- United States

- /

- Energy Services

- /

- NYSE:HAL

Halliburton (NYSE:HAL) Collaborates With PETRONAS To Enhance Reservoir Management With Advanced Technologies

Reviewed by Simply Wall St

Halliburton (NYSE:HAL) experienced a 7% price increase over the past month, which coincides with the announcement of its collaboration with PETRONAS Carigali, aimed at advancing subsurface modeling and reservoir management. This partnership, designed to deploy cutting-edge technology and streamline workflows, may have supported Halliburton's price movement. Additionally, the award of a long-term contract from Repsol Resources UK could have positively influenced the company's market performance. The declaration of a second-quarter dividend provides further stability, potentially appealing to investors. Overall, Halliburton's recent initiatives and consistent dividend offerings reflect its growth potential and resilience in a market up nearly 10% over the past year.

Be aware that Halliburton is showing 2 possible red flags in our investment analysis.

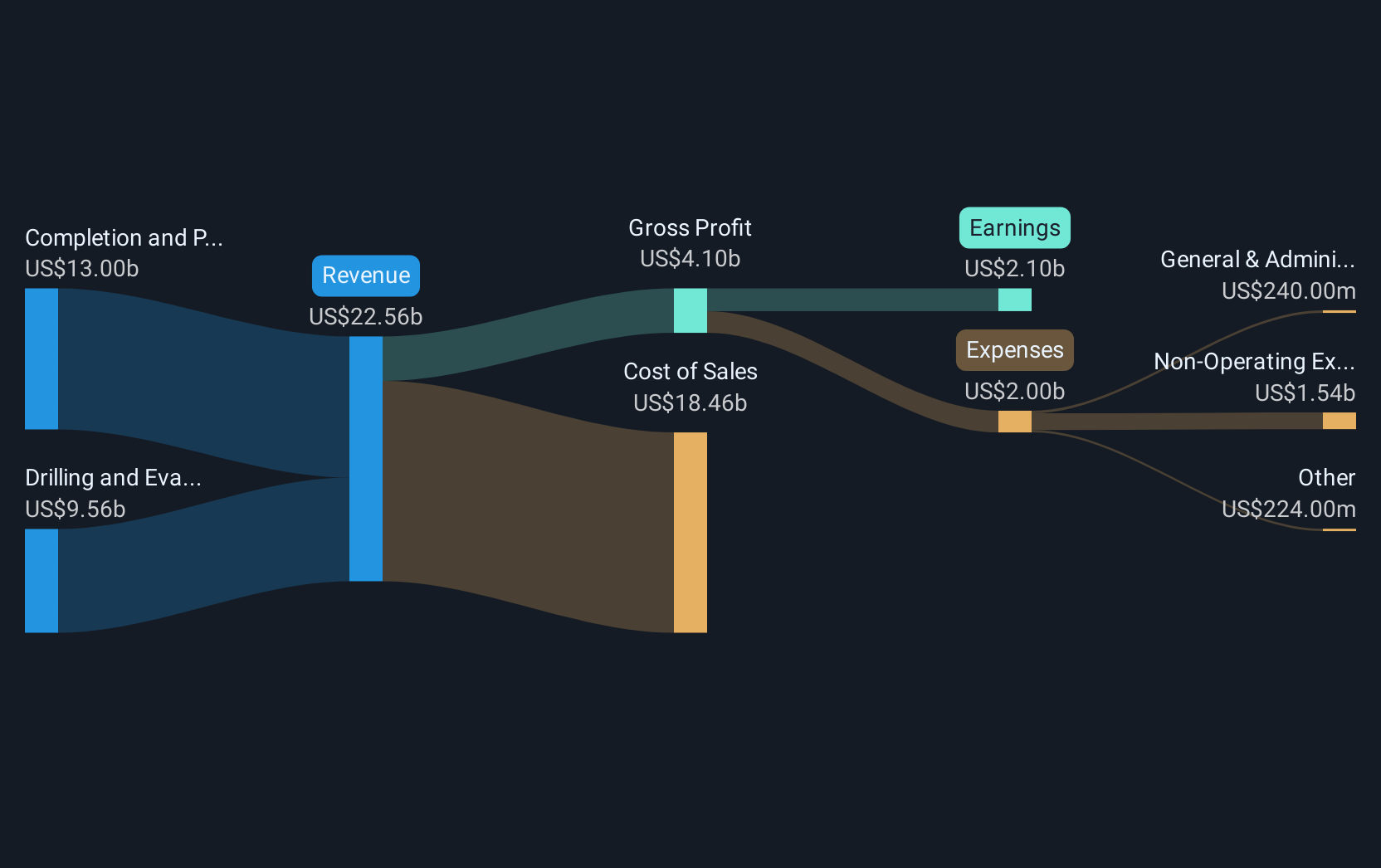

The recent collaboration between Halliburton and PETRONAS Carigali, alongside a contract with Repsol Resources UK, could significantly influence the company's future revenue and earnings projections. This partnership aims to enhance subsurface modeling and reservoir management, potentially increasing operational efficiencies and boosting margins. As these technologies are implemented, they could drive Halliburton's earnings forecast, which analysts presently predict will grow to US$2.4 billion by 2028, from US$2.1 billion today.

Looking at long-term performance, Halliburton's total shareholder return was approximately 103.84% over five years, showcasing its resilience and growth during that period. Despite this, the company's one-year return underperformed the US market, which gained 9.9% over the same year. This underscores varying dynamics in short-term versus long-term performance and highlights potential areas for strategic improvement.

Currently, Halliburton's share price remains discounted relative to the consensus price target of US$28.93, reflecting a substantial upside potential as perceived by analysts. If the company's innovative initiatives bear fruit, they could catalyze further share price appreciation, aligning it closer to or beyond these predictions. However, challenges such as economic uncertainties and regional revenue declines, notably in North America and Latin America, pose potential risks to achieving these targets.

Jump into the full analysis health report here for a deeper understanding of Halliburton.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives