- United States

- /

- Oil and Gas

- /

- NYSE:ET

Energy Transfer’s Major Asset Acquisitions Spark Debate as Shares Climb 79% in Three Years

Reviewed by Bailey Pemberton

- Curious if Energy Transfer is a bargain or just another name in your watchlist? You're in the right place to break down whether this stock is undervalued or just riding the hype.

- After climbing 3.4% in the last week and holding steady for the month, Energy Transfer is up nearly 6% for the year, with eye-catching longer-term returns of over 79% in three years and a massive 316% across five years. However, it has slipped a bit year-to-date.

- Several reports have spotlighted Energy Transfer’s ongoing expansion projects and notable asset acquisitions, fueling investor excitement and contributing to recent share price strength. The company's active role in North American energy infrastructure deals keeps it frequently in the headlines and often changes how investors perceive its growth path and risk profile.

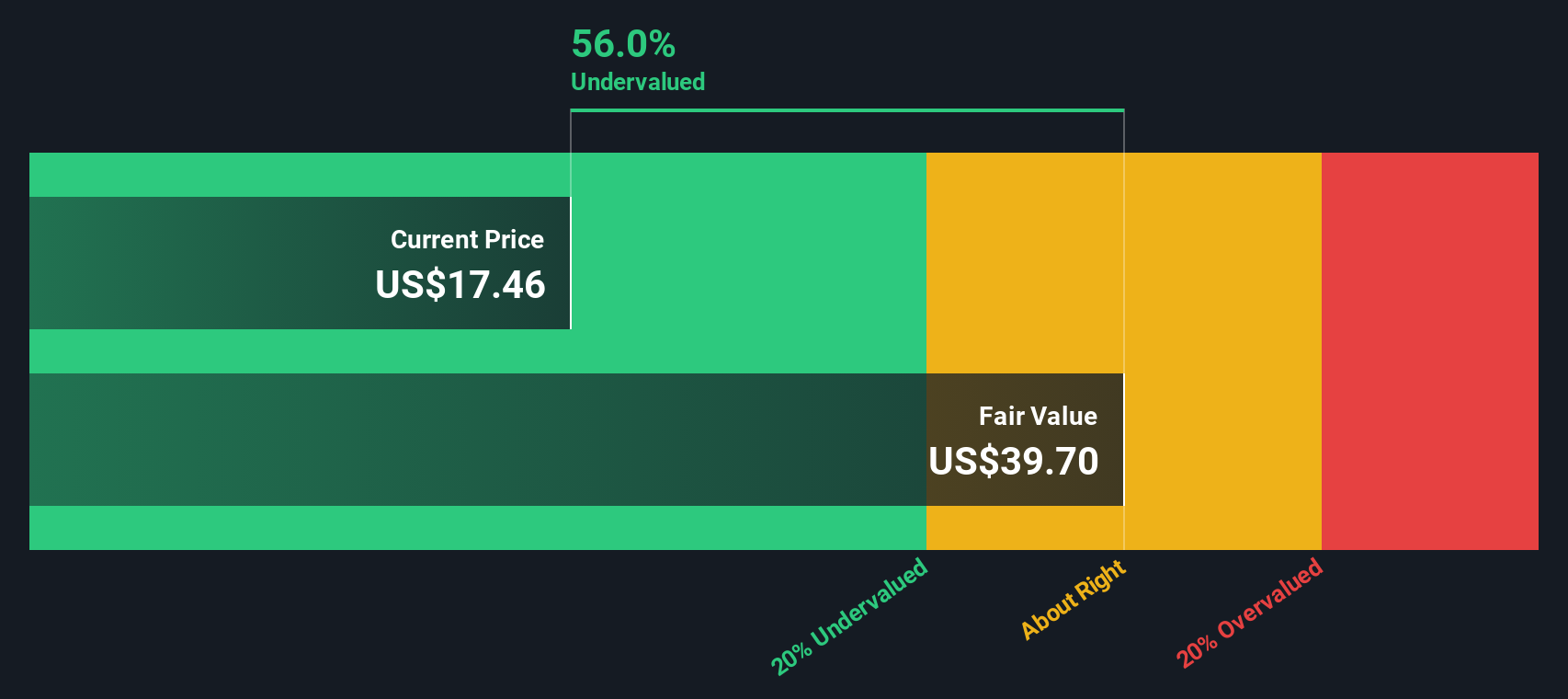

- On our valuation checks, Energy Transfer scores a perfect 6 out of 6 for being undervalued, but traditional metrics are only half the story. Stick with us as we dig into the specifics of how analysts value this company, and reveal an even better way to gauge if the stock is really worth your attention.

Approach 1: Energy Transfer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value. This approach focuses on how much cash Energy Transfer is expected to generate for shareholders over time, rather than relying solely on current earnings or assets.

Currently, Energy Transfer reports Free Cash Flow of $6.77 Billion. According to analyst forecasts and model extrapolations, annual Free Cash Flow is projected to grow, reaching $7.81 Billion by 2029. Continued increases are anticipated for several years beyond. These projections combine analyst estimates for the next five years with modeled growth for subsequent periods and aim to provide a comprehensive long-term outlook.

Using this methodology, the DCF model indicates an intrinsic value of $43.84 per share. Compared to today’s share price, this represents a 61.2% discount and suggests that Energy Transfer stock could be significantly undervalued based on future cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Energy Transfer is undervalued by 61.2%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Energy Transfer Price vs Earnings (PE)

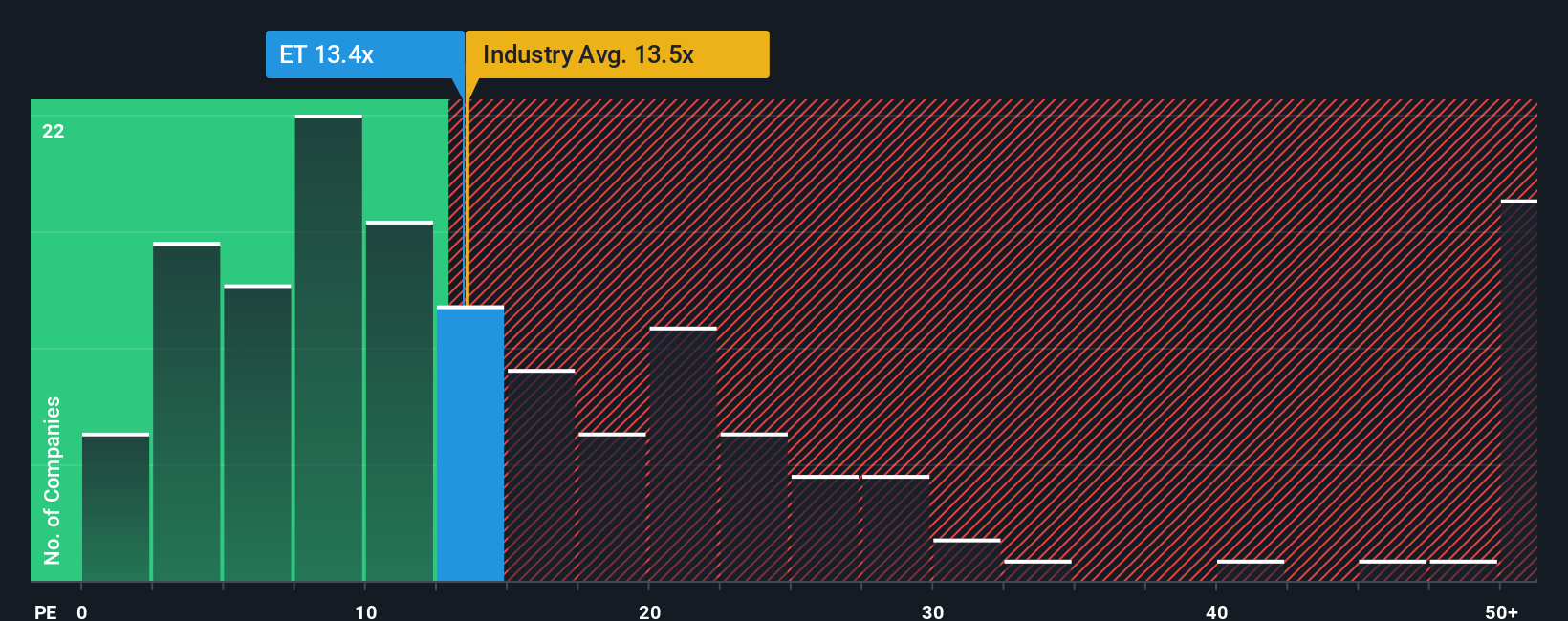

For profitable companies like Energy Transfer, the Price-to-Earnings (PE) ratio is a widely used and meaningful measure because it captures the relationship between a company’s market value and its current earnings. Investors often look to the PE ratio to judge how expensive or cheap a stock is relative to the profits it generates.

Of course, what qualifies as a “normal” or “fair” PE ratio can shift based on growth expectations and perceived risks. Companies with faster expected earnings growth or lower risk profiles commonly command higher PE multiples, while those facing challenges or volatility tend to trade at lower ones.

Currently, Energy Transfer trades at a PE ratio of 13.54x. This is slightly below the Oil and Gas industry average of 14.20x and also below the average of similar peers at 19.35x. At first glance, this makes it look relatively cheap. However, Simply Wall St’s proprietary “Fair Ratio” for Energy Transfer is 20.42x. The Fair Ratio is unique because it incorporates not just raw comparisons with industry or peers but also the company’s own growth prospects, profit margins, risk factors, and size. This context-driven approach gives a more accurate picture of value than simple benchmarking.

Since Energy Transfer’s current PE ratio is meaningfully below its Fair Ratio, the analysis points to the stock being undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Energy Transfer Narrative

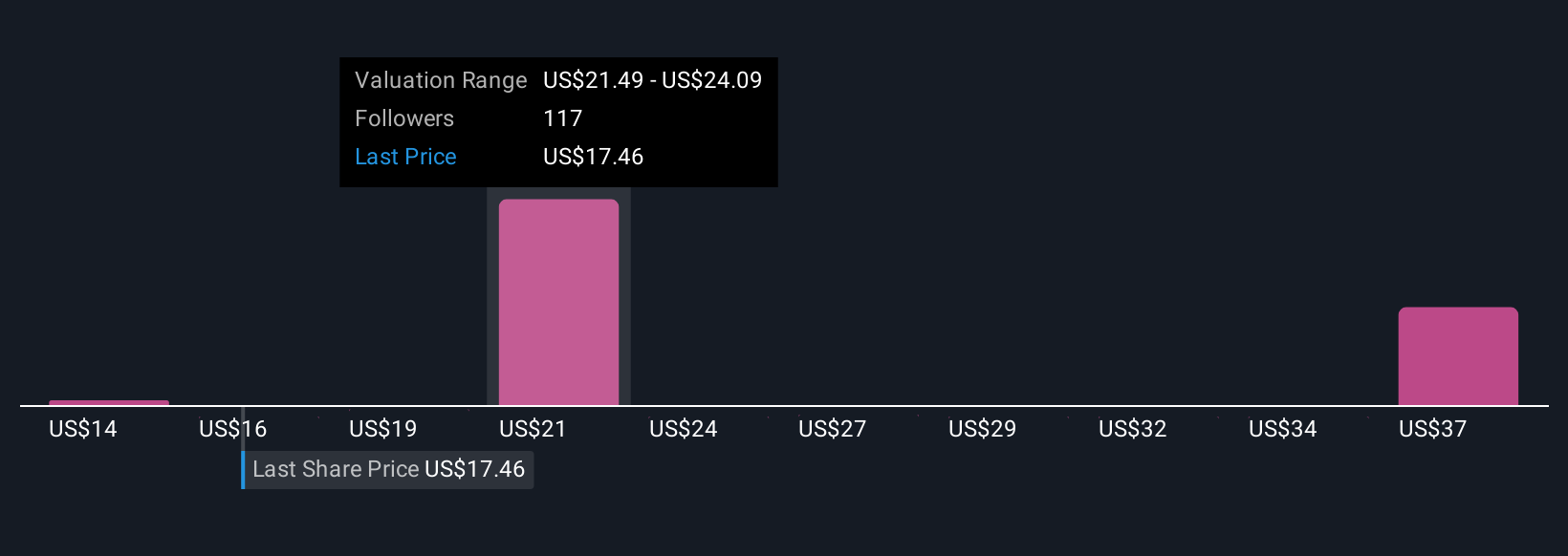

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Instead of just crunching numbers, a Narrative is your personalized story for a company, reflecting how you see its future rather than focusing solely on its price or earnings today.

On Simply Wall St’s platform, Narratives allow you to connect the dots. You articulate your perspective on a company’s future by laying out assumptions for key financials like revenue growth, future profit margins, and “fair” PE ratios. The system then translates your story into a clear forecast and an up-to-date intrinsic value, making it easy to compare your fair value against Energy Transfer’s live market price.

What sets Narratives apart is how accessible and dynamic they are, available for everyone to use right inside the Community page. As news breaks or new results come in, Community Narratives automatically update, so your investment thesis can evolve in real time with the company’s story.

For example, some investors think Energy Transfer will deliver $7.6 billion in earnings and deserve a higher valuation (the “bullish” view, suggesting upside), while others see only $4.1 billion and prefer a more conservative outlook (the “bearish” scenario). Narratives let you explore these paths, sense-check your own forecasts, and make investment decisions with much greater context and confidence.

Do you think there's more to the story for Energy Transfer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Transfer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ET

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives