- United States

- /

- Oil and Gas

- /

- NYSE:MNR

Is Mach Natural Resources a Hidden Opportunity After a 32% Drop in 2025?

Reviewed by Bailey Pemberton

- Curious if Mach Natural Resources might be a hidden gem or an overpriced pick? Let’s break down the facts to see where true value could be hiding right now.

- The stock has seen some turbulence lately, falling 3.2% over the last week and down 32.0% year-to-date, which could signal changing sentiment or fresh opportunities for investors.

- Recent headlines suggest that shifts in energy prices and new regulatory discussions are shaping the outlook for many energy companies, including Mach Natural Resources. With markets unsure about near-term prospects, investors have been recalibrating their expectations and risk profiles for stocks like this.

- When it comes to fundamentals, Mach Natural Resources scores a strong 5 out of 6 on our valuation checks, underlining some attractive metrics we will dig into soon. There is more than one way to measure value, so stick around for our take on what really matters most for long-term investors.

Find out why Mach Natural Resources's -17.1% return over the last year is lagging behind its peers.

Approach 1: Mach Natural Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach offers a way to look beyond market sentiment and focus on the business’s capacity to generate cash over time.

For Mach Natural Resources, the latest reported Free Cash Flow is negative at $-394 million. However, analysts expect a significant turnaround, projecting positive Free Cash Flows that rise steadily over the next decade. According to current estimates and forecast assumptions, Free Cash Flow is anticipated to reach about $279 million by the end of 2029, with the next few years seeing consistent improvement.

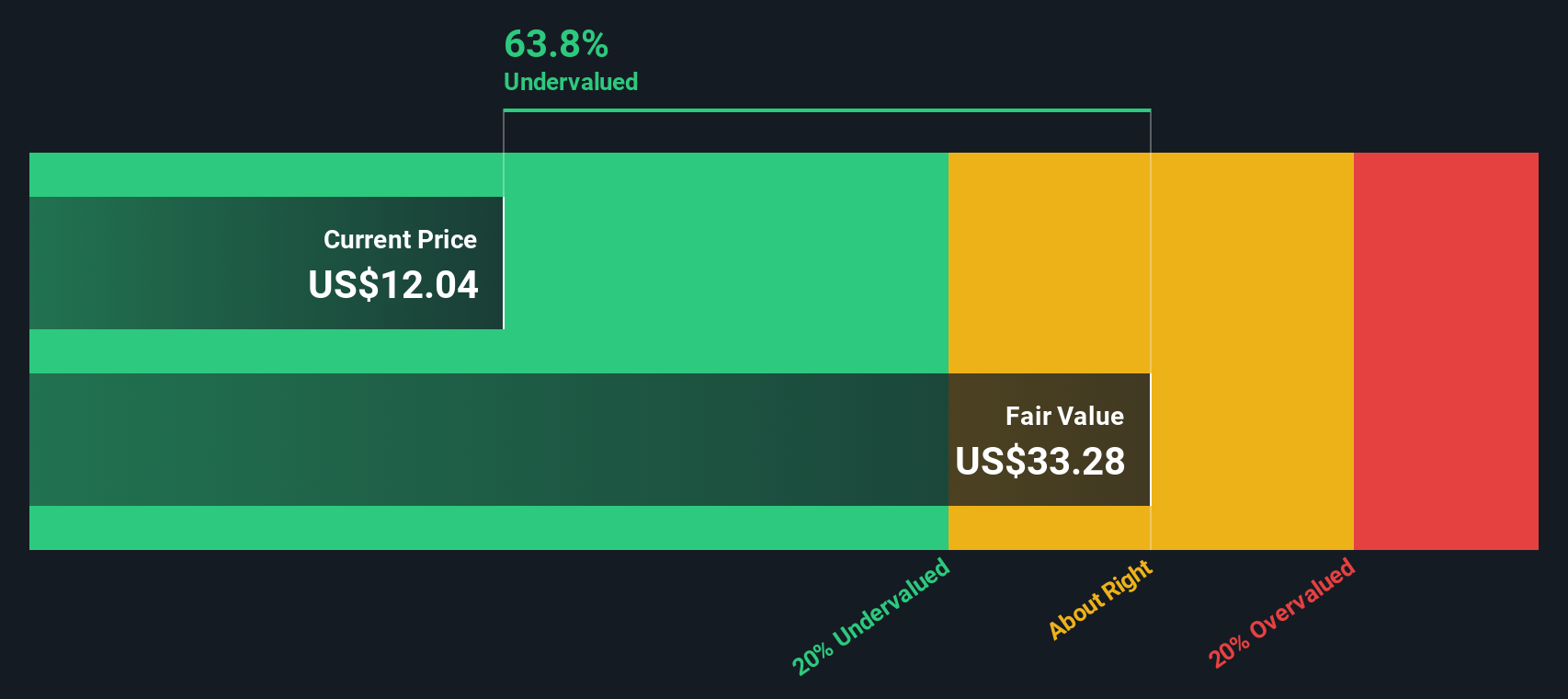

These cash flow projections, combined with the DCF methodology, give Mach Natural Resources an estimated intrinsic value of $44.24 per share. Compared to the current share price, this valuation suggests the stock is trading at a 73.8% discount to its intrinsic value. This means it appears substantially undervalued based on future cash flow prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mach Natural Resources is undervalued by 73.8%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Mach Natural Resources Price vs Earnings

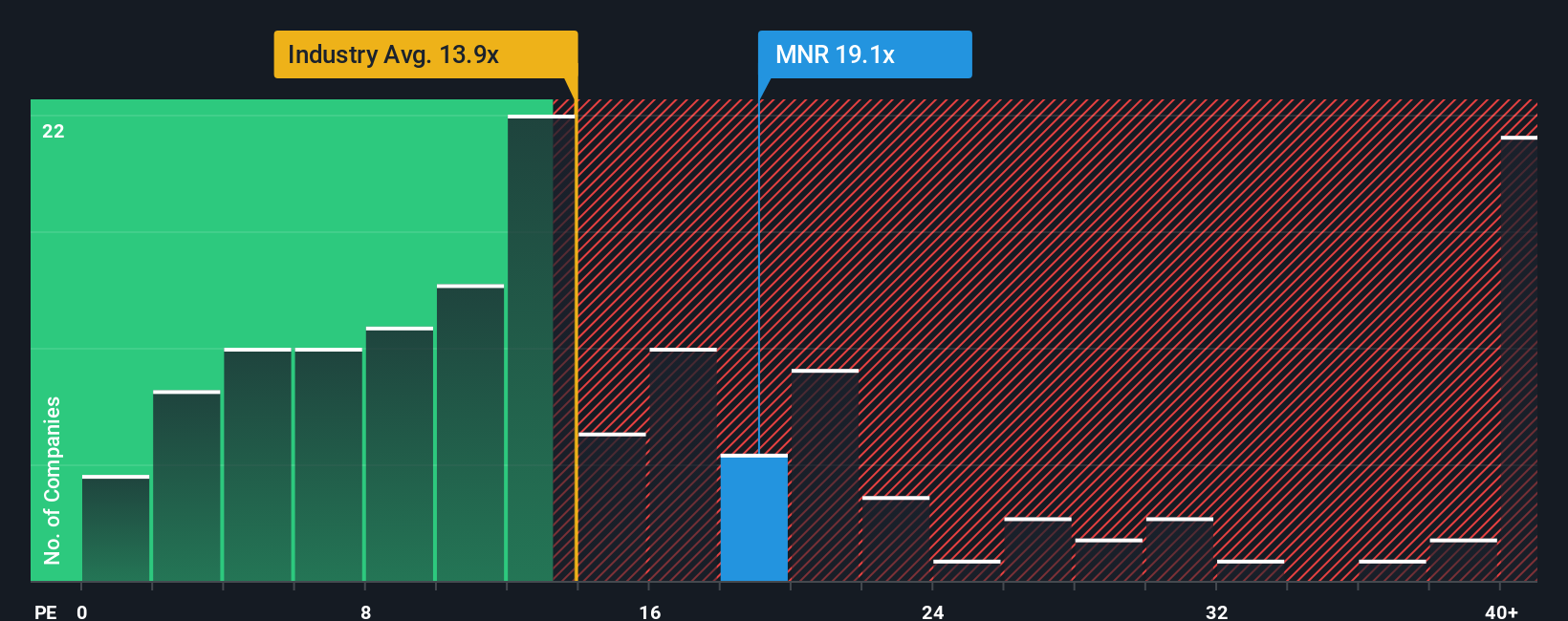

The Price-to-Earnings (PE) ratio is a classic valuation tool for profitable companies, as it allows investors to compare the price of a stock to its underlying earnings power. This makes it especially useful for businesses that generate consistent profits, like Mach Natural Resources is now beginning to do.

When assessing what a “normal” or “fair” PE ratio should be, it is important to remember that expectations for future growth and the level of risk both play major roles. Higher expected earnings growth or lower business risks can justify a higher PE ratio, while slower growth or elevated risks typically mean a lower multiple is appropriate.

Mach Natural Resources currently trades on a PE ratio of 12.91x, which is just above the average for its peers at 12.53x and slightly below the broader Oil and Gas industry average of 13.47x. However, Simply Wall St’s proprietary “Fair Ratio” for the company stands at 17.11x. This “Fair Ratio” reflects more than basic comparisons, as it adjusts for specific factors such as Mach’s earnings growth, profit margins, size, and unique risks.

By using the Fair Ratio, investors get a clearer and more nuanced sense of value. Unlike peer or industry averages, which do not fully account for a company’s unique qualities, the Fair Ratio helps highlight when a business deserves a higher or lower multiple based on its own outlook and challenges.

With Mach’s actual PE ratio at 12.91x and its Fair Ratio at 17.11x, there is a notable valuation gap. This suggests the market may not be fully appreciating its earnings potential based on the factors that matter most.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mach Natural Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, story-driven approach that lets you define how you see a company’s future. It is your personal perspective behind the numbers, connecting expected business trends with your own estimates of future revenue, earnings, and margins. Narratives take your story, translate it into a full financial forecast, and instantly show what you believe is a fair value for Mach Natural Resources, all within a few easy steps.

This approach is accessible to everyone and is at the core of Simply Wall St’s Community page, where millions of investors participate and share their views. Narratives help you decide exactly when to buy or sell by spotlighting the gap between your Fair Value and the current Price. They update automatically whenever new earnings or news are released, ensuring that your analysis stays relevant in real time.

For example, for Mach Natural Resources, some investors forecast strong natural gas demand and assign a higher value of $22.00, while others are more cautious, projecting $18.00 as fair value. Your own Narrative may fall anywhere between, reflecting what you expect from the business and the industry’s future.

Do you think there's more to the story for Mach Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNR

Mach Natural Resources

An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Undervalued second-rate dividend payer.

Market Insights

Community Narratives