- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

FLEX LNG (NYSE:FLNG): Evaluating Valuation After Recent Pullback and Long-Term Outperformance

Reviewed by Simply Wall St

See our latest analysis for FLEX LNG.

While FLEX LNG’s share price has slipped lower in the last month, this mild pullback comes after a strong run, with its one-year total shareholder return sitting at nearly 20%. Recent momentum appears to be fading a bit, but the long-term performance remains eye-catching and is up over 460% for investors holding over five years.

If FLEX LNG’s journey got your attention, this could be a great moment to expand your perspective and discover fast growing stocks with high insider ownership

That raises the question: after this recent pullback and years of strong returns, is FLEX LNG now trading at an attractive valuation, or has the market already factored in all of the company’s future growth potential?

Most Popular Narrative: Fairly Valued

The most widely followed narrative suggests FLEX LNG’s current share price of $25.19 aligns closely with its latest fair value estimate. This sets the stage for a detailed rationale behind this consensus and why catalysts might shift sentiment soon.

The company's multi-year contract backlog (56 years minimum, up to 85 years with options) and long-term charters secure steady revenue and earnings despite short-term market softness. This positions FLEX LNG to benefit as global LNG trade volumes are projected to rise due to new export capacity coming online, particularly from the US, Qatar, and Africa, which could boost future cash flow visibility and net margin stability.

Curious about the story behind these numbers? Hidden within this narrative are key assumptions on future growth, margins, and cash flows, revealing the building blocks of FLEX LNG’s current valuation band. Wondering what exactly analysts are forecasting for utilization rates, industry demand, and potential profit expansion? Unwrap the details and find out what drives fair value for this LNG leader.

Result: Fair Value of $24.97 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, FLEX LNG’s reliance on a fully contracted fleet and potential LNG market oversupply could put pressure on charter rates and dampen long-term earnings.

Find out about the key risks to this FLEX LNG narrative.

Another View: What Do Earnings Ratios Say?

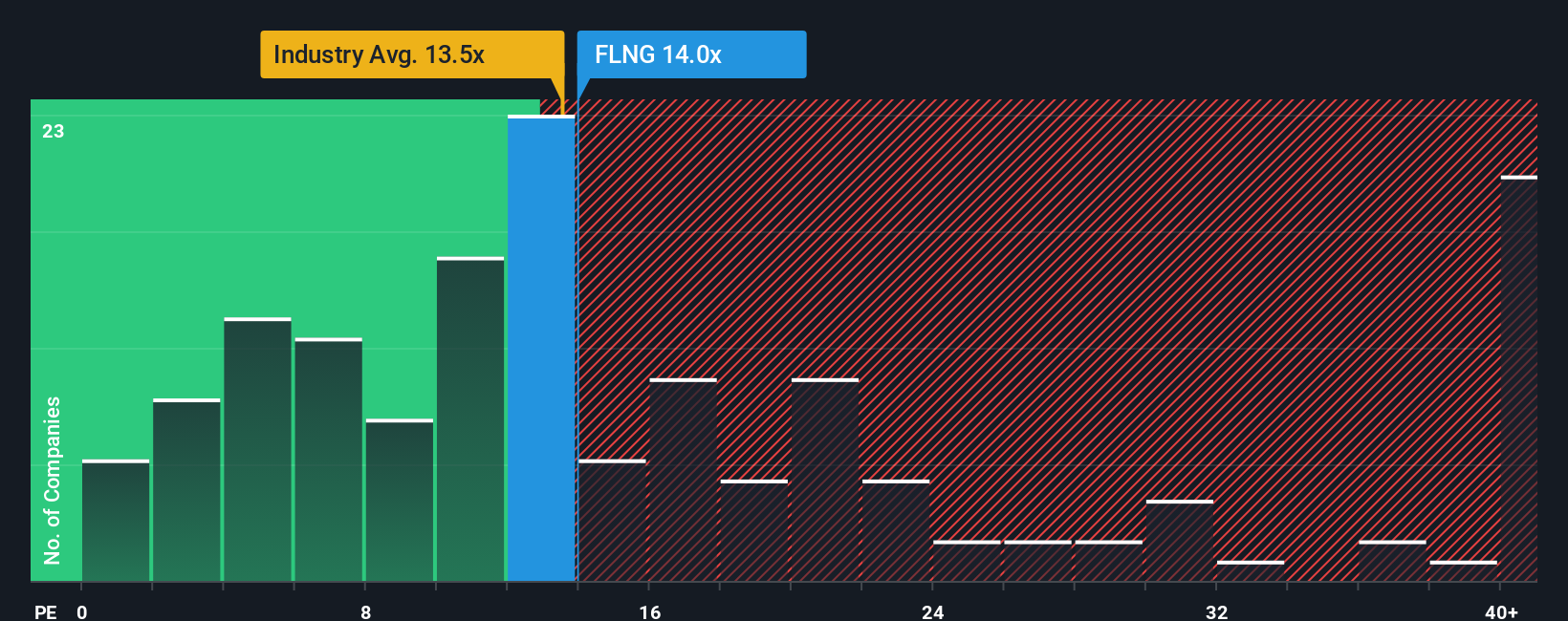

Looking through the lens of earnings multiples, FLEX LNG currently trades at 13.8x, making it slightly more expensive than both the US Oil and Gas industry average of 13.6x and the peer average of 12.3x. Interestingly, this is well below the estimated fair ratio of 17.6x, suggesting there might be some upside. Does this gap represent hidden value, or does it point to caution around future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FLEX LNG Narrative

If you’re seeing the story differently or want to reach your own conclusions, you can build your own FLEX LNG narrative and dive into the numbers yourself in just a few minutes. Do it your way

A great starting point for your FLEX LNG research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors don't wait for the perfect moment. They seize new opportunities before the crowd. Keep your portfolio fresh and ahead of the market with ideas built for tomorrow.

- Capitalize on high-potential price moves by checking out these 3565 penny stocks with strong financials that have solid financials and break the mold of the typical micro-cap stock.

- Supercharge your growth strategy by tapping into these 30 healthcare AI stocks at the forefront of medical technology, using artificial intelligence to change lives and boost returns.

- Raise your passive income game by hunting for these 14 dividend stocks with yields > 3% featuring robust yields that could power up your investment returns for years to come.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026