- United States

- /

- Oil and Gas

- /

- NYSE:FRO

Frontline (NYSE:FRO): Evaluating Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Frontline.

Momentum is clearly building for Frontline, with a 26.6% share price return over the past 90 days and a year-to-date gain topping 76%. Even more compelling, its one-year total shareholder return stands at nearly 41%, handily outpacing its sector. The recent surge reflects renewed optimism about the company’s prospects, as investors look past short-term swings to its impressive multi-year performance and persistently strong demand signals.

If the buzz around Frontline has you interested in what else is showing strong momentum, this is a perfect moment to discover fast growing stocks with high insider ownership

But with shares up so dramatically, investors are left to wonder whether Frontline’s stock is still undervalued given its fundamentals or if the market has already priced in all the anticipated growth.

Most Popular Narrative: 6.8% Undervalued

Frontline's most popular narrative estimates a fair value of $27.80 per share compared to the last close of $25.90. This suggests the shares may still have upside potential if strong profit margin improvements are realized. This narrative considers recent margin momentum and improving fleet dynamics while also weighing potential market volatility.

Frontline's modern, eco-friendly fleet (average age 7 years, 100% ECO vessel, over 50% scrubber-fitted) positions the company to benefit from both stricter environmental regulations and higher fuel efficiency, helping to keep operating costs low and supporting better net margins as older, less efficient vessels are phased out.

What exactly is driving this target price? Hint: long-term margin expansion and profit forecasts are the focus, not revenue growth. The full narrative details the quantitative assumptions that are setting Frontline apart in this competitive sector. If you want to see the numbers behind this valuation, you’ll want to read further.

Result: Fair Value of $27.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still risks, such as volatile oil demand and potential regulatory changes, that could challenge Frontline's optimistic outlook if industry conditions shift unexpectedly.

Find out about the key risks to this Frontline narrative.

Another View: Market Multiples Challenge

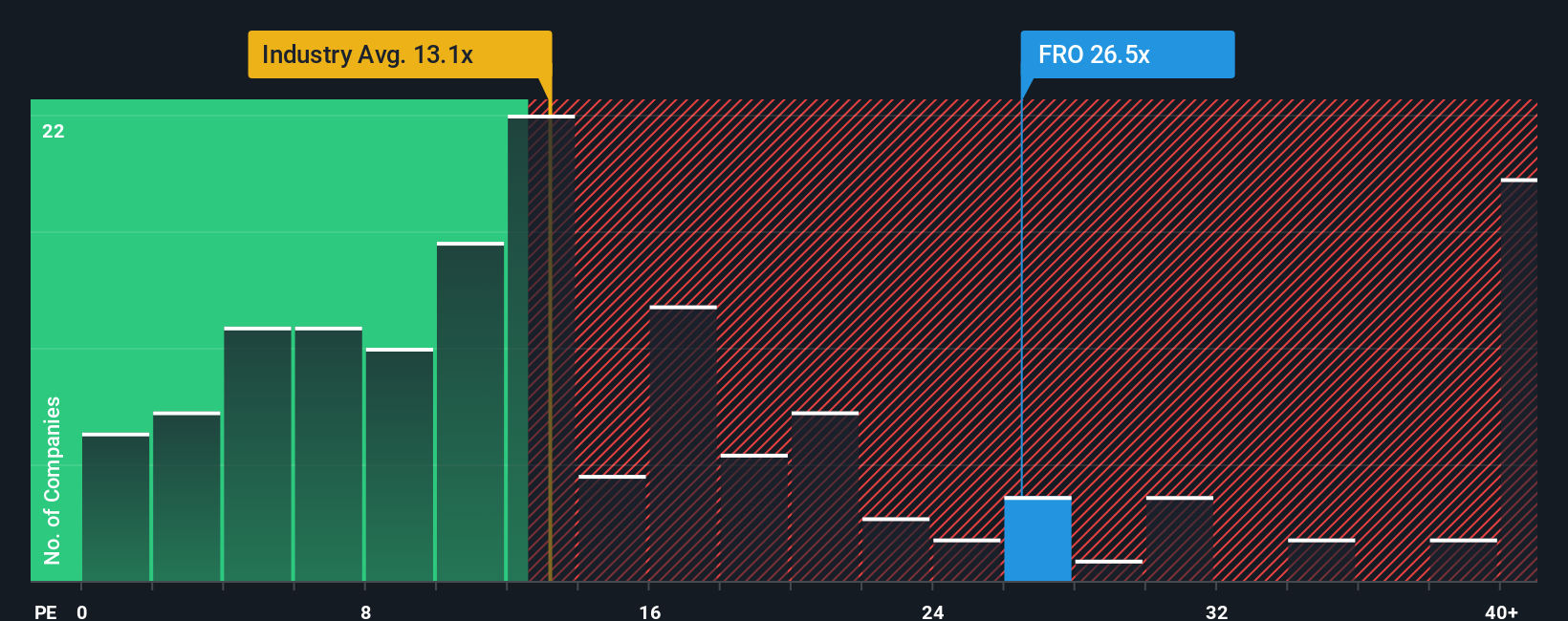

Looking from a market multiple perspective, Frontline is trading at a price-to-earnings ratio of 26.5x, which appears expensive relative to both the US Oil and Gas industry average of 13.1x and a fair ratio estimate of 25.3x. While this might reflect growth expectations, it poses valuation risks if those expectations are not met. Could the market be overvaluing momentum?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Frontline Narrative

If you want to crunch the numbers or challenge these conclusions, you can dive into the data and shape your own story in just minutes: Do it your way

A great starting point for your Frontline research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities don’t wait for anyone. Equip yourself with fresh stock ideas you might otherwise overlook by using these tailored tools from Simply Wall Street:

- Boost your portfolio’s growth potential by scanning these 927 undervalued stocks based on cash flows, which currently trade well below their intrinsic value and offer promising fundamentals.

- Tap into innovations in patient care and medical technology by targeting these 30 healthcare AI stocks, which are transforming the healthcare sector through advanced artificial intelligence.

- Maximize recurring income by searching for these 16 dividend stocks with yields > 3%, which offer attractive yields and sustainable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRO

Frontline

A shipping company, engages in the ownership and operation of oil and product tankers worldwide.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives