- United States

- /

- Oil and Gas

- /

- NYSE:EPD

Is There an Opportunity in Enterprise Products Partners After Its Pipeline Expansion in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Enterprise Products Partners stock right now? You are not alone. Investors have seen the share price move up 1.5% in the last week, even after a slightly negative 1.3% slide over the past month. That may not sound like fireworks, but take a step back and the long-term picture is anything but dull. Over the past year, the stock has jumped 14.9%, and if you have stuck around for five years, your returns would have soared 168.0%. That is not a typo.

What is driving these changes? While energy markets have been choppy this year, the company recently made headlines for expanding its pipeline footprint and deepening partnerships across the sector. These moves hint at management’s confidence and willingness to put capital to work, even as some competitors hit pause. The market appears to have picked up on this, adjusting expectations about Enterprise Products Partners’ future stability and growth potential.

Here is where it gets interesting for anyone eyeing value: looking across six key valuation checks, the company is undervalued in five of them, giving it a valuation score of 5. That is a strong result and suggests the stock could be cheaper than it looks at first glance.

Of course, not all valuation methods are created equal. Up next, I will walk through the major approaches and how Enterprise Products Partners stacks up on each. I will also share an even more insightful way to judge whether it truly belongs in your portfolio.

Approach 1: Enterprise Products Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting those numbers back to their present value. This allows investors to figure out what a business is really worth today based on its ability to generate cash in the years ahead.

For Enterprise Products Partners, the current Free Cash Flow over the last twelve months is $4.95 Billion. Analysts provide projections for the next five years, showing steady growth, with the Free Cash Flow expected to reach $7.22 Billion by 2029. Beyond that timeframe, additional growth estimates are extrapolated using fair assumptions, which bring the projected 2035 Free Cash Flow to $7.64 Billion. All forecasts are based in dollars, the company’s reporting currency.

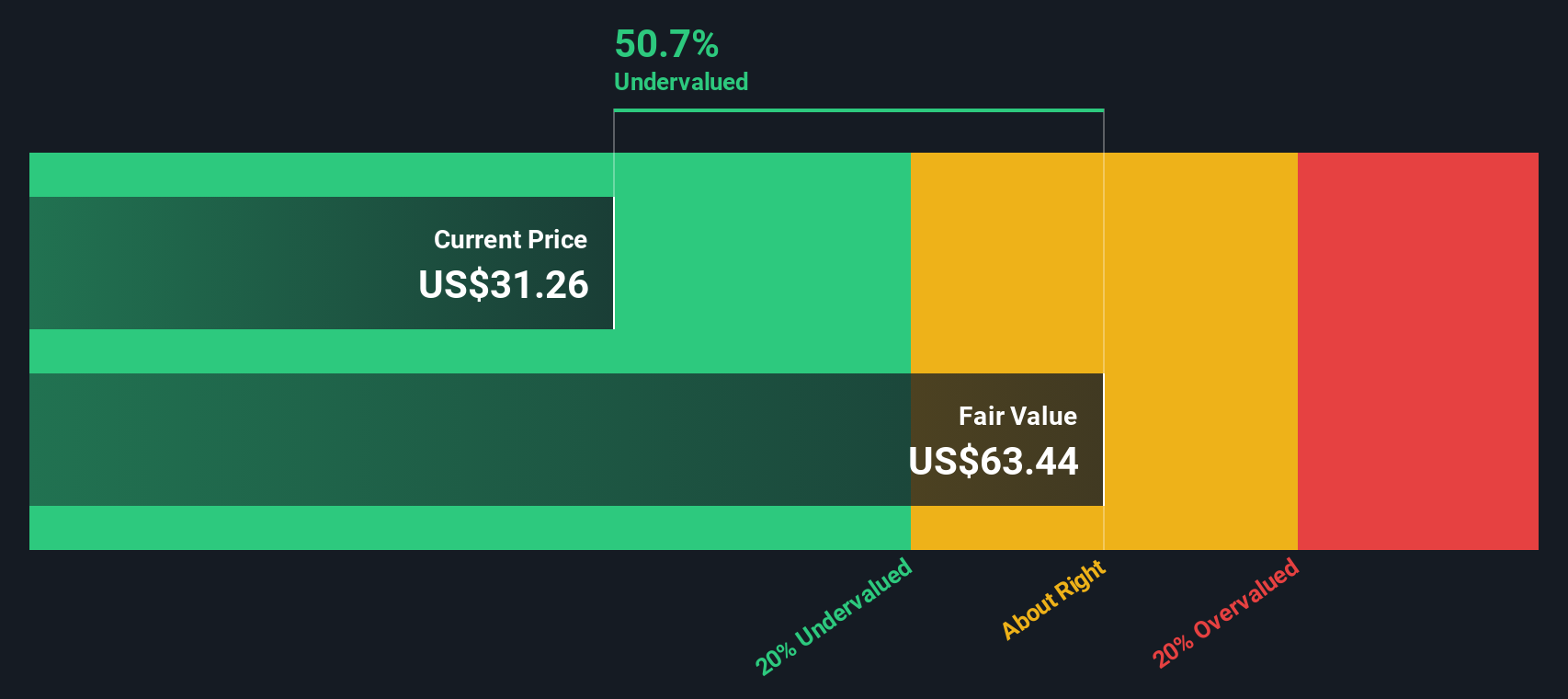

According to the DCF model, these cash flow projections result in an estimated intrinsic value of $63.38 per share. Currently, the stock trades at roughly half that price level, making it approximately 50.7% undervalued on this basis. This significant gap implies there could be substantial upside for long-term investors if these projections are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enterprise Products Partners is undervalued by 50.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Enterprise Products Partners Price vs Earnings

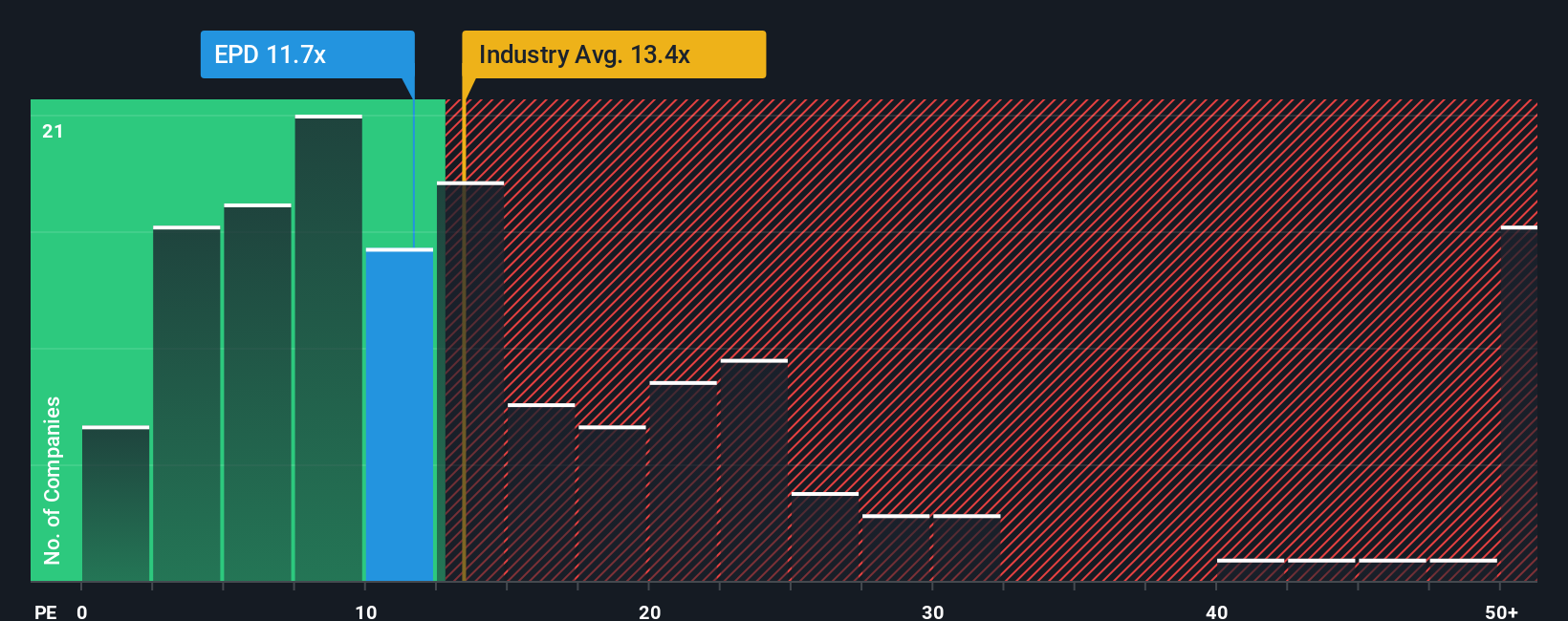

For profitable businesses like Enterprise Products Partners, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. This ratio tells investors how much they are paying for each dollar of earnings, making it a simple yet powerful way to compare value across similar companies.

What counts as a "normal" or "fair" PE ratio can swing widely depending on a company's growth outlook and risk profile. Firms with better prospects or fewer risks tend to have higher PE ratios, while slower growers or those with more uncertainty typically trade at lower multiples.

Currently, Enterprise Products Partners trades at a PE ratio of 11.6x. That is meaningfully below both the Oil and Gas industry average of 13.1x and the peer group average of 18.9x. By those comparisons alone, the stock may look cheap.

However, Simply Wall St’s proprietary "Fair Ratio" offers a sharper lens. This benchmark is tailored for each company by modeling earnings growth, industry dynamics, profit margins, size, and risks, producing a PE ratio that is uniquely fair to the business in question. That added layer makes it more useful than blunt industry or peer averages, which do not always account for unique strengths and vulnerabilities.

In this case, the Fair Ratio for Enterprise Products Partners is 18.9x, well above its actual 11.6x multiple. The gap suggests there is a sizable margin of undervaluation when you factor in the firm’s financial health and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enterprise Products Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal take on a company, connecting the story you believe, including its future growth, risks, and unique qualities, to your own forecast and fair value. Narratives make investing more intuitive by helping you translate the events and insights you see in the news into tangible financial outlooks, allowing you to actually estimate what a business is worth based on your perspective, rather than relying only on conventional models or averages.

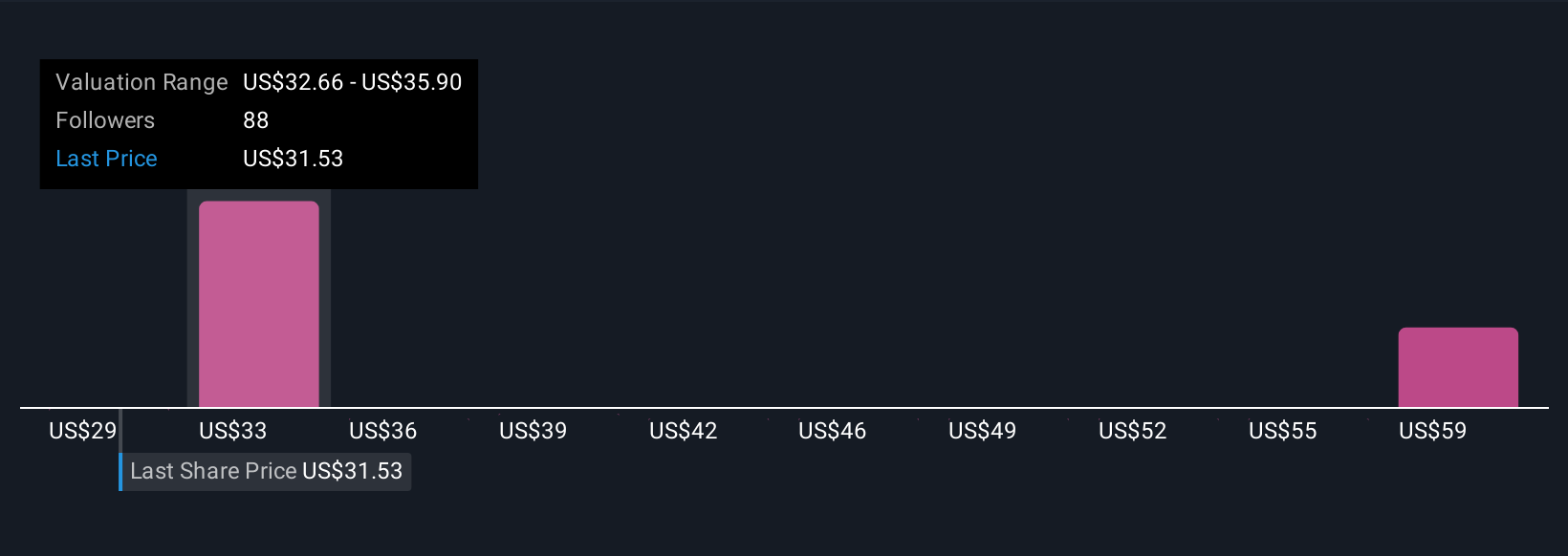

Narratives are available to all investors on Simply Wall St's Community page, where millions share their own views and projections. With Narratives, you can easily compare your fair value estimate to the current share price, making buy or sell decisions clearer and more personal. The best part? Narratives are dynamic and automatically update as new developments, such as breaking news or fresh earnings results, emerge. For example, while some investors currently project a fair value for Enterprise Products Partners at $40.00 (reflecting bullish optimism for export growth), others set it as low as $32.00 (citing debt or market volatility). Narratives empower you to choose your own evidence-based path and act confidently on it.

Do you think there's more to the story for Enterprise Products Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Products Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPD

Enterprise Products Partners

Provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives