- United States

- /

- Oil and Gas

- /

- NYSE:MNRL

Brigham Minerals (NYSE:MNRL) Is Paying Out A Larger Dividend Than Last Year

The board of Brigham Minerals, Inc. (NYSE:MNRL) has announced that it will be increasing its dividend on the 27th of August to US$0.35. This makes the dividend yield 6.2%, which is above the industry average.

View our latest analysis for Brigham Minerals

Brigham Minerals Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Brigham Minerals is unprofitable despite paying a dividend, and it is paying out 768% of its free cash flow. This is quite a strong warning sign that the dividend may not be sustainable.

EPS could fall quite dramatically over the next 12 months if recent trends continue. This could force the company to make difficult decisions around continuing payouts to shareholders or putting additional pressure on the balance sheet.

Brigham Minerals' Dividend Has Lacked Consistency

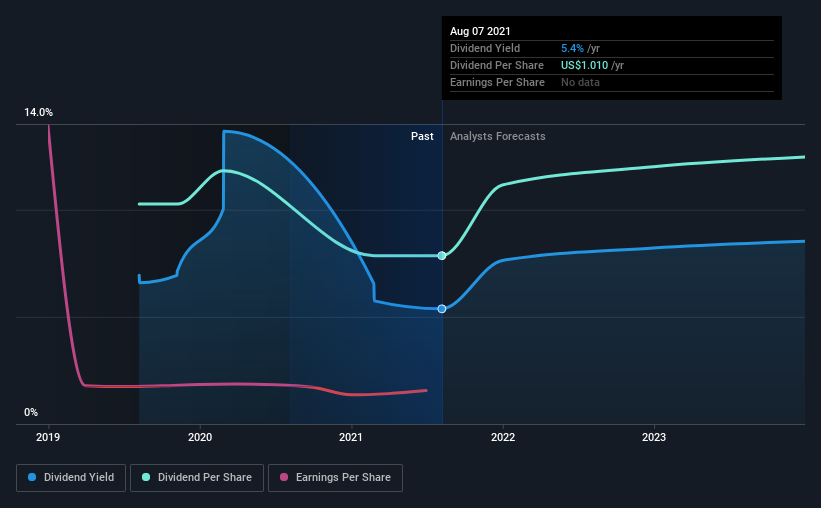

The track record isn't the longest, but we are already seeing a bit of instability in the payments. The dividend has gone from US$1.32 in 2019 to the most recent annual payment of US$1.01. This works out to a decline of approximately 23% over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS is growing. Brigham Minerals has seen EPS fall by 319% over the last 12 months. Decreases in earnings as large as this could start to put some pressure on the dividend if they are sustained for several years. Any one year of performance can be misleading for a variety of reasons, so we wouldn't like to form any strong conclusions based on these numbers alone.

Brigham Minerals' Dividend Doesn't Look Great

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. We don't think that this is a great candidate to be an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Brigham Minerals has 2 warning signs (and 1 which can't be ignored) we think you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Brigham Minerals, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Brigham Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:MNRL

Brigham Minerals

Brigham Minerals, Inc. owns and operates a portfolio of mineral and royalty interests in the continental United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026