- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Marathon Petroleum (MPC): Assessing Valuation After Q3 Earnings Jump Spurs Investor Interest

Reviewed by Simply Wall St

Marathon Petroleum (MPC) reported a sharp jump in net income and earnings per share for the third quarter, even as sales edged down compared to last year. This earnings beat is catching investors’ attention.

See our latest analysis for Marathon Petroleum.

Marathon Petroleum’s stock has gained significant momentum this year, with a year-to-date share price return of nearly 37% and an impressive 1-year total shareholder return of 29%. Big moves like the $650 million buyback and recent boardroom changes have kept investor attention high. The 5-year total return of nearly 500% sets a powerful long-term backdrop for current optimism.

If the company’s earnings surge has you thinking bigger, this could be the perfect time to discover fast growing stocks with high insider ownership

The strong results raise a pressing question: Is Marathon Petroleum still undervalued given its recent run, or has the market already baked in expectations for future growth, leaving limited room for new investors?

Most Popular Narrative: 1.2% Undervalued

The most widely followed narrative sets Marathon Petroleum’s fair value at $196 per share, just above the latest close of $193.76. This hints at only a slight gap between current pricing and potential worth. This valuation suggests that, while the market has recognized recent gains, there could still be a slim valuation upside.

Strong product demand and capacity reductions support high refinery utilization, improved margins, and revenue growth in supply-constrained markets. Portfolio optimization, disciplined capital allocation, and investment in renewables bolster operational flexibility, shareholder returns, and long-term resilience.

Want the real reason this narrative barely tips the stock as undervalued? It hinges on surprisingly optimistic profit forecasts, margin leaps, and aggressive share reduction assumptions. What drives these bold projections, and which numbers make the difference? Unlock the narrative and see the precise growth blueprint that underpins this fair value.

Result: Fair Value of $196 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stricter environmental policies or an unexpected decline in fuel demand could quickly challenge the current bullish view on Marathon Petroleum’s prospects.

Find out about the key risks to this Marathon Petroleum narrative.

Another View: Is Multiples-Based Valuation Sending Mixed Signals?

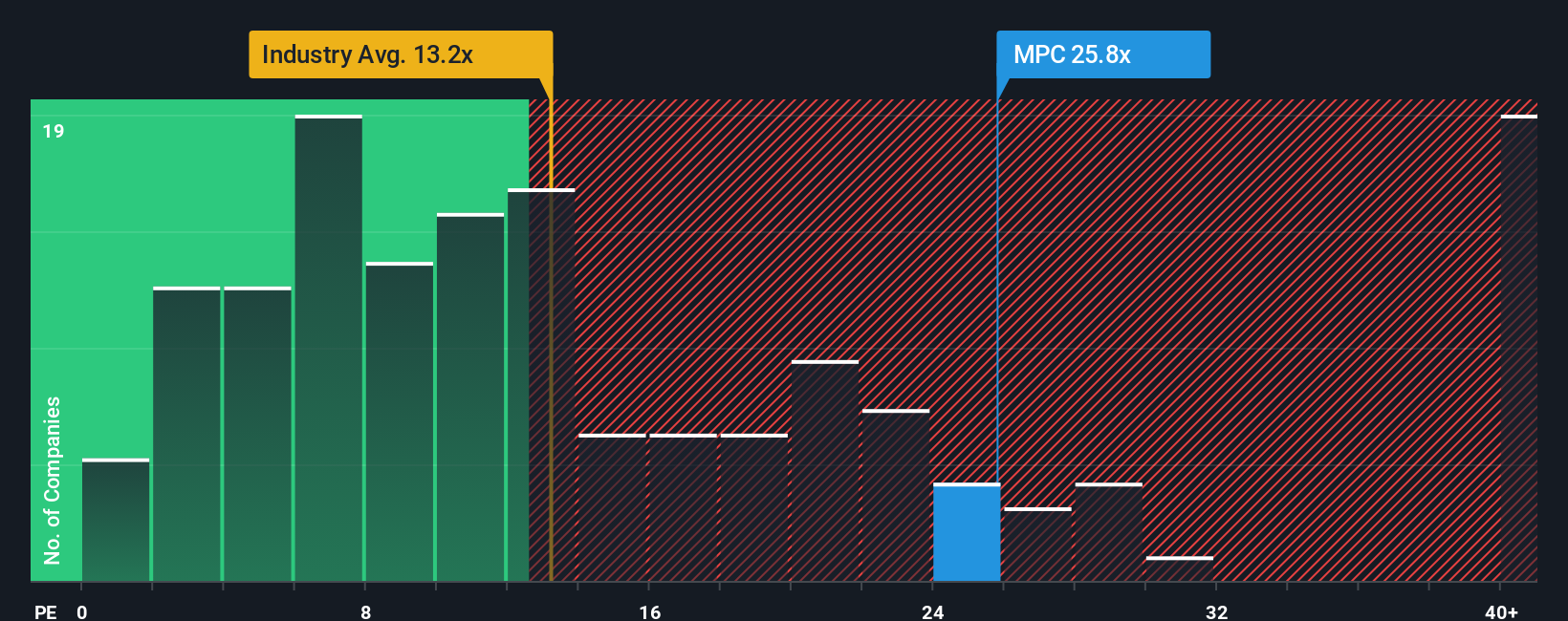

While the fair value estimate signals Marathon Petroleum is slightly undervalued, a closer look at its price-to-earnings ratio points to a different story. The company trades at 20.2 times earnings, which is notably higher than the US Oil and Gas industry average of 13.4 and its own fair ratio of 19.5. This premium could suggest investors are already paying up for expected growth, increasing the risk if those expectations fall short. Are the market’s optimism and premium price justified by the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marathon Petroleum Narrative

If the numbers or outlook here do not match your take, you can easily craft your own Marathon Petroleum narrative in just a few minutes. Do it your way

A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to just one opportunity? Unlock powerful stock ideas others might miss using the Simply Wall Street Screener and spot where big trends are happening now.

- Target long-term income by checking out these 16 dividend stocks with yields > 3%, which features companies delivering consistent yields above 3%.

- Accelerate your search for future game-changers by reviewing these 24 AI penny stocks, a tool focused on companies making headlines in artificial intelligence innovation.

- Pinpoint bargains the market is overlooking with these 870 undervalued stocks based on cash flows, which shows stocks trading below their intrinsic value based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives