- United States

- /

- Oil and Gas

- /

- NYSE:MUR

Murphy Oil (MUR): Exploring Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Murphy Oil.

Murphy Oil’s share price has slipped 13.4% over the last month and is now down 14.2% year-to-date, reflecting a broader cooling in sentiment even as oil prices remain volatile. While momentum has faded in 2024, the longer-term picture is much brighter, with a five-year total shareholder return of over 260%, which showcases the company’s resilience and recovery potential.

If you’re eyeing new pockets of opportunity in energy and industrials, consider exploring other auto manufacturers making waves right now via our See the full list for free..

With shares trading just below analyst targets and a sharp pullback from recent highs, the big question for investors is whether Murphy Oil is undervalued or if markets have already priced in its future growth prospects.

Most Popular Narrative: 3.5% Undervalued

Murphy Oil's last close at $26.57 sits just under the most popular narrative fair value of $27.53. This gap is fueled by optimism around its next phase of earnings growth. That fair value suggests the market is missing key growth drivers and cost discipline that analysts believe could play out over the next few years.

Significant exploration and appraisal activity across the Gulf of Mexico, Vietnam, and Côte d'Ivoire is poised to potentially add substantial new reserves and long-lived, high-margin production. This could support long-term revenue growth and future cash flows as global energy demand rises.

Why are analysts backing up this price target? It comes down to their bold projections for future profitability and margin expansion, hinging on assumptions that have not yet played out in the reported numbers. Is there a game-changing outlook on future cash flows that the wider market might be missing? Dive in to uncover the catalysts driving this valuation call.

Result: Fair Value of $27.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated offshore exposure and unpredictable exploration costs could challenge future growth. This is particularly the case if oil prices weaken or if operational issues arise.

Find out about the key risks to this Murphy Oil narrative.

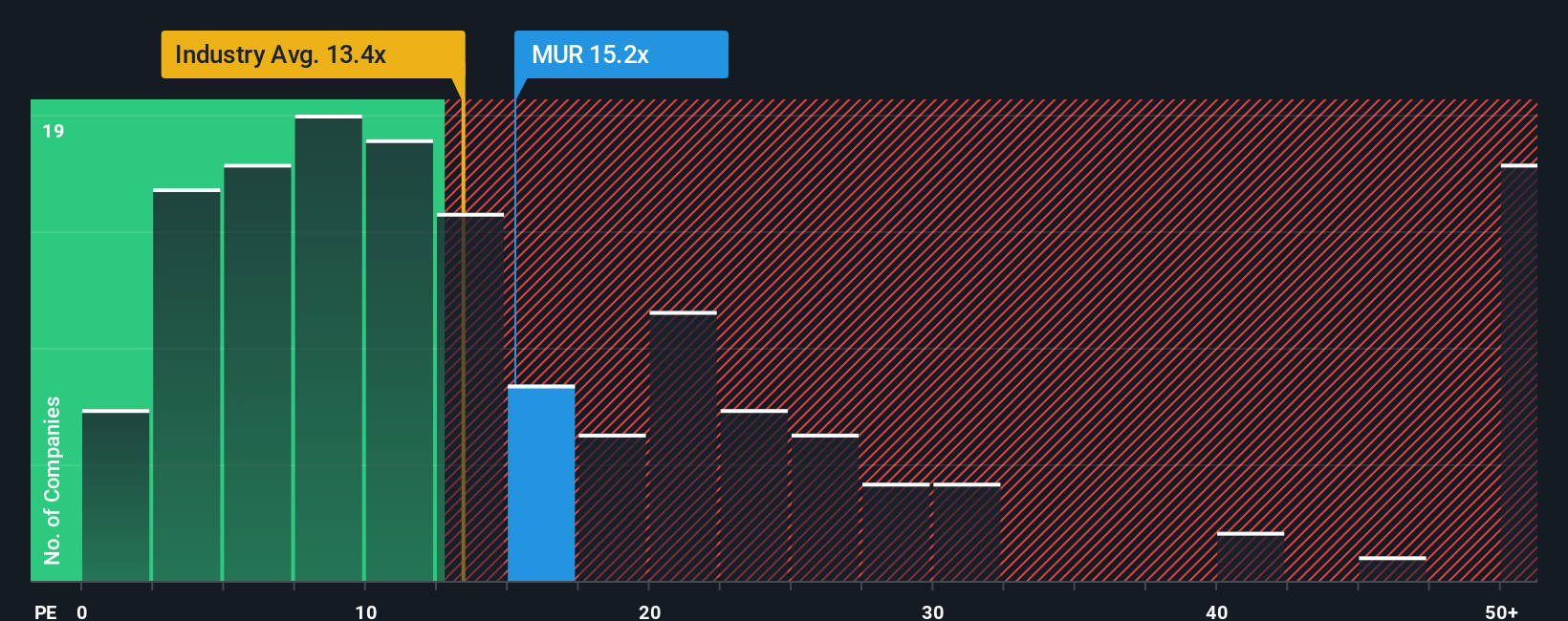

Another View: What Do Market Multiples Say?

While the fair value narrative leans optimistic, a simple look at Murphy Oil's price-to-earnings ratio tells a different story. At 13.3x, it is currently more expensive than both the industry average (12.7x) and its peers (6.5x), though it remains below the US market average (18.1x). The fair ratio based on regression sits at 14.8x, suggesting some upside, but also highlighting valuation risk if expectations falter. Which metric should investors trust most as market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Murphy Oil Narrative

If you want to dig deeper and challenge the consensus, take a few minutes to review the numbers and shape your own perspective. Do it your way.

A great starting point for your Murphy Oil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know there is always another opportunity waiting. Start your search beyond Murphy Oil to uncover stocks that align with your strategy and long-term goals.

- Uncover robust income streams by targeting companies delivering reliable payouts with yields over 3 percent through these 20 dividend stocks with yields > 3%.

- Stay ahead of transformative market shifts by focusing on businesses at the forefront of life-changing health technology across these 33 healthcare AI stocks.

- Get in early on high-potential upstarts by screening for value-driven opportunities among these 3603 penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives