- United States

- /

- Oil and Gas

- /

- NYSE:EQT

Will EQT’s (EQT) Renewables Pivot Reshape Its Place in the Energy Transition?

Reviewed by Sasha Jovanovic

- In October 2025, EQT announced it has shifted Zelestra India to its Asia Pacific infrastructure team rather than selling it, alongside a US$600 million investment and a leadership change for further development in renewables, while also addressing Federal Court proceedings for its subsidiary in Australia and being named as a potential beneficiary of major global grid investments driven by AI-related energy demand.

- This set of developments highlights EQT’s increased focus on both renewables and traditional natural gas infrastructure, positioning the firm at the crossroads of rising energy transition investments and the expanding digital economy.

- We'll examine how EQT's refocus on renewables alongside anticipated grid upgrades could alter its long-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

EQT Investment Narrative Recap

To own EQT stock, you have to believe that demand for natural gas infrastructure will stay resilient even as renewables gain ground and that EQT’s upstream and midstream investments are well positioned to benefit from the AI-powered growth in electricity consumption. The recent organizational shift of Zelestra India signals an operational emphasis on renewables, but it does not materially change the main short-term business catalyst: securing long-term gas supply contracts for US data centers and LNG export facilities. The biggest current risk remains exposure to evolving environmental regulation, especially as EQT expands infrastructure in a higher-scrutiny market.

The recent 20-year LNG sale and purchase agreements with Commonwealth LNG and Port Arthur LNG are central to EQT’s story, directly addressing the catalyst of long-term, demand-secured gas offtake, and reinforcing the narrative that reliable gas infrastructure can underpin both US power and export growth, even as market focus broadens to renewables.

However, investors should also weigh the impact of tightening regulatory oversight on new infrastructure development, as...

Read the full narrative on EQT (it's free!)

EQT's narrative projects $9.8 billion in revenue and $3.8 billion in earnings by 2028. This requires 11.3% yearly revenue growth and a $2.7 billion increase in earnings from the current $1.1 billion.

Uncover how EQT's forecasts yield a $62.80 fair value, a 17% upside to its current price.

Exploring Other Perspectives

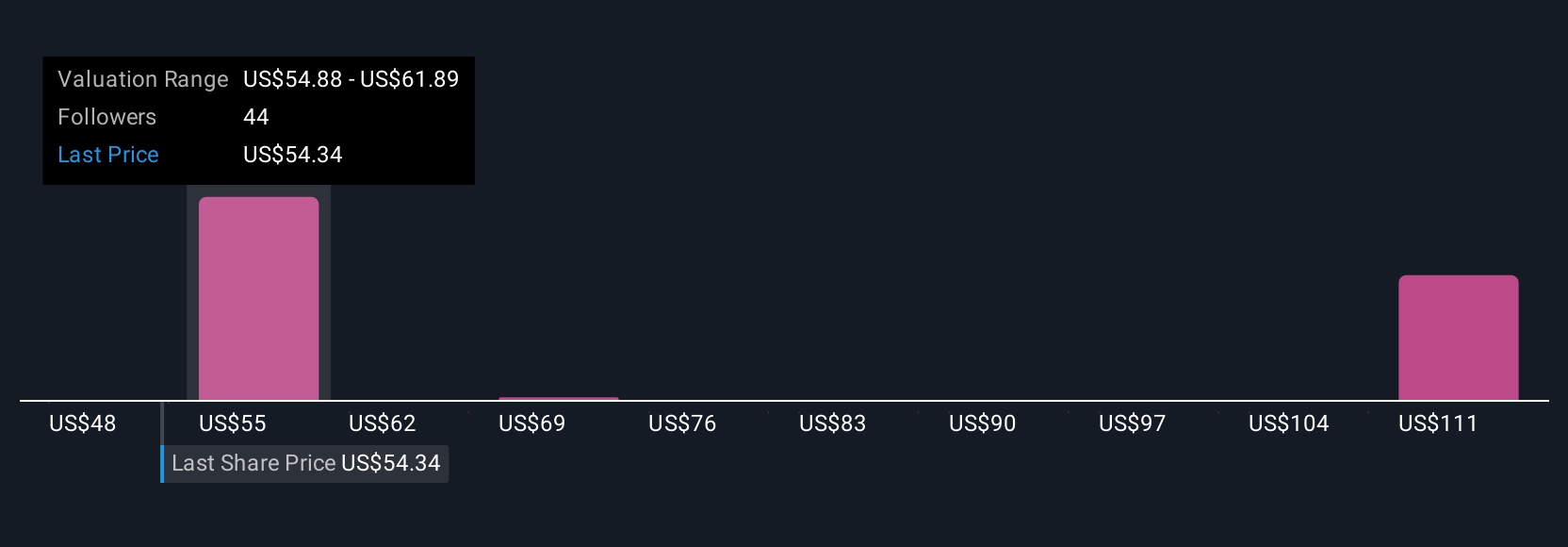

Five Simply Wall St Community fair value estimates put EQT’s price between US$47.87 and US$96.75 per share, showing a nearly twofold swing in outlooks. While some focus on long-term LNG contract catalysts, others caution that regulatory or environmental hurdles could change the pace of EQT’s growth, reminding you to explore several viewpoints before deciding.

Explore 5 other fair value estimates on EQT - why the stock might be worth as much as 80% more than the current price!

Build Your Own EQT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your EQT research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free EQT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate EQT's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EQT

EQT

Engages in the production, gathering, and transmission of natural gas.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives