- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Here's Why We Think Marathon Petroleum (NYSE:MPC) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Marathon Petroleum (NYSE:MPC). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Marathon Petroleum

Marathon Petroleum's Improving Profits

In the last three years Marathon Petroleum's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Marathon Petroleum's EPS shot from US$14.03 to US$31.68, over the last year. Year on year growth of 126% is certainly a sight to behold.

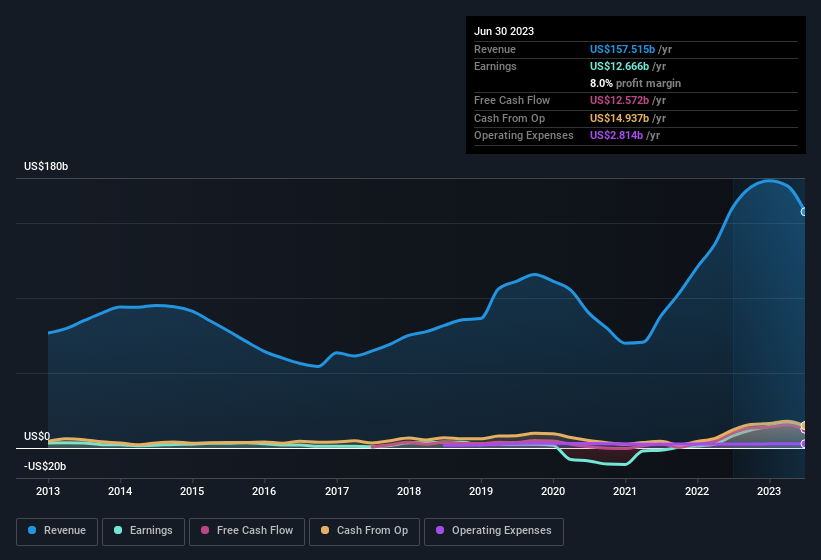

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Despite the relatively flat revenue figures, shareholders will be pleased to see EBIT margins have grown from 8.0% to 11% in the last 12 months. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Marathon Petroleum.

Are Marathon Petroleum Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$59b company like Marathon Petroleum. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Given insiders own a significant chunk of shares, currently valued at US$83m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Is Marathon Petroleum Worth Keeping An Eye On?

Marathon Petroleum's earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering Marathon Petroleum for a spot on your watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Marathon Petroleum (1 doesn't sit too well with us) you should be aware of.

Although Marathon Petroleum certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company primarily in the United States.

Established dividend payer and good value.