- United States

- /

- Energy Services

- /

- NYSE:FTI

A Look at TechnipFMC (NYSE:FTI) Valuation Following Major Maha Project Contract Win

Reviewed by Simply Wall St

TechnipFMC (NYSE:FTI) just secured a sizable Engineering, Procurement, Construction, and Installation contract from Eni for Indonesia’s deepwater Maha project. This marks another step in their ongoing collaboration and expands the reach of their Subsea 2.0 technology.

See our latest analysis for TechnipFMC.

TechnipFMC’s latest contract win with Eni seems to have fueled already strong momentum, with a 1-month share price return of 14% and more than 52% year-to-date. The announcement builds on recent events like their participation in the TD Cowen Energy Conference, and the stock’s five-year total shareholder return has soared over 640%, which suggests that investors see long-term value and growth potential gathering pace.

If news like this has you watching for the next big mover, consider expanding your search and uncovering opportunities among fast growing stocks with high insider ownership.

With TechnipFMC’s share price surging ahead of its latest contract win, investors are left weighing whether further growth is already factored into the current valuation or if there is still a genuine buying opportunity ahead.

Most Popular Narrative: 1.6% Undervalued

TechnipFMC's most widely followed narrative sees its fair value just above the last close, suggesting shares are still trading slightly below the consensus valuation. This narrative weighs a promising margin outlook against the realities of a mature energy sector and evolving market dynamics.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20, 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement.

What future numbers are powering this valuation? Hidden inside the narrative are bullish profit margin forecasts and a financial model that expects strong recurring income over the next few years. Want to see which projected shifts in margins and cash flow are making analysts take notice? The real assumptions driving this price are waiting inside.

Result: Fair Value of $45.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on oil and exposure to volatile global markets could present challenges for TechnipFMC’s growth outlook if conditions shift unexpectedly.

Find out about the key risks to this TechnipFMC narrative.

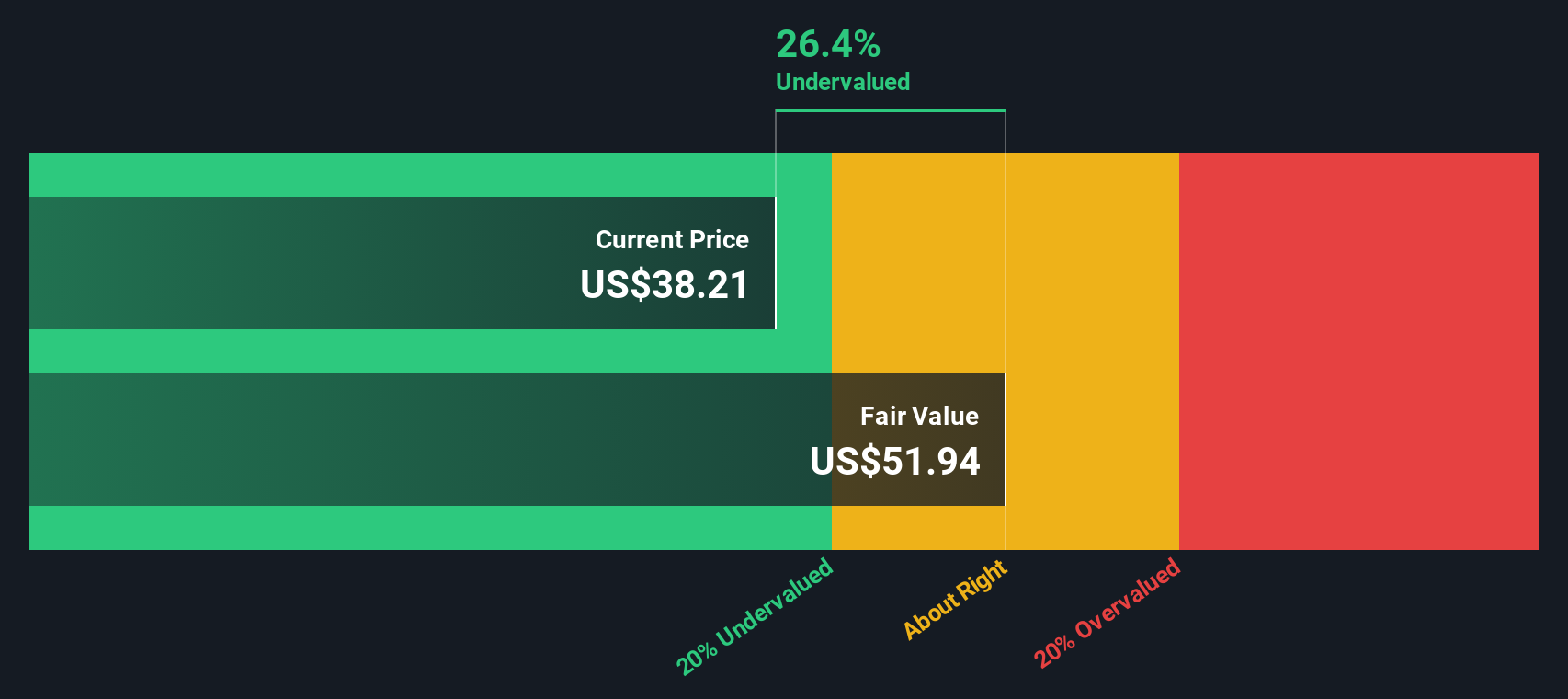

Another View: SWS DCF Model Flags a Larger Gap

While multiples suggest TechnipFMC trades close to consensus estimates, our SWS DCF model presents a different perspective. The DCF calculation indicates shares are trading well below fair value, which could mean the market is underestimating the long-term earnings potential within the business. Is there a bigger opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TechnipFMC Narrative

If you have a different perspective or would rather dive into the numbers yourself, it takes just a few minutes to generate your own view and see where you land. Do it your way.

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't limit your potential. The market is brimming with exciting opportunities that could fit your goals. Here are a few powerful angles to put on your radar.

- Unleash your portfolio’s potential by scanning these 924 undervalued stocks based on cash flows, revealing companies trading below what they're truly worth based on cash flows and fundamentals.

- Tap into the next wave of digital disruption by checking out these 81 cryptocurrency and blockchain stocks, featuring businesses at the forefront of blockchain innovation and crypto assets.

- Capitalize on booming healthcare advances with these 30 healthcare AI stocks, focusing on companies merging artificial intelligence with medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success