- United States

- /

- Energy Services

- /

- NYSE:NBR

Take Care Before Jumping Onto Nabors Industries Ltd. (NYSE:NBR) Even Though It's 31% Cheaper

Nabors Industries Ltd. (NYSE:NBR) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 45% in that time.

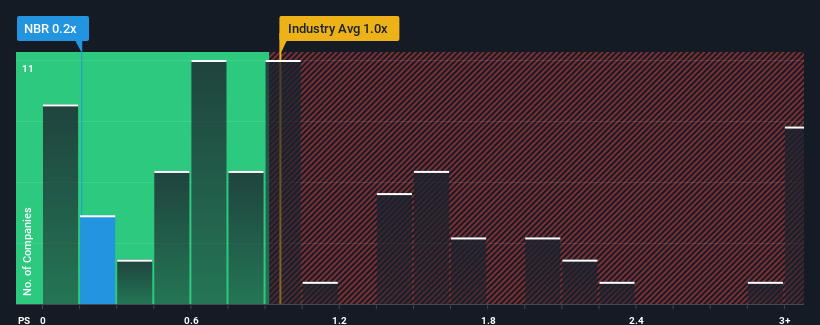

After such a large drop in price, when close to half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Nabors Industries as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Nabors Industries

How Nabors Industries Has Been Performing

Nabors Industries could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nabors Industries.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Nabors Industries' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. Still, the latest three year period has seen an excellent 45% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 3.4% each year during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 4.9% each year growth forecast for the broader industry.

In light of this, it's peculiar that Nabors Industries' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Nabors Industries' P/S Mean For Investors?

Nabors Industries' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nabors Industries' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Nabors Industries with six simple checks.

If you're unsure about the strength of Nabors Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nabors Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NBR

Nabors Industries

Provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success