- United States

- /

- Oil and Gas

- /

- NYSE:LNG

Where Does Cheniere Stand After Recent Long-term LNG Export Contract Developments?

Reviewed by Bailey Pemberton

- Wondering if Cheniere Energy is a hidden gem or priced to perfection? You are not alone, and digging into the numbers reveals some surprising insights.

- The stock has been on a bit of a roller coaster, delivering a flat 0.2% over the past week, down 3.0% for the month, and slipping 3.7% so far this year. It is still holding an impressive 276.0% gain over the last five years.

- Recent headlines have centered on the shifting global LNG market and Cheniere's ongoing efforts to secure long-term export contracts. These developments have certainly added both optimism and volatility to the share price.

- The company's current valuation score stands at 6 out of 6, showing that it ticks every box for being undervalued by standard checks. Up next, we will break down those checks in detail, but stick around as there is an even more insightful way to think about value that we will explore by the end of this article.

Approach 1: Cheniere Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company's future cash flows and then discounts those amounts back to their value in today's dollars. This method helps estimate a fair price for the stock based on expected long-term performance rather than short-term market swings.

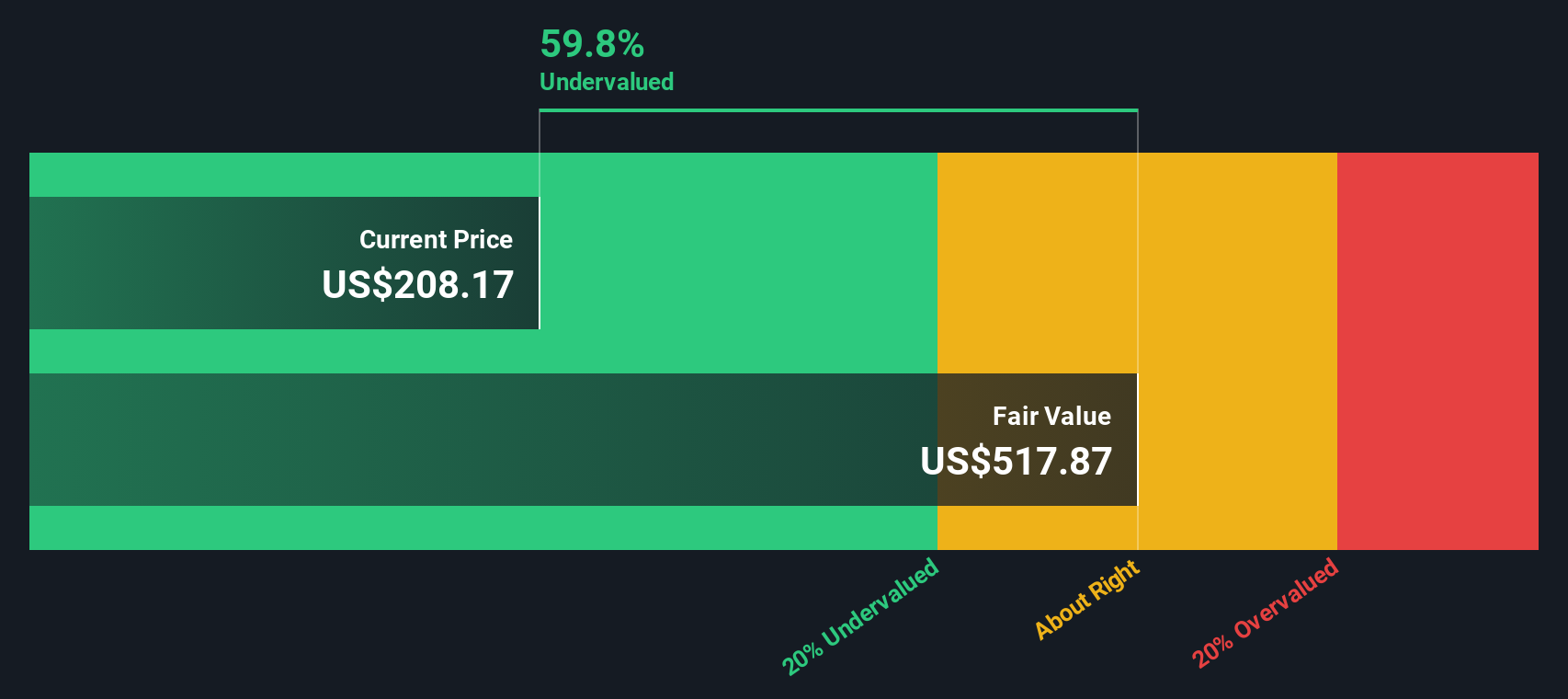

For Cheniere Energy, the most recent twelve months of Free Cash Flow total $2.81 billion. Analysts expect this to rise over the next few years, with projections suggesting Free Cash Flow could reach around $4.63 billion by 2029. Further projections that anticipate continued growth out to 2035 are based on reasonable estimates from available information. These cash flows have been discounted using a two-stage Free Cash Flow to Equity model to reflect their present value.

Based on these calculations, the intrinsic value of Cheniere Energy shares is estimated at $521.12 per share. Given the current share price, this represents the stock trading at a 59.2% discount to its fair value. This indicates meaningful undervaluation according to the DCF approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cheniere Energy is undervalued by 59.2%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Cheniere Energy Price vs Earnings (PE)

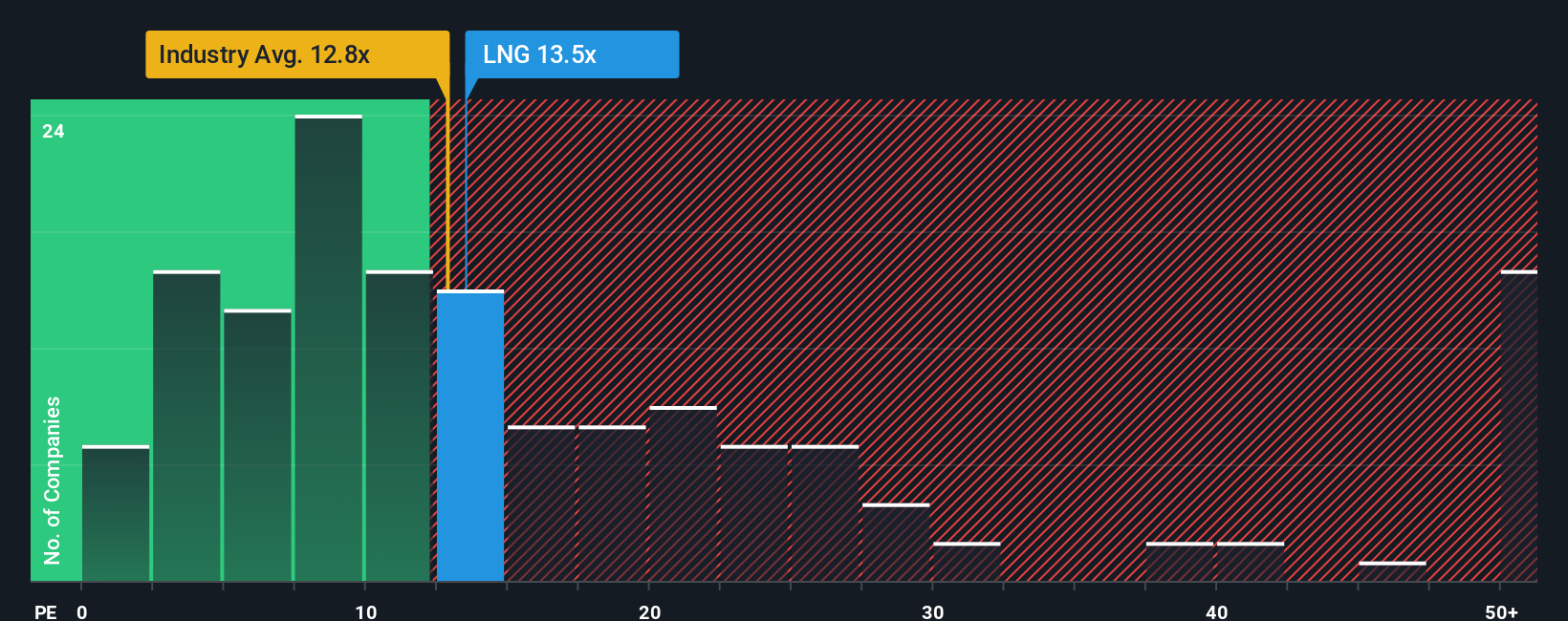

The Price-to-Earnings (PE) ratio is widely used to value established, profitable companies like Cheniere Energy because it compares a company’s share price to its actual earnings, providing a tangible sense of how much investors are paying per dollar of profit. A company with stable or growing earnings is especially well suited to PE-based analysis.

Growth prospects and perceived risks help define what a “normal” or “fair” PE ratio should be for any business. When growth expectations are high, investors are willing to pay a higher multiple for current earnings. In contrast, higher risk leads them to pay less. So, context is key.

Cheniere Energy currently trades at a PE ratio of 11.4x. That is below both its peer average of 18.0x and the oil and gas industry average of 13.5x, suggesting the market is not fully pricing in its earnings. However, raw comparisons can be misleading if you do not account for unique company factors.

This is where Simply Wall St’s "Fair Ratio" comes in. The Fair Ratio is a proprietary measure that reflects the PE you would expect, factoring in things like Cheniere’s earnings growth, industry, profit margin, market cap, and risks. It provides a more tailored benchmark than headline industry or peer multiples.

For Cheniere, the Fair Ratio stands at 15.5x, versus its actual 11.4x. That significant difference points to the stock being undervalued by this measure, indicating the market appears to be discounting Cheniere’s prospects too heavily in relation to its underlying fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1421 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cheniere Energy Narrative

Earlier, we noted there is an even better way to understand a stock’s value, and that is through Narratives. A Narrative is a simple, user-driven story about a company’s future, grounded in your expectations for its business performance — things like future revenue, earnings, and margins — which then flow through to an estimated fair value. Narratives connect the dots from what’s happening in the business and industry all the way to what the share price should be, making complex forecasts more accessible and actionable than ever.

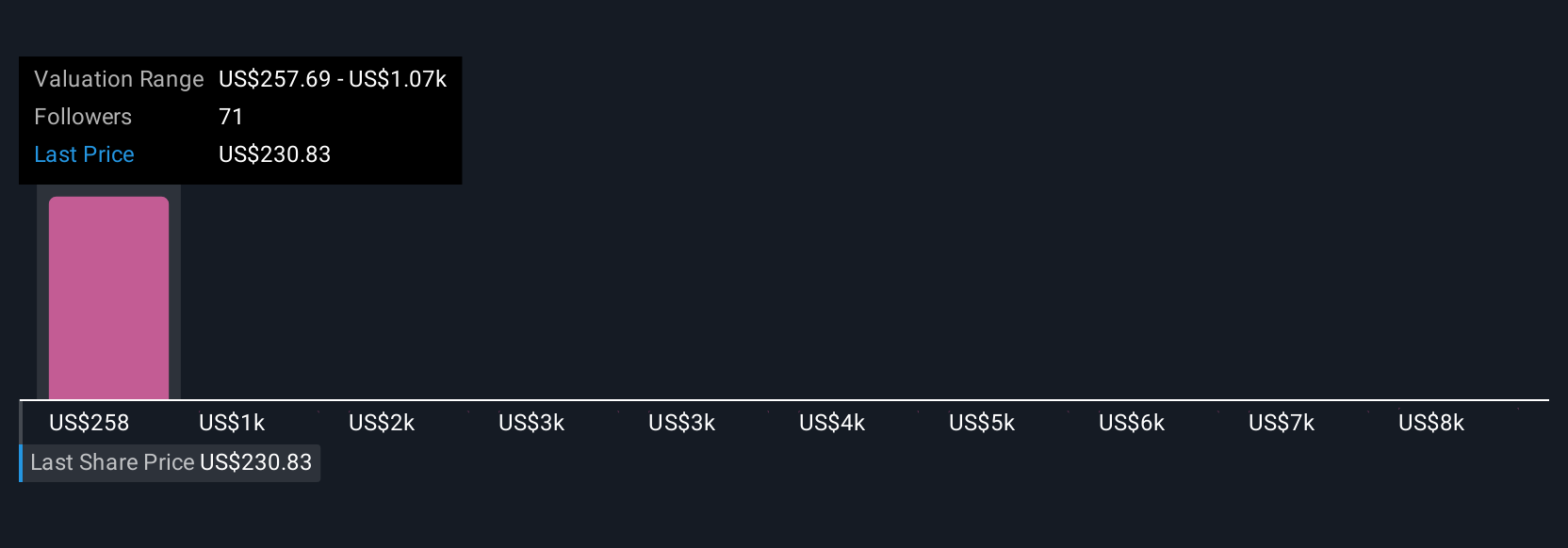

On Simply Wall St’s Community page, Narratives are a popular, easy-to-use tool available to all investors. They help you make clear buy or sell decisions by directly comparing your own Fair Value estimate with the current market Price, and are dynamically updated when new data or news emerges. For example, among Cheniere Energy investors, one Narrative sees expansion projects and long-term supply deals leading to a fair value as high as $295 per share, while another warns global oversupply or tightening climate policy could push the fair value as low as $240. Narratives make these differing perspectives transparent and help you act with more clarity — no spreadsheet required.

Do you think there's more to the story for Cheniere Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives