- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Should Strong Q3 Profit, Higher Dividend, and Leadership Changes Prompt Action From Marathon Petroleum (MPC) Investors?

Reviewed by Sasha Jovanovic

- Marathon Petroleum recently reported third-quarter 2025 results with net income of US$1.37 billion and declared a quarterly dividend increase to US$1.00 per share, approximately 10% higher than its previous payout.

- This earnings release coincided with major leadership changes and the completion of a significant multi-year share buyback program, reflecting active capital management and confidence in its future cash flows.

- We’ll now explore how the firm’s strong quarterly profitability and larger dividend may shape its longer-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Marathon Petroleum Investment Narrative Recap

For me, the central belief behind owning Marathon Petroleum is confidence that demand for refined fuels and midstream logistics will remain robust even as low-carbon alternatives grow. This quarter’s sharp earnings rebound and increased dividend are positives, but the main short-term catalyst is still refining margin strength; the recent news, including the share buyback completion and management changes, does not fundamentally alter this. The biggest risk remains longer-term: accelerated electrification and tougher carbon policies could eventually erode fuel demand and asset values, but for now, the latest news doesn’t materially affect this outlook.

The most interesting recent development linked to this is the completion of the company’s multi-year US$44.66 billion share buyback program, with over 92% of the announced repurchases finalized. While such sizable buybacks can boost per-share earnings and signal confidence in future cash flows, they do not address the underlying risk from sector-wide shifts toward electrification and decarbonization. For investors focused on future catalysts, watch how Marathon adapts capital allocation as the competitive and regulatory backdrop evolves.

However, investors should also be aware that even as buybacks and dividends rise, the risk of stranded refining assets remains a factor that ...

Read the full narrative on Marathon Petroleum (it's free!)

Marathon Petroleum's narrative projects $123.8 billion in revenue and $4.2 billion in earnings by 2028. This assumes a 2.6% annual revenue decline and a $2.1 billion increase in earnings from the current $2.1 billion level.

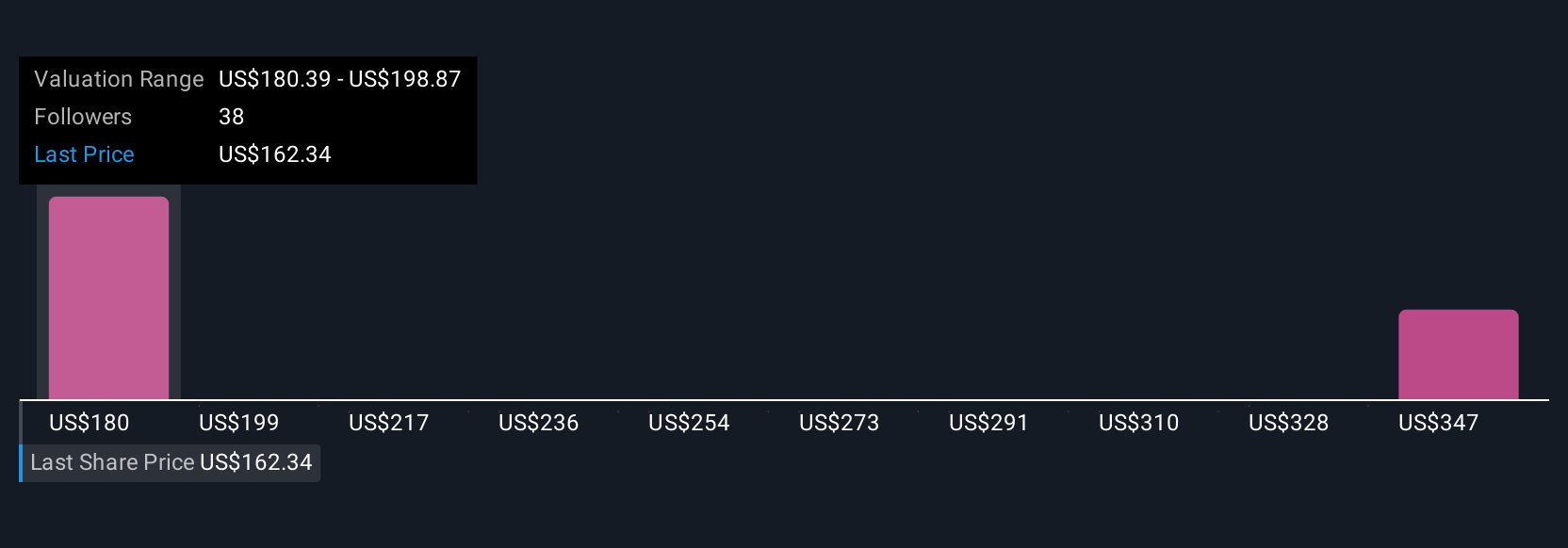

Uncover how Marathon Petroleum's forecasts yield a $197.50 fair value, in line with its current price.

Exploring Other Perspectives

Four recent fair value estimates from the Simply Wall St Community span a wide band from US$197.50 to US$517.14 per share. While some see significant upside, others focus on issues like sustained demand erosion from electrification, reflecting how your views on these trends can shape expectations for Marathon’s future performance.

Explore 4 other fair value estimates on Marathon Petroleum - why the stock might be worth over 2x more than the current price!

Build Your Own Marathon Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marathon Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marathon Petroleum's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives