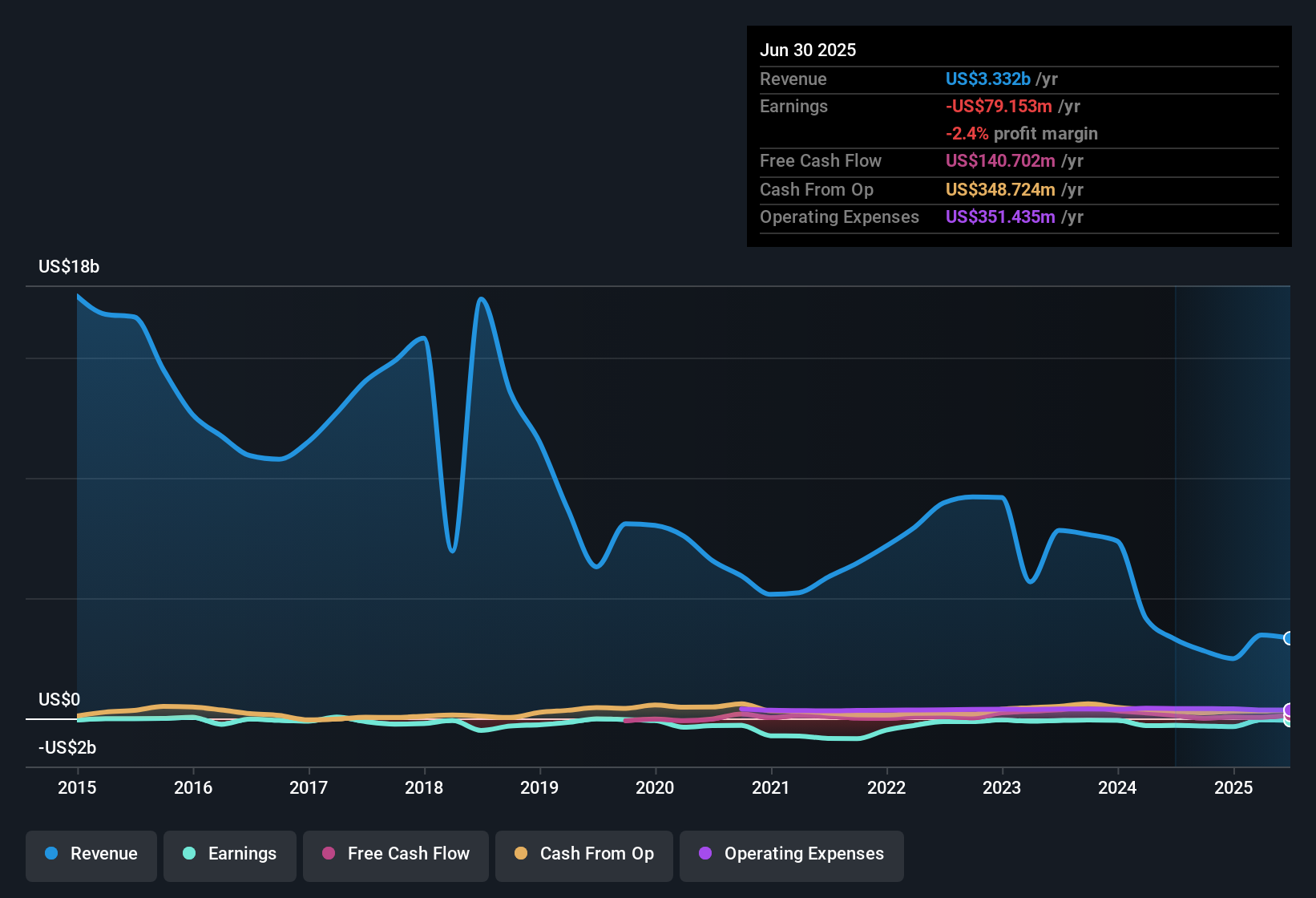

NGL Energy Partners (NGL) remains unprofitable, with no available forecasts for earnings or revenue growth. However, it has managed to narrow its losses by 36% annually over the past five years. Despite the absence of earnings, NGL’s Price-to-Sales ratio of 0.3x is notably below both the US Oil and Gas industry average of 1.5x and the peer average of 1.1x. This indicates the stock is valued attractively on its sales multiples. The market price of $8.57 currently sits above the $2.71 fair value estimate from discounted cash flow analysis. This suggests investors are weighing narrowing losses against ongoing unprofitability and premium market pricing.

See our full analysis for NGL Energy Partners.The next section will put these numbers side by side with the dominant narratives from the market and community. It will highlight where expectations match reality, and where the data tells a different story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Loss Reduction Pace Outshines Sector

- Losses have been reduced at a 36% annual rate over the past five years, signaling significant improvement in operational efficiency even though the company is still unprofitable.

- This strongly supports the case that focusing on cost-cutting and tighter management can allow a company to make real headway even in the absence of revenue growth forecasts.

- Bulls often highlight this level of loss reduction as evidence that a turnaround could be within reach, especially compared to peers that may not be cutting losses as quickly.

- However, the lack of any reported profit margin improvement last year means the optimism must be balanced with cautious monitoring of future progress.

Deep Value Signal from Sales Ratio

- The Price-to-Sales ratio stands at 0.3x for NGL, which is materially below the US Oil and Gas industry average of 1.5x and the peer average of 1.1x. This marks NGL as one of the most discounted on a sales basis.

- What is notable is that despite this low multiple, the market assigns a valuation that could reflect skepticism over NGL’s ability to achieve profitability.

- Investors may see the outsized discount as a double-edged sword. While it could reward patience if future profitability materializes, the ongoing lack of earnings tempers the appeal for some.

- This tension creates a scenario where the stock is attractively cheap on past sales but remains a "show me" story in terms of operating improvement.

Market Price Outpaces DCF Fair Value

- NGL’s current share price of $8.57 is well above the DCF fair value estimate of $2.71. This indicates that investors are paying a significant premium over intrinsic value based on traditional discounted cash flow analysis.

- The prevailing view is that the market is pricing in optimism for continued operational improvement or other positive catalysts beyond what fundamentals currently justify.

- This gap between price and DCF fair value means some are betting on turnaround momentum, while others may view it as a warning that sentiment has run ahead of hard evidence.

- With no major risk statements identified, the decision comes down to whether investors trust the narrative of narrowing losses to eventually deliver profits worthy of today’s market pricing.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on NGL Energy Partners's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

NGL’s continued unprofitability and its market price sitting well above fair value raise concerns about both earnings quality and valuation discipline.

If you’re put off by stocks that trade at a premium without supporting fundamentals, check out these 839 undervalued stocks based on cash flows to discover companies trading more sensibly relative to their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGL Energy Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGL

NGL Energy Partners

Engages in the transportation, storage, blending, and marketing of crude oil, natural gas liquids, refined products/renewables, and water solutions in the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives