- United States

- /

- Oil and Gas

- /

- NYSE:MUR

Piper Sandler Downgrade and Spending Debate Might Change The Case For Investing In Murphy Oil (MUR)

Reviewed by Sasha Jovanovic

- Earlier this week, Piper Sandler downgraded Murphy Oil from Overweight to Neutral, citing concerns over exploration spending and production declines, even as the company announced reduced operating expenses and third-quarter production that exceeded guidance.

- The market response ran counter to this downgrade, suggesting investors may be focused on Murphy Oil’s recent operational improvements and its pipeline of exploration projects.

- Let's examine how Piper Sandler’s reassessment and the debate over exploration spending may influence Murphy Oil’s investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Murphy Oil Investment Narrative Recap

To be a Murphy Oil shareholder, you need confidence in the company’s ability to translate offshore and frontier exploration into lasting production growth while containing costs amid commodity price swings. While the Piper Sandler downgrade raises concerns about increased exploration spending and possible production declines, these new views do not appear to materially impact the primary short-term catalyst: upcoming offshore exploration results. The biggest risk remains operational and commodity price volatility given Murphy’s upstream focus.

Of recent company announcements, third-quarter production exceeding guidance most clearly resonated with this news event, as positive operational surprises can help counter analyst caution on spending and output sustainability. Even as earnings remain pressured compared to last year, the reaffirmed production guidance and efficiency gains position the company for production milestones that investors continue to monitor closely.

Yet, in contrast to the operational wins, it’s crucial for investors not to overlook the potential impact of higher exploration spending and delayed discoveries...

Read the full narrative on Murphy Oil (it's free!)

Murphy Oil's narrative projects $3.1 billion in revenue and $452.6 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $167.2 million earnings increase from the current earnings of $285.4 million.

Uncover how Murphy Oil's forecasts yield a $28.33 fair value, a 8% downside to its current price.

Exploring Other Perspectives

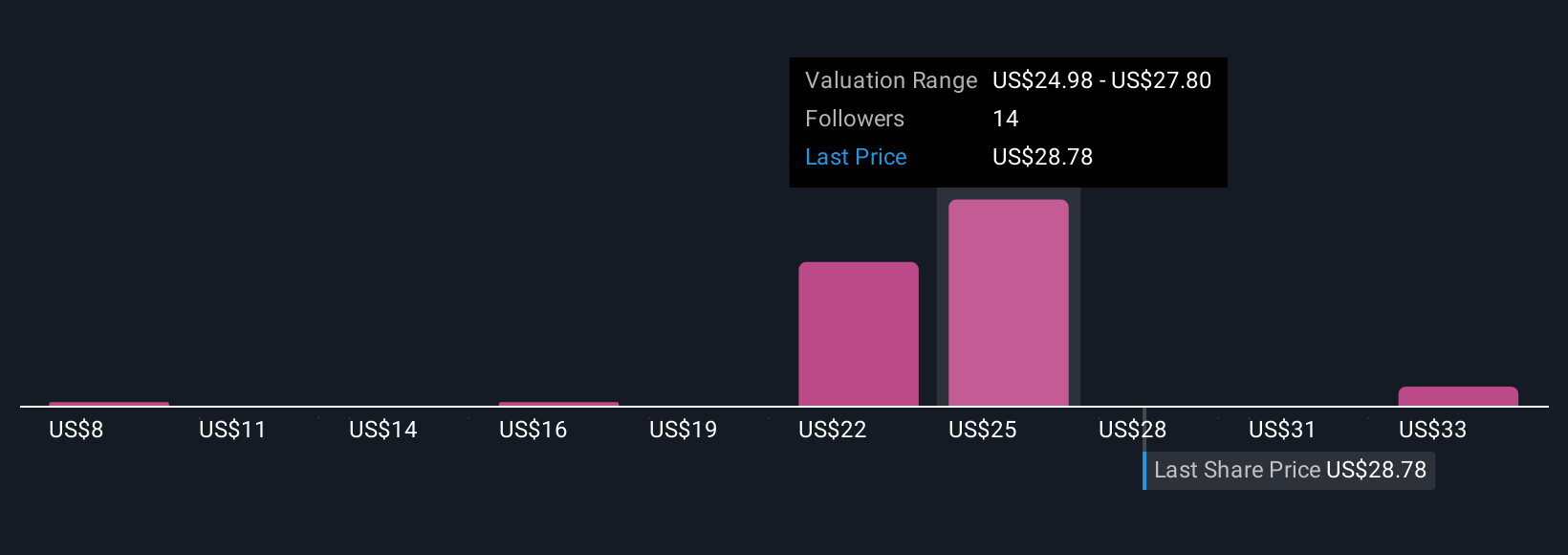

Seven individual fair value estimates from the Simply Wall St Community range widely, from US$6.71 up to US$36.29 per share. With exposure to volatile offshore production and rising exploration costs, investors’ perspectives reflect meaningful differences on Murphy Oil’s risk-reward outlook, explore these viewpoints for a broader context.

Explore 7 other fair value estimates on Murphy Oil - why the stock might be worth less than half the current price!

Build Your Own Murphy Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Murphy Oil research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Murphy Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Murphy Oil's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives