- United States

- /

- Energy Services

- /

- NYSE:FET

Revenues Not Telling The Story For Forum Energy Technologies, Inc. (NYSE:FET) After Shares Rise 27%

Forum Energy Technologies, Inc. (NYSE:FET) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

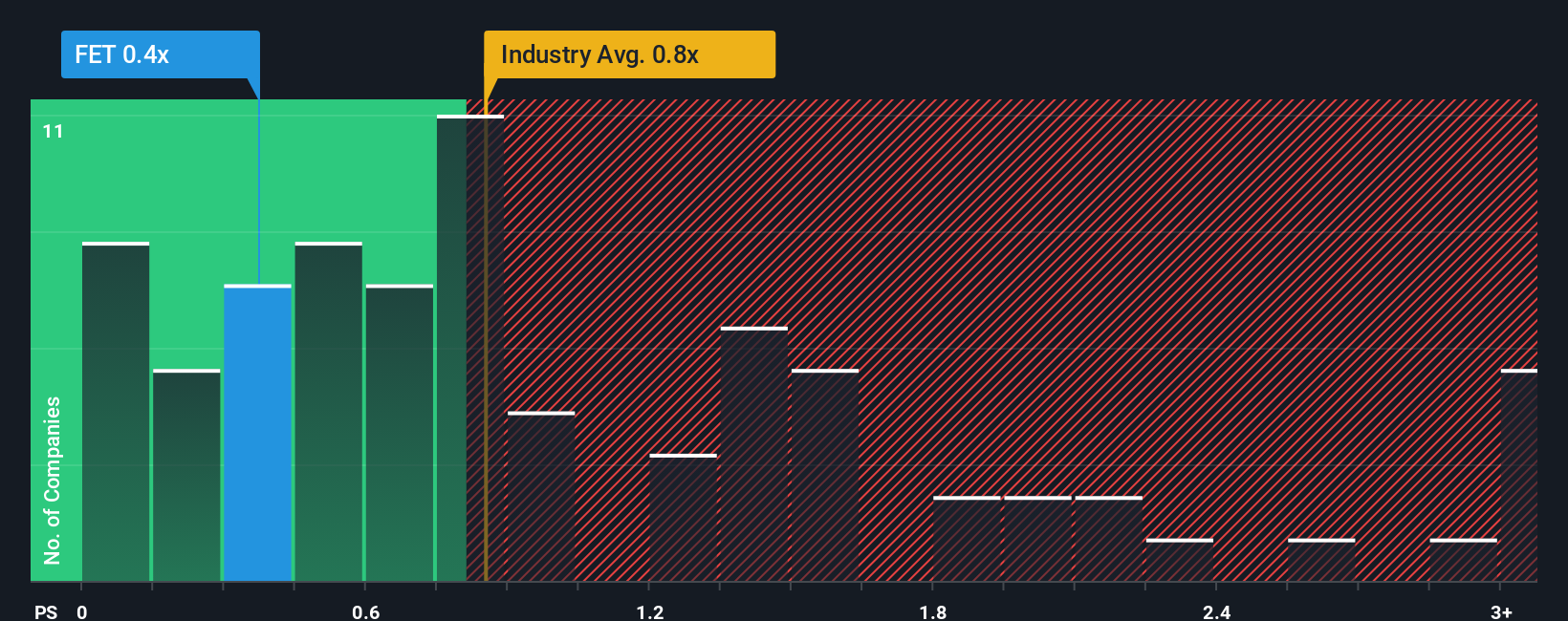

Even after such a large jump in price, it's still not a stretch to say that Forum Energy Technologies' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Energy Services industry in the United States, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Forum Energy Technologies

How Has Forum Energy Technologies Performed Recently?

Recent times haven't been great for Forum Energy Technologies as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Forum Energy Technologies.Is There Some Revenue Growth Forecasted For Forum Energy Technologies?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Forum Energy Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.9%. This was backed up an excellent period prior to see revenue up by 30% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 4.2% over the next year. Meanwhile, the broader industry is forecast to expand by 1.5%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Forum Energy Technologies' P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Forum Energy Technologies' P/S Mean For Investors?

Its shares have lifted substantially and now Forum Energy Technologies' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It appears that Forum Energy Technologies currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Forum Energy Technologies with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FET

Forum Energy Technologies

Designs, manufactures, and supplies products serving the oil, natural gas, industrial, and renewable energy industries in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives