- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

Will MPLX's (MPLX) Consistent Distributions Shape Perceptions of Its Cash Flow Strategy?

Reviewed by Simply Wall St

- The board of MPLX LP’s general partner declared a quarterly cash distribution of $0.9565 per common unit for Q2 2025, with payment set for August 15 to unitholders of record as of August 8.

- This continued commitment to regular distributions highlights the company’s emphasis on shareholder returns and underlines confidence in its steady cash flow generation.

- With the board’s affirmation of the upcoming distribution, we’ll explore how MPLX’s payout stability influences its broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MPLX Investment Narrative Recap

To be an MPLX shareholder, you need to believe in the resilience of the US energy infrastructure and the company’s ability to sustain high and reliable cash distributions amid its significant capital spending. While the board’s affirmation of the quarterly payout signals continued confidence in cash flow, it doesn’t materially shift the near-term growth catalyst, which remains driven by execution of major expansion projects; any delay here continues to represent the most significant short-term risk.

Among the latest company announcements, the recently completed US$700 million investment share in the new joint venture LPG export terminal stands out as highly relevant. This project directly supports MPLX’s efforts to grow cash generation, which underpins the reliability of its distributions, a core theme reinforced by this quarter’s payout announcement.

But in contrast to the stable payout news, there’s still the looming issue of project delays that investors should be aware of, especially when...

Read the full narrative on MPLX (it's free!)

MPLX's narrative projects $14.0 billion revenue and $5.2 billion earnings by 2028. This requires 7.2% yearly revenue growth and a $0.8 billion earnings increase from $4.4 billion.

Uncover how MPLX's forecasts yield a $56.03 fair value, a 8% upside to its current price.

Exploring Other Perspectives

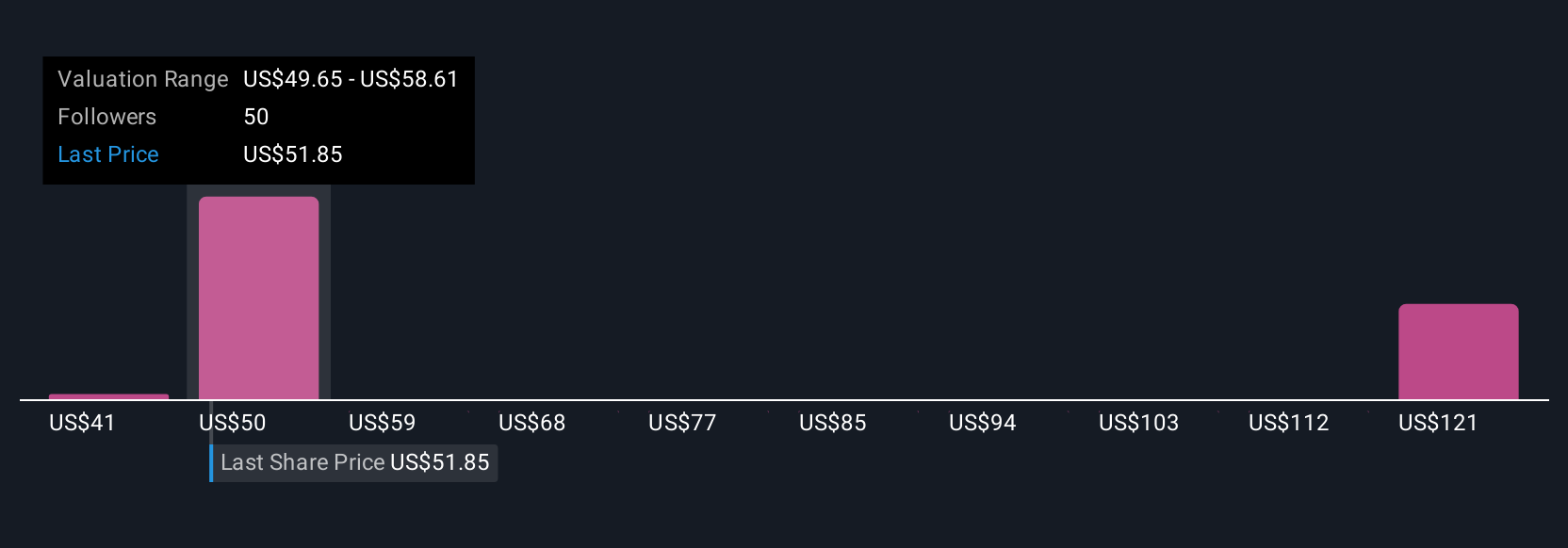

Six Simply Wall St Community fair value opinions for MPLX range from US$40.69 to US$129.21 per unit. While many see MPLX as undervalued, the company’s capital projects must deliver on time to support that optimism, different market views highlight the importance of digging into all available insights.

Explore 6 other fair value estimates on MPLX - why the stock might be worth 21% less than the current price!

Build Your Own MPLX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MPLX research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MPLX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MPLX's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives