Key Takeaways

- Strategic acquisitions and capacity expansions strengthen MPLX's infrastructure, driving throughput, cost efficiency, and margin growth amid rising energy demand.

- Robust contracts and disciplined capital allocation ensure stable cash flows, supporting sustainable, growing distributions and attractive capital returns.

- Heavy dependence on U.S. oil and gas cycles, ambitious expansion, and short contract terms expose MPLX to demand shifts, overbuilding risk, and rising financial pressure.

Catalysts

About MPLX- Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

- The recent acquisition of Northwind Midstream and full ownership of BANGL NGL pipeline, both adjacent and complementary to MPLX's existing Permian infrastructure, are set to drive higher throughput, expand access to dedicated acreage, and unlock additional volumes, supporting both revenue growth and improved operating margins over the next several years.

- Large-scale expansions in sour gas treating, NGL fractionation, and Permian processing capacity-targeting rising natural gas and NGL production and export demand-leverage global growth in energy consumption (particularly in emerging markets) and the continued critical role of fossil fuels in electricity generation, positioning MPLX to benefit from stable or growing revenues and EBITDA through at least the late 2020s.

- Strong contractual protections such as minimum volume commitments (MVCs), multi-year producer agreements, and a high percentage of fee-based revenue provide high cash flow visibility and durability, directly supporting the sustainability and potential growth of distributions and distributable cash flow.

- Integration and optimization of MPLX's expanded asset base, including enhanced blending and treating capabilities and increased operational flexibility, are expected to drive further cost efficiencies and improved asset utilization, contributing to margin expansion and higher earnings.

- The company's disciplined capital allocation-prioritizing mid-teens returns on investment, maintaining low leverage, and growing both organic and bolt-on projects-positions MPLX for continued mid-single-digit annual EBITDA growth and double-digit distribution increases, enhancing total capital returns to unitholders.

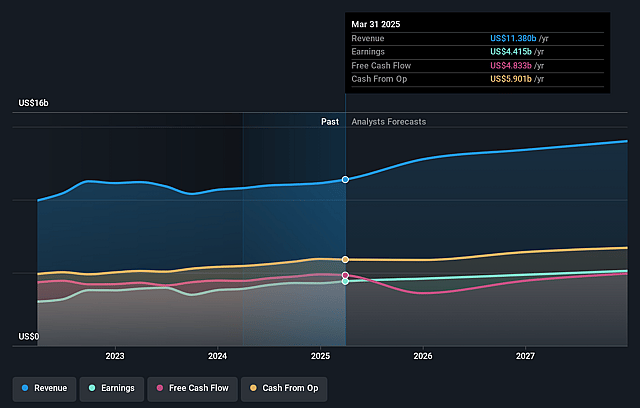

MPLX Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MPLX's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 37.4% today to 38.2% in 3 years time.

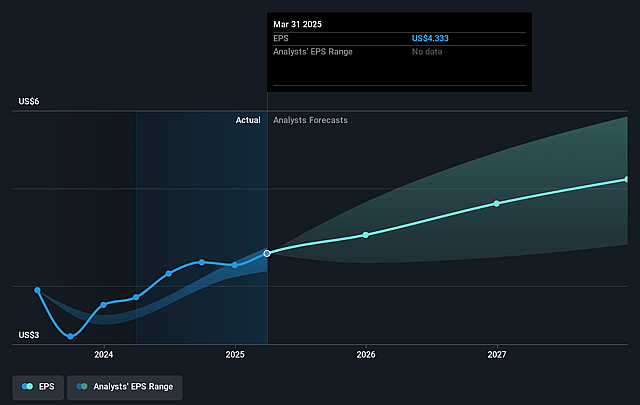

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $5.26) by about September 2028, up from $4.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, up from 11.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

MPLX Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- MPLX's growth strategy is heavily concentrated in the Permian and Delaware basins, regions highly exposed to U.S. oil and gas production cycles; any long-term decline in fossil fuel demand-driven by electrification, efficiency gains, and energy transition-could lead to underutilized assets and stagnant throughput volumes, negatively impacting top-line revenue and long-run asset values.

- The company's significant capital spending on acquisitions and organic expansion-including the $2.4 billion Northwind Midstream deal and $1.7 billion in 2025 organic growth CapEx-amplifies risk if project returns are impaired by market downturns, overbuilding in midstream, or stricter decarbonization policies, potentially straining MPLX's net margins and return on invested capital.

- Despite management assurances, the economics of upcoming NGL fractionation and LPG export projects face headwinds from recent bearish sentiment on global LPG demand; if export markets remain weak, MPLX risks overbuilding expensive infrastructure, reducing earnings from these investments and pressuring distributable cash flows.

- While the company touts strong average contract lives and minimum volume commitments, some processing contracts (notably at Northwind) have durations as short as 2-3 years, exposing MPLX to potential renegotiation risk, customer volume reduction, or contract non-renewals, which could erode revenue stability and profit margins as contracts roll off.

- Frequent and sizeable bolt-on acquisitions, funded with both cash and debt, increase leverage and financial risk-if sector-wide capital flight toward ESG-compliant investments or higher regulatory costs limit MPLX's access to low-cost capital, financing future growth or refinancing maturities could become costlier, compressing net margins and threatening distribution growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.0 for MPLX based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $51.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.0 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of $50.03, the analyst price target of $57.0 is 12.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.