- United States

- /

- Oil and Gas

- /

- NYSE:GPRK

Even With A 34% Surge, Cautious Investors Are Not Rewarding GeoPark Limited's (NYSE:GPRK) Performance Completely

GeoPark Limited (NYSE:GPRK) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Looking further back, the 17% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

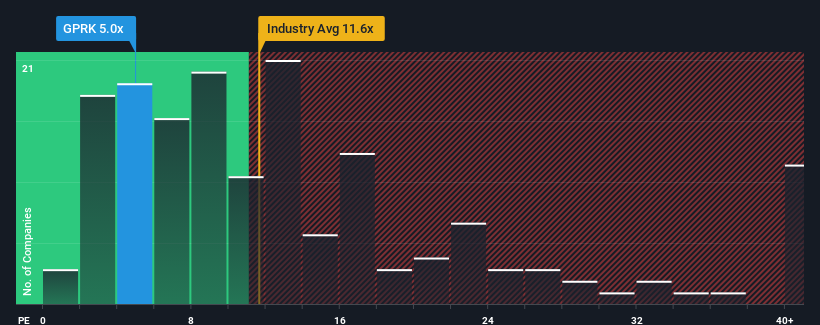

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider GeoPark as a highly attractive investment with its 5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

GeoPark could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for GeoPark

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like GeoPark's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 14% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we find it odd that GeoPark is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Shares in GeoPark are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of GeoPark's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for GeoPark that you should be aware of.

If you're unsure about the strength of GeoPark's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GPRK

GeoPark

Operates as an oil and natural gas exploration and production company in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026