- United States

- /

- Energy Services

- /

- NYSE:HLX

Helix Energy Solutions Group, Inc. (NYSE:HLX) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

To the annoyance of some shareholders, Helix Energy Solutions Group, Inc. (NYSE:HLX) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 49% in that time.

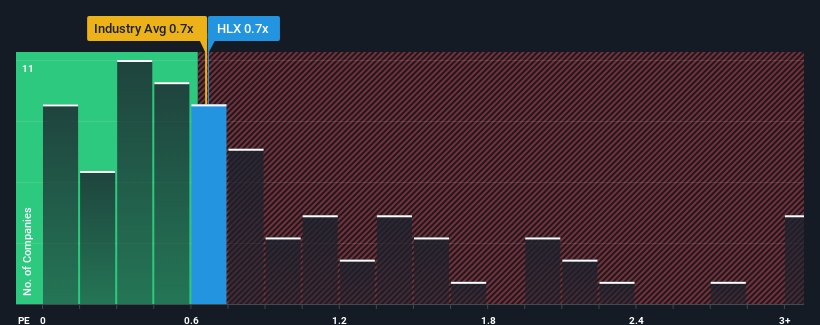

In spite of the heavy fall in price, it's still not a stretch to say that Helix Energy Solutions Group's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Energy Services industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Helix Energy Solutions Group

How Has Helix Energy Solutions Group Performed Recently?

With revenue growth that's inferior to most other companies of late, Helix Energy Solutions Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Helix Energy Solutions Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Helix Energy Solutions Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.3% last year. This was backed up an excellent period prior to see revenue up by 101% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.3% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 4.3% per year, which is not materially different.

With this in mind, it makes sense that Helix Energy Solutions Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Helix Energy Solutions Group's P/S Mean For Investors?

Helix Energy Solutions Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Helix Energy Solutions Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Helix Energy Solutions Group you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Helix Energy Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HLX

Helix Energy Solutions Group

An offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the United States, North Sea, the Asia Pacific, West Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives