- United States

- /

- Oil and Gas

- /

- NYSE:LPG

A Fresh Look at DorianG (LPG) Valuation After Strong Q2 Earnings and Special Dividend Announcement

Reviewed by Simply Wall St

DorianG (LPG) just announced a $0.65 per share irregular cash dividend and revealed second quarter earnings that showed a sharp jump in both revenue and net income compared to last year. Investors are watching these moves closely.

See our latest analysis for DorianG.

DorianG’s jump in second quarter profits and generous cash dividend have certainly caught investors’ attention, but the share price hasn’t delivered the same fireworks. It is trading at $26.72 after a modest 1-day move, while its 1-year total shareholder return stands at 10.2%. Momentum has cooled over the past quarter, yet long-term total returns remain impressive, reflecting both periods of growth and recent volatility.

If today’s blend of strong results and evolving momentum has you interested in what else is out there, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With DorianG’s earnings surge and a generous dividend in play, the spotlight now turns to valuation. Is the recent strength fully factored into today’s price, or does this setup hint at a buying opportunity?

Most Popular Narrative: 20% Undervalued

Compared to its last close of $26.72, the most widely followed narrative assigns DorianG a fair value of $33.40. This significant spread has drawn extra attention to recent forecasts. What does this gap reveal about how the market is interpreting future growth potential?

DorianG's ongoing investments in enhancing fleet energy efficiency, retrofitting vessels for ammonia carriage, and early compliance with IMO decarbonization targets position the company to benefit from tightening environmental regulations, supporting improved margins and lower compliance costs.

The fair value calculation is built on assumptions the market may not expect. Hint: it draws heavily from strategic upgrades and margin projections that pack a punch. Want to know why this drives the valuation higher? The full narrative unpacks the key forecasts powering this potential upside.

Result: Fair Value of $33.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, DorianG’s outlook remains sensitive to shifting freight rates and global demand. These factors could quickly challenge earnings stability and today’s bullish view.

Find out about the key risks to this DorianG narrative.

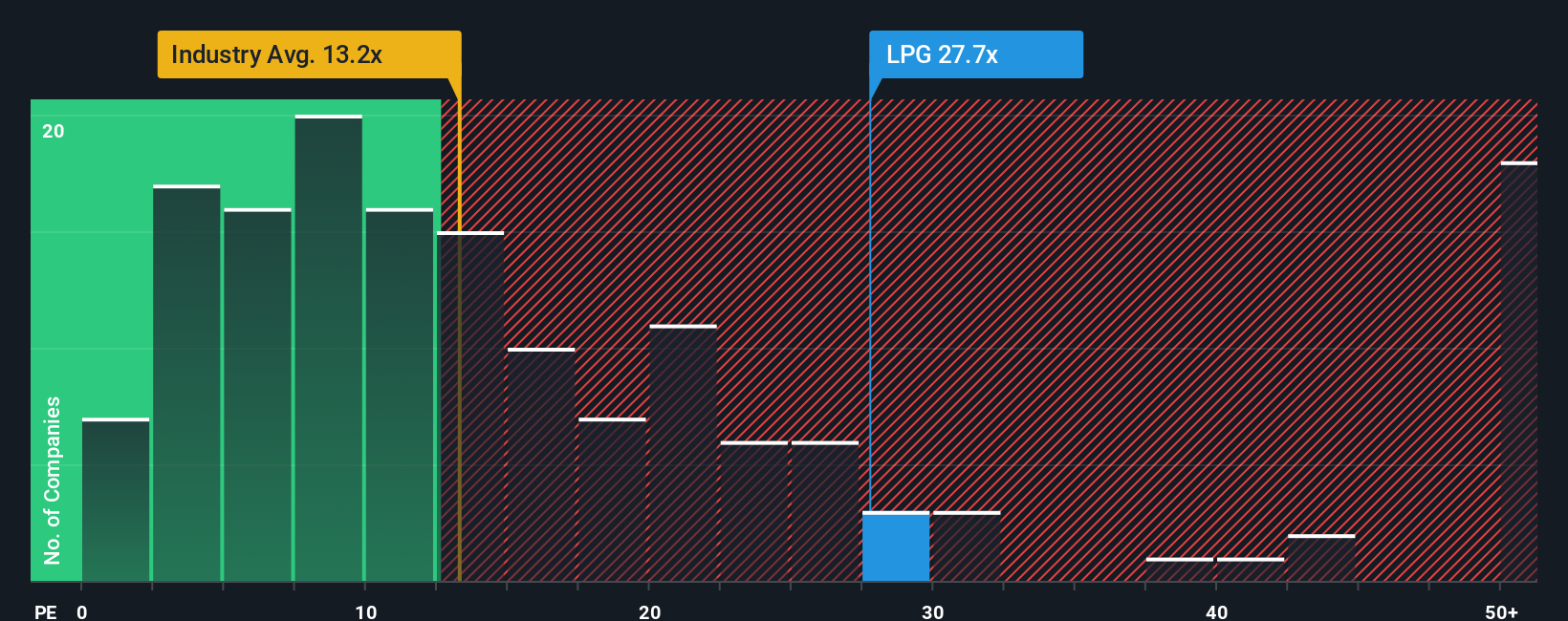

Another View: Multiples Tell a Different Story

Looking at price-to-earnings, DorianG trades at 12.1x, notably lower than both the US Oil and Gas industry average of 14.3x and its peer group. Yet, the fair ratio for this company sits at just 8.7x. This suggests that while it appears cheap alongside competitors, the market could tighten its valuation standards. Are investors ready for this potential shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DorianG Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own DorianG outlook in just a few minutes, and Do it your way

A great starting point for your DorianG research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Stay ahead of the curve and uncover fresh picks that thousands are already tracking on Simply Wall St’s screeners.

- Tap into tomorrow’s disruptive trends by reviewing these 25 AI penny stocks, which are powering innovations in artificial intelligence and automation across global industries.

- Strengthen your portfolio’s income with steady potential from these 16 dividend stocks with yields > 3%, as these offer attractive yields above 3% for long-term wealth building.

- Seize value overlooked by the market and search among these 878 undervalued stocks based on cash flows, which stand out for their discounted cash flows and upside possibilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LPG

DorianG

Engages in the transportation of liquefied petroleum gas through its LPG tankers worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives