- United States

- /

- Energy Services

- /

- NYSE:HAL

Halliburton (NYSE:HAL) Has Re-Affirmed Its Dividend Of US$0.045

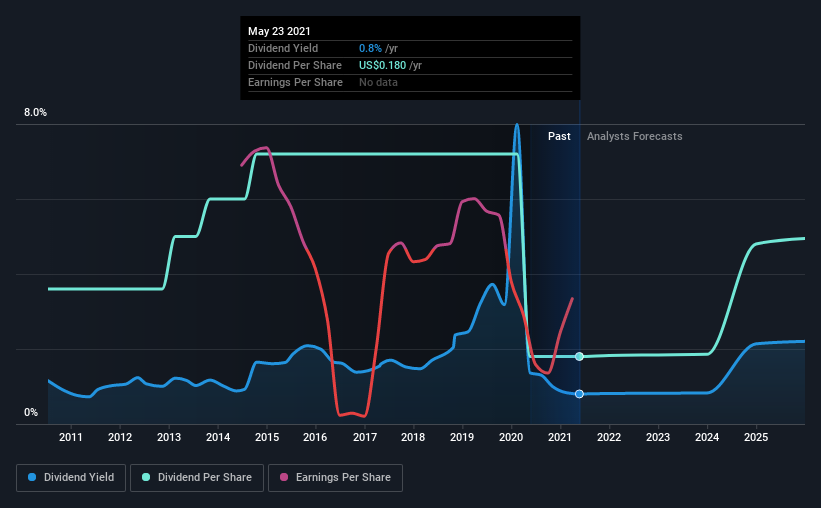

The board of Halliburton Company (NYSE:HAL) has announced that it will pay a dividend on the 23rd of June, with investors receiving US$0.045 per share. This payment means the dividend yield will be 0.8%, which is below the average for the industry.

Check out our latest analysis for Halliburton

Halliburton Might Find It Hard To Continue The Dividend

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. While Halliburton is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Assuming the trend of the last few years continues, EPS will grow by 17.1% over the next 12 months. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2011, the dividend has gone from US$0.36 to US$0.18. Doing the maths, this is a decline of about 6.7% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Halliburton has impressed us by growing EPS at 17% per year over the past five years. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 25 analysts we track are forecasting for Halliburton for free with public analyst estimates for the company. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you’re looking to trade Halliburton, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives