- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

MPLX (MPLX) Announces 12.5 Percent Distribution Hike Could Be a Game Changer for Investors

Reviewed by Sasha Jovanovic

- The board of directors of MPLX LP's general partner recently declared a third-quarter 2025 cash distribution of US$1.0765 per common unit, marking a 12.5% increase over the prior quarter and scheduled for payment on November 14, 2025 to unitholders of record as of November 7.

- This notable distribution increase reflects MPLX's confidence in its financial position and ongoing commitment to returning value to unitholders.

- We'll examine how this sizable distribution hike informs the company's investment narrative and future capital return outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MPLX Investment Narrative Recap

To invest in MPLX, you need to believe that stable, long-term demand for U.S. midstream infrastructure will support sustained distributable cash flows, even as energy transition and regulatory pressures persist. The recent 12.5% increase in MPLX's cash distribution supports investor focus on capital return strength, but does not materially alter the central catalyst, successful integration and throughput growth from recent Permian acquisitions, nor does it diminish the main risk: sensitivity to fossil fuel demand cycles and contract renewal uncertainties.

Alongside the distribution increase, MPLX's August 2025 announcement of a partnership on the Eiger Express Pipeline directly connects with that key throughput growth catalyst, adding scale to the company's existing network and aiming to bolster future cash flow stability.

Yet, it’s also important to be aware, contract renewal timing on select processing assets may present concentrated revenue risk as existing deals come up for negotiation...

Read the full narrative on MPLX (it's free!)

MPLX's narrative projects $14.0 billion revenue and $5.3 billion earnings by 2028. This requires 6.8% yearly revenue growth and a $1.0 billion earnings increase from $4.3 billion.

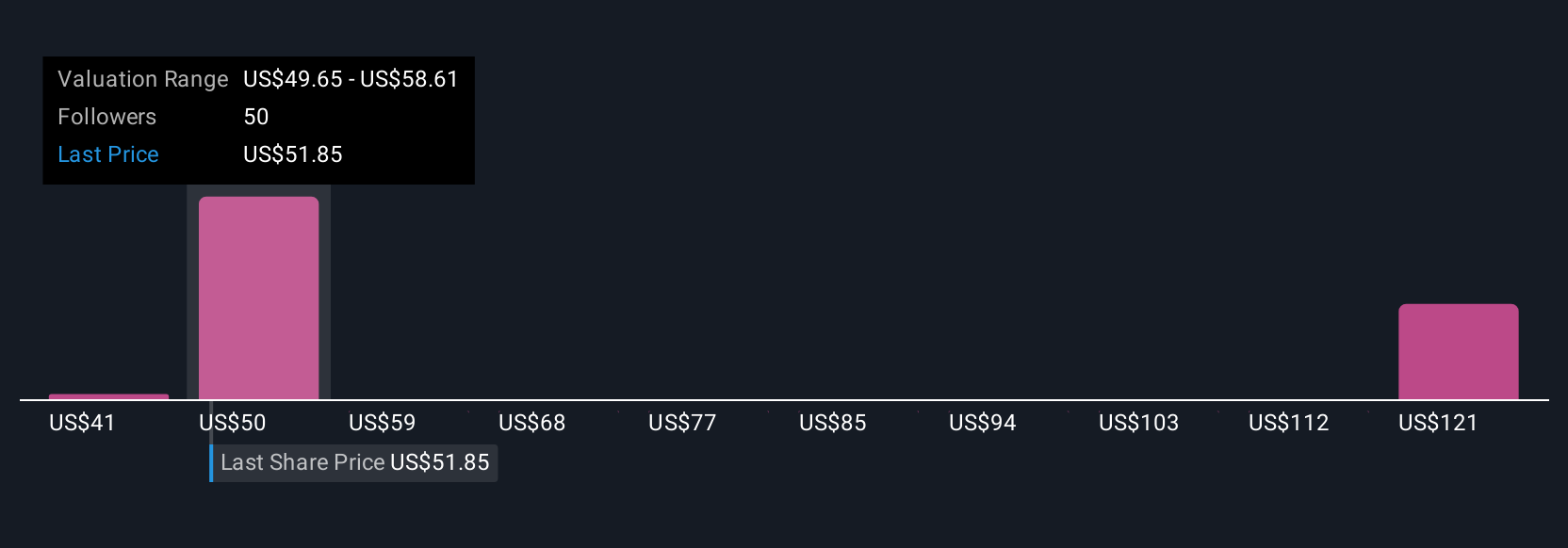

Uncover how MPLX's forecasts yield a $57.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members estimate MPLX’s fair value from US$41.26 to as high as US$116.61 per unit. Against this backdrop of diverging outlooks, the recurring risk of contract renegotiations could shape future distributable cash flows and unit value, so consider a variety of perspectives before deciding.

Explore 7 other fair value estimates on MPLX - why the stock might be worth 19% less than the current price!

Build Your Own MPLX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MPLX research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MPLX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MPLX's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives