- United States

- /

- Oil and Gas

- /

- NYSE:INSW

International Seaways (INSW): Exploring the Stock’s Valuation After Recent Strong Gains

Reviewed by Simply Wall St

International Seaways (INSW) stock continued to show resilience in recent trading, with investors eyeing its solid returns this year. The company’s performance over the past month has drawn attention, particularly as many shipping stocks face ongoing market uncertainty.

See our latest analysis for International Seaways.

Recent momentum in International Seaways’ share price is hard to overlook, with a 16.2% gain over the past month pushing its stock to $53.60. This latest move adds to its impressive 47.9% year-to-date share price return and a standout five-year total shareholder return of 372.8%. This suggests that investors remain optimistic about its long-term growth story despite some swings along the way.

If recent gains have you wondering what else is out there, it’s a great time to broaden your investing lens and discover fast growing stocks with high insider ownership

The surge in International Seaways’ share price raises a critical question: are investors seeing real value at these levels, or has the stock’s robust future already been priced in, leaving little room for further upside?

Most Popular Narrative: 6.8% Undervalued

International Seaways' latest fair value estimate from the most widely followed narrative stands noticeably above its last close price of $53.60. This sets a compelling backdrop for investors seeking signals about untapped upside in the current share price.

Expanding trade routes and tightening global vessel supply are expected to boost tanker utilization, charter rates, and long-term earnings potential. Fleet modernization and strong financial flexibility position the company to capitalize on environmental regulation shifts and market opportunities.

Want to know the hidden drivers that shape this stock’s premium valuation? The narrative rests on transformative growth levers, operational upgrades, and aggressive earnings projections. Which combination of future business upgrades and expected profitability is fueling the bullish price target? Uncover the full story behind how these well-informed assumptions stack up and why the number-crunchers see hidden potential right now.

Result: Fair Value of $57.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing decarbonization policies and unpredictable trade flows could challenge International Seaways’ growth trajectory and could alter the tanker market outlook ahead.

Find out about the key risks to this International Seaways narrative.

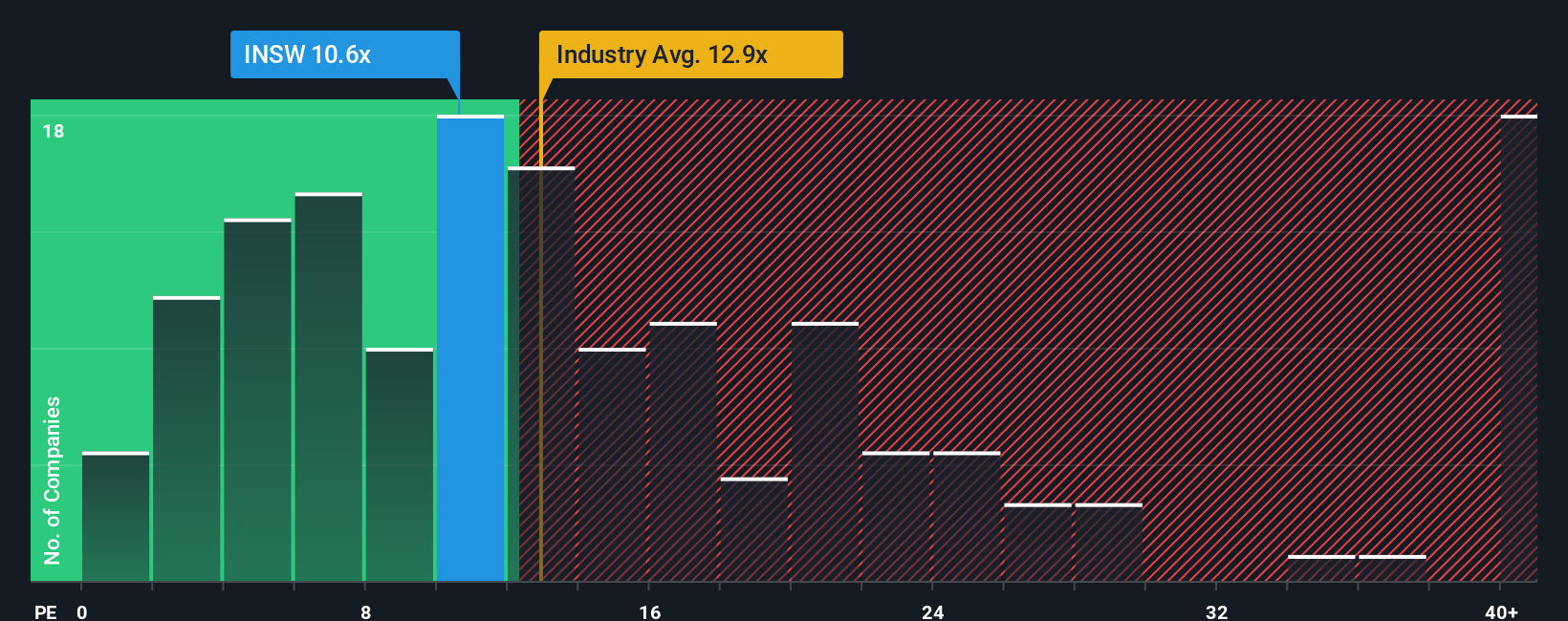

Another View: Market Multiples Tell a Different Story

Looking at International Seaways through the lens of price-to-earnings, the stock trades at 12.2 times earnings, higher than both peer (10.7x) and industry averages (14.2x), yet closely matching the fair ratio of 12.3x. This signals limited room for a valuation re-rating and possible downside risk for bargain seekers. Which approach should investors trust to guide their next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Seaways Narrative

If you see things differently or want your own perspective, you can assemble your own take backed by the facts in just minutes. Do it your way

A great starting point for your International Seaways research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for More Winning Ideas?

Don’t get left behind while others gain an edge. Use the Simply Wall Street Screener to spot stand-out opportunities tailored to your investing style and goals.

- Tap into future tech breakthroughs by searching for the innovators among these 26 quantum computing stocks for unique growth potential.

- Put your cash to work with confidence by targeting reliable income from these 18 dividend stocks with yields > 3% with attractive yields above 3%.

- Catch the next breakout opportunity in digital assets and blockchain by reviewing these 82 cryptocurrency and blockchain stocks and capitalize on this dynamic trend.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives